Back

brijesh Patel

Founder | Venture Pa... • 2m

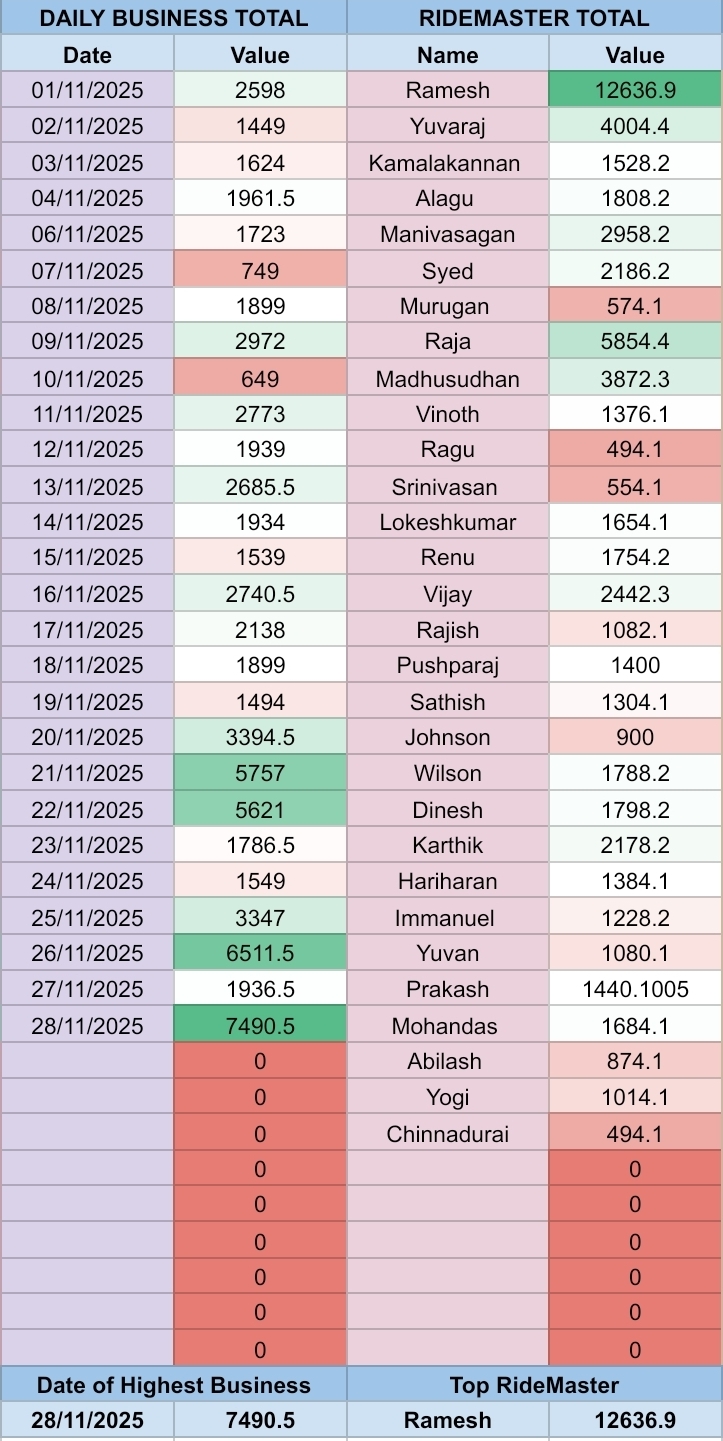

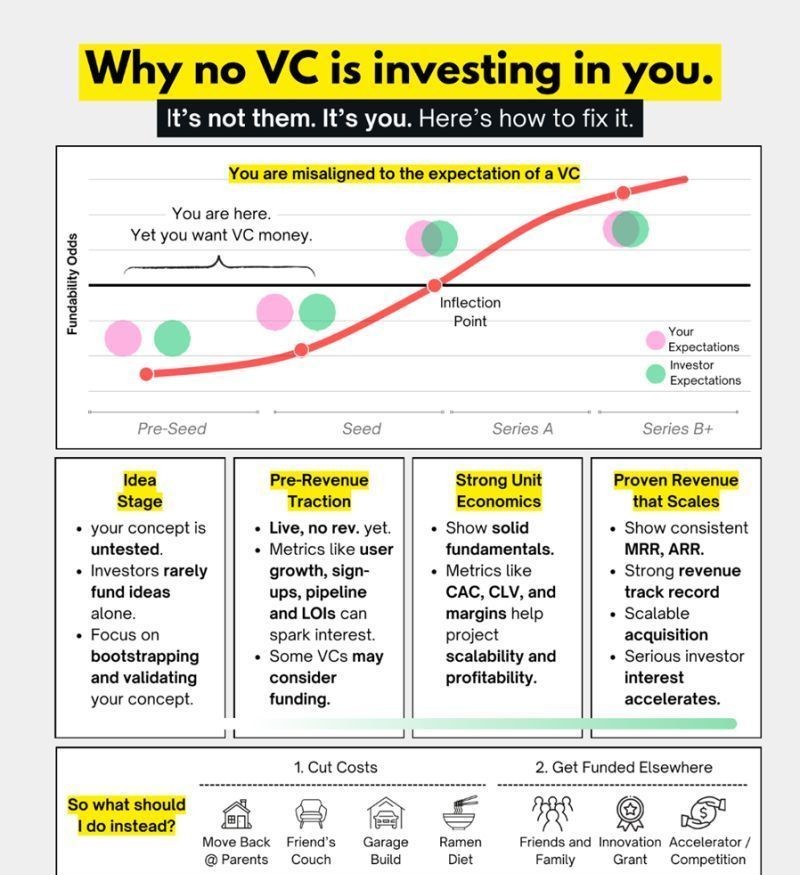

🚫 Why No VC Is Investing in You (Yet) Let’s be honest — it’s rarely the VC. It’s the mismatch between where your startup is and what VCs expect. This visual explains it perfectly 👇 Most founders think they’re “ready for funding.” But their expectations and VC expectations are miles apart. 💡 Here’s the uncomfortable truth: 🟡 IDEA STAGE Your concept is untested. Investors almost never fund ideas. You need: ✔️ Validation ✔️ Early proof ✔️ Customer signals Bootstrap. Test. Iterate. This is not VC territory. 🟡 PRE-REVENUE TRACTION You’re live, but no revenue yet. Metrics that matter: • User sign-ups • Growth speed • Pipeline • LOIs A few VCs may look — but only if your traction curve is strong. 🟡 STRONG UNIT ECONOMICS Now investors start paying attention. Show real fundamentals: • CAC • CLV • Margins • Payback period VCs want to know: Can this scale without burning the planet? 🟡 PROVEN, SCALABLE REVENUE MRR ✔️ ARR ✔️ Acquisition channels ✔️ Repeat customers ✔️ THIS is where VC interest accelerates. VC money flows fastest into businesses that have already proven they can grow without VC money. 🚀 So what should you do instead? You scrap. You survive. You build with whatever you have. • Move back with parents • Sleep on a friend’s couch • Garage build • Ramen diet • Innovation grants • Accelerator programs • Friends & family round Because your real job in the early days is simple: Prove the idea → Prove the traction → Prove the economics. That’s when VCs stop ignoring you — and start chasing you. 💡 Founders — If you’re ready for VC funding and want to check your eligibility As a Venture Partner at StartupLanes, I help early-stage founders connect with serious investors. Check if your startup is ready: 👉 Fill this form https://lnkd.in/datmxnsT VC money isn’t magic. It’s alignment.

Replies (2)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 8m

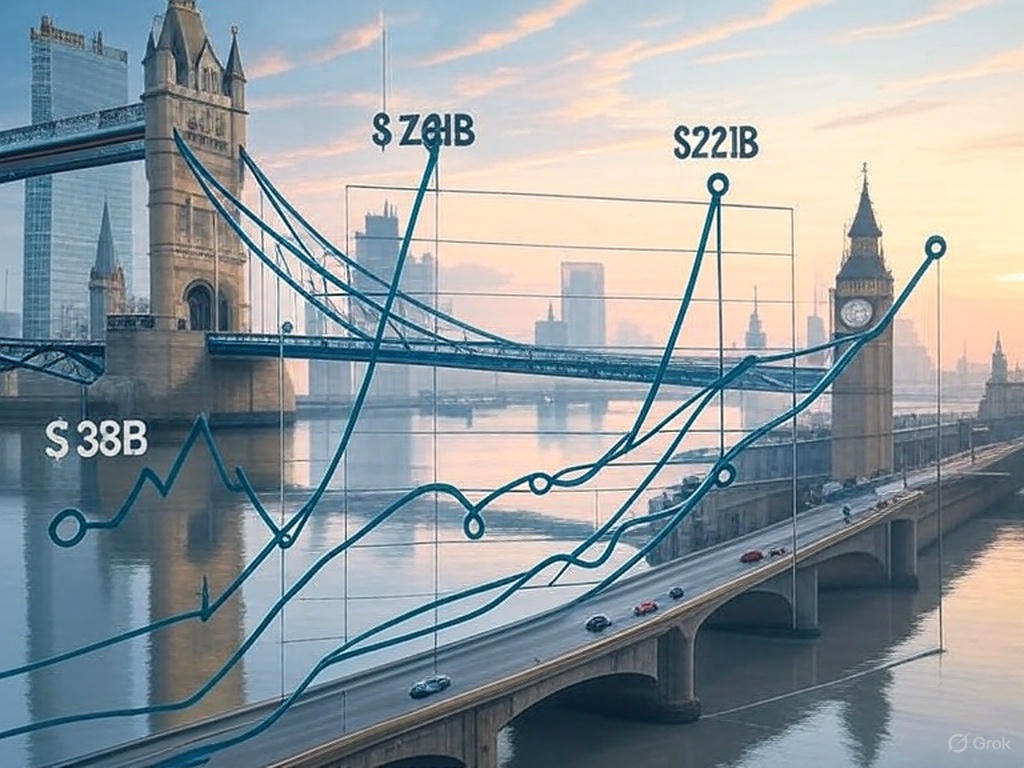

For early-stage startups, generating revenue and driving growth trump chasing venture capital (VC) funding. In 2023-2025, VC funding trends underscore this shift. Global VC investment plummeted from $381B in 2022 to $221B in 2023, with 2024 seeing on

See More

Account Deleted

Hey I am on Medial • 9m

What VCs say vs What they mean: 1) “Come back after traction” = We want proof without risk. 2) “We love the team” = The idea is meh, but you seem cool. 3) “Let’s stay in touch” = Probably never gonna happen unless you blow up. Drop your favorite

See MoreManik Gruver

•

Macwise Capital • 7m

You spend months understanding your customer's pain, but VCs skip your problem slide in 30 seconds for XYZ reasons. Since VCs rush through problem statements, how can founders ensure that VCs understand the depth of problem? #39 # Started #VC #Fundr

See MoreVivek Joshi

Director & CEO @ Exc... • 6m

D2C Founders: Ready for VC Funding? Submit Your Pitch! Are you a revenue-generating D2C startup on the hunt for VC funding? Excess Edge Experts Consulting is partnering with a prominent VC fund to connect visionary founders like you with the capital

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

D2C Founders: Ready for VC Funding? Submit Your Pitch! Are you a revenue-generating D2C startup on the hunt for VC funding? Excess Edge Experts Consulting is partnering with a prominent VC fund to connect visionary founders like you with the capital

See More

Download the medial app to read full posts, comements and news.