Back

Vivek Joshi

Director & CEO @ Exc... • 7m

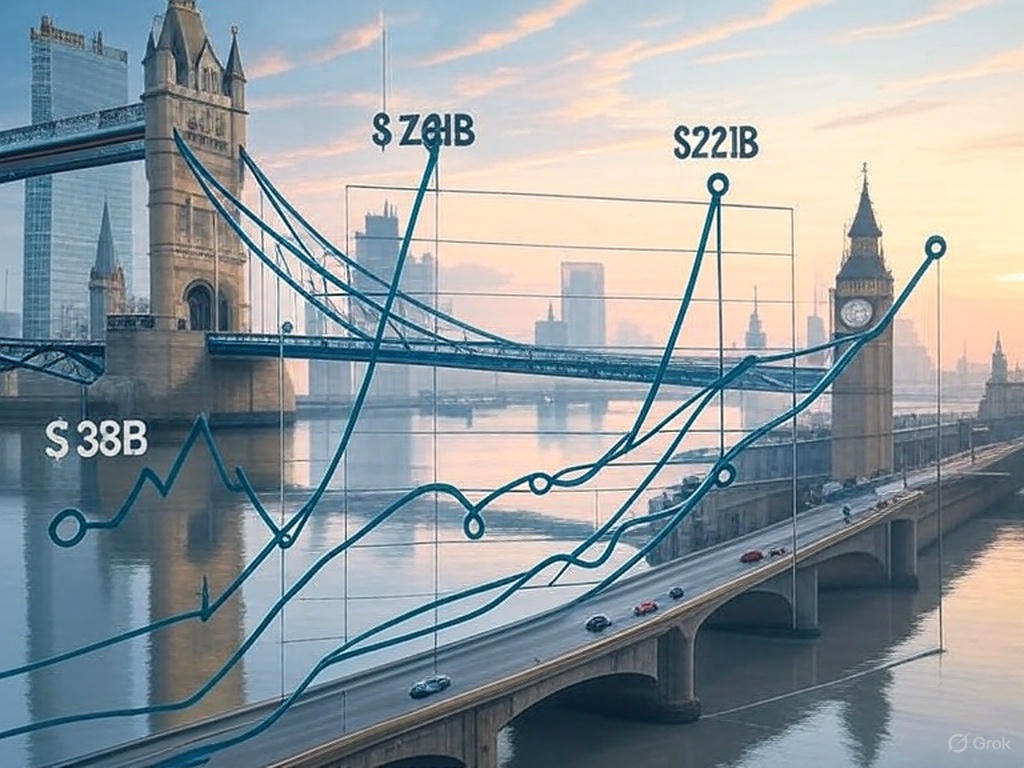

For early-stage startups, generating revenue and driving growth trump chasing venture capital (VC) funding. In 2023-2025, VC funding trends underscore this shift. Global VC investment plummeted from $381B in 2022 to $221B in 2023, with 2024 seeing only a modest rebound to $314B, largely driven by AI megadeals. Investors now prioritize startups with proven revenue streams and strong fundamentals over non-revenue ventures. In 2023, 770 startups shut down due to a harsh funding climate starving seed-stage firm. VCs shun non-revenue startups, favoring those with $2M+ in annual recurring revenue, doubling prior benchmarks. Long scalability tenures also deter funding, as investors seek quicker exits amid an 8-year unicorn holding period backlog. Revenue signals product-market fit and sustainability, reducing reliance on fickle VC cash. In 2025, focus on customer-driven growth—VCs reward real traction, not just big dreams.

More like this

Recommendations from Medial

Mayank Kumar

Strategy & Product @... • 1y

The Impact of Venture Capital on Innovation! Venture capital (VC) plays a crucial role in driving innovation. By providing the necessary funds, VCs enable startups to scale and develop groundbreaking technologies. Think of companies like Uber, Air

See MoreVivek Joshi

Director & CEO @ Exc... • 5m

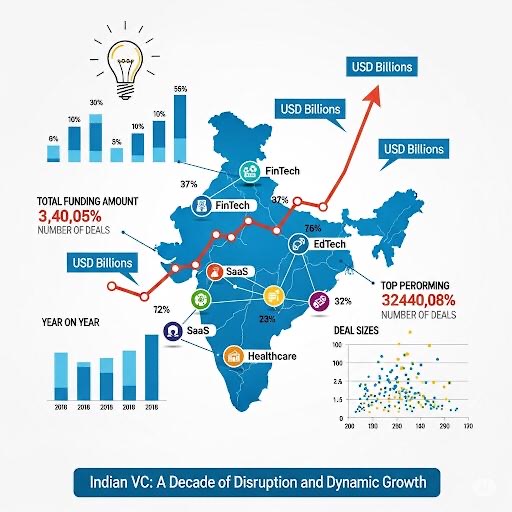

Beyond the Buzzwords: India’s Revenue-Making Startups & the VC Lens India’s startup scene isn’t just about hype—it’s about real, revenue-generating ventures ready to scale. Founders who’ve proven product-market fit and built solid revenue engines no

See More

Vivek Joshi

Director & CEO @ Exc... • 5m

Beyond the Buzzwords: India’s Revenue-Making Startups & the VC Lens India’s startup scene isn’t just about hype—it’s about real, revenue-generating ventures ready to scale. Founders who’ve proven product-market fit and built solid revenue engines no

See More

VCGuy

Believe me, it’s not... • 1y

Last week, news broke that India's former Defence Secretary launched his VC fund, Mount Tech Growth Fund. The first fund, named Kavachh, is expected to be ~₹500 Cr, supporting Defence Tech startups. ⏭️Demand for Defence Technology seems to be on t

See MoreVivek Joshi

Director & CEO @ Exc... • 2m

Quick breakdown for VC analysts: Family offices vs. institutional VCs — what each brings, how their mandates, time horizons, decision-making, and involvement shape startup strategy. Learn when patient capital, values-aligned investing, and flexible d

See MoreVivek Joshi

Director & CEO @ Exc... • 4m

📈 Indian VC rebounds! PE-VC investments +9% to ~$43B in 2024, led by VC/growth at ~$14B (+40%) across 1270 deals (+45%). Consumer tech & SaaS lead. Public markets a key growth driver. VCs now prioritize AI with strong IP & early capital efficiency.

See More

Download the medial app to read full posts, comements and news.