Back

Arcane

Hey, I'm on Medial • 1y

Imagine a company's purchasing team negotiates amazing deals with suppliers, getting extended credit terms (like a long payment deadline on your credit card). This frees up cash. But what if the sales team is so good they collect payments from customers quickly (like immediately paying off your credit card)? Now the company has excess cash sitting around. This is where things get tricky. If the company has long-term projects needing funding (like buying new equipment), they might be tempted to use that short-term cash to pay for them. The problem? It's like using your credit card to buy groceries - it might seem convenient, but it can lead to big problems down the road if you can't pay it back on time. This is a classic financial management mistake - using short-term funds for long-term needs. ❌ Lesson learned: Businesses need to carefully match the timing of their cash inflows and outflows to avoid financial trouble.

Replies (5)

More like this

Recommendations from Medial

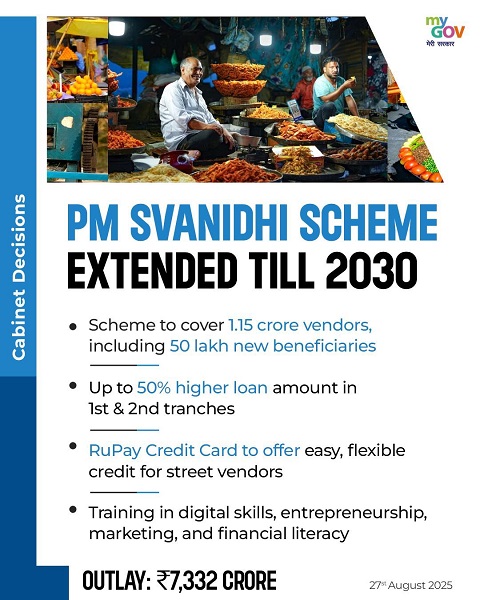

Government Schemes Updates

We provide updates o... • 4m

The Central Government’s PM SVANidhi Scheme continues to empower millions of India’s street vendors by providing easy access to short-term working capital loans up to ₹50,000. With added benefits like 7% interest subsidy, monthly cashback for digita

See More

Anirudh Gupta

CA Aspirant|Content ... • 7m

Daily dose of financial ratios by Anirudh Gupta Current ratio: =Current assets/current liabilities Purpose: -To evaluate the company's short-term financial health and liquidity. -This ratio tells us whether the company can meet its short term ob

See MoreBasavaraja V

Software Engineer • 1y

Many people want to make big purchases online but don't have a credit card. At the same time, some credit card holders have unused credit limits. ConnectCred solves this problem by allowing shoppers to make purchases through a service that connects t

See More

AjayEdupuganti

I like software and ... • 1y

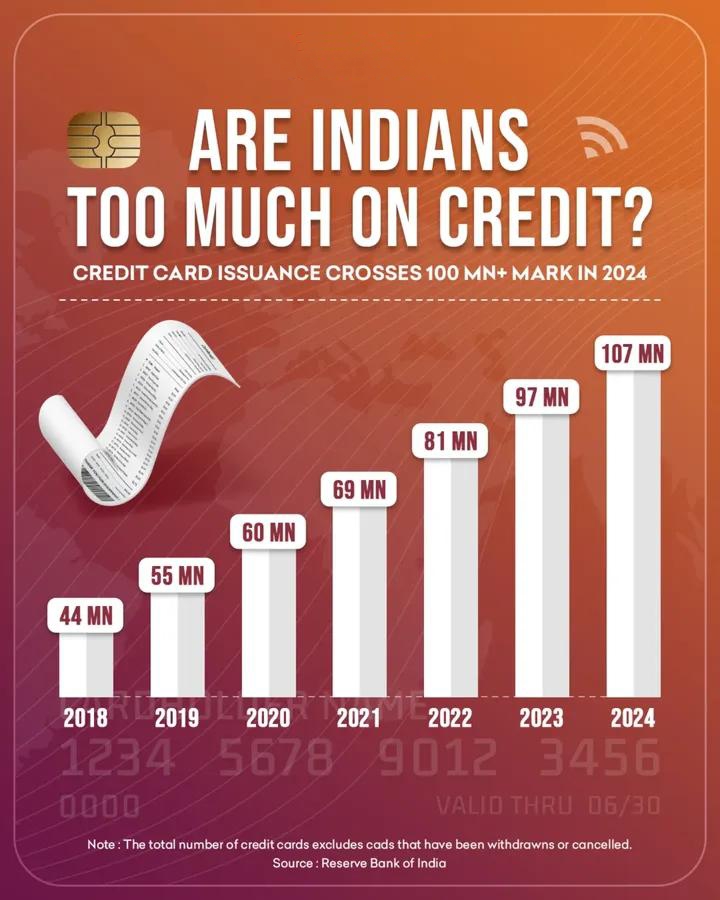

Do you use a RuPay credit card with UPI? How often does your credit card bill exceed your expectations? Are you spending more because of your credit card? I just want to understand whether this could become another potential debt trap for Indians

See MoreAatif dehalvi

Hey I am on Medial • 12m

Business Idea: Enabling Credit Card Discounts and Cashback for Non-Credit Card Users In today’s digital shopping era, e-commerce platforms like Flipkart, Amazon, and others frequently offer discounts and cashback deals, especially for customers using

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)