Back

Vivek Joshi

Director & CEO @ Exc... • 5m

Beyond the Buzzwords: India’s Revenue-Making Startups & the VC Lens India’s startup scene isn’t just about hype—it’s about real, revenue-generating ventures ready to scale. Founders who’ve proven product-market fit and built solid revenue engines now face a crucial question: What makes them VC-ready in 2024? VCs today seek more than numbers: ✅ Sustainable Growth with strong unit economics ✅ Defensible Moats like tech IP, brand loyalty, or network effects ✅ Scalability with Efficiency—grow revenue without ballooning costs ✅ Strong Teams with vision, resilience & execution power ✅ Strategic Use of Capital—how VC fuels real growth In a market where funding is thawing, especially in fintech, SaaS & consumer tech, proven models matter more than ever. If your startup is ready to scale, now’s the time to align with the right VC partner. You’ve built the foundation—let’s launch the rocket. 🔗 www.excessedgeexperts.com

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 5m

D2C Founders: Ready for VC Funding? Submit Your Pitch! Are you a revenue-generating D2C startup on the hunt for VC funding? Excess Edge Experts Consulting is partnering with a prominent VC fund to connect visionary founders like you with the capital

See More

Vivek Joshi

Director & CEO @ Exc... • 5m

D2C Founders: Ready for VC Funding? Submit Your Pitch! Are you a revenue-generating D2C startup on the hunt for VC funding? Excess Edge Experts Consulting is partnering with a prominent VC fund to connect visionary founders like you with the capital

See More

Vivek Joshi

Director & CEO @ Exc... • 5m

Are you a revenue-generating startup in the D2C space looking for VC funding? Excess Edge Experts Consulting is excited to invite passionate founders with validated market potential to submit their pitch decks and business plans for evaluation by a r

See More

brijesh Patel

Founder | Venture Pa... • 1m

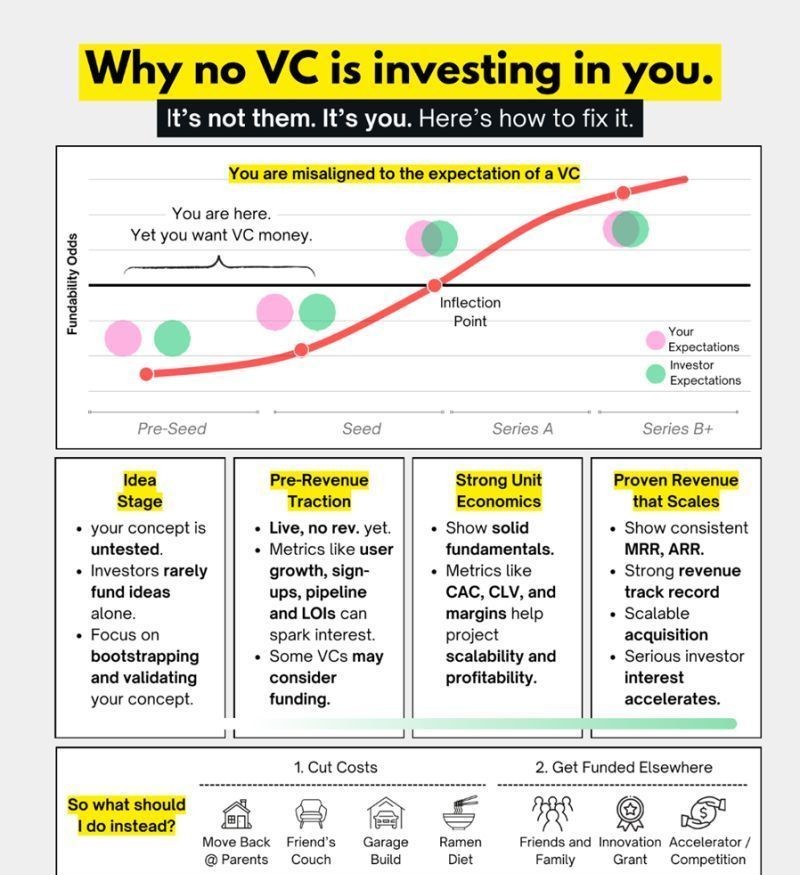

🚫 Why No VC Is Investing in You (Yet) Let’s be honest — it’s rarely the VC. It’s the mismatch between where your startup is and what VCs expect. This visual explains it perfectly 👇 Most founders think they’re “ready for funding.” But their expec

See More

Vivek Joshi

Director & CEO @ Exc... • 4m

Are you leading a revenue-generating D2C startup and looking for the capital to supercharge your growth? Excess Edge Experts Consulting has teamed up with a leading VC fund that's actively investing in the D2C space, and we want to help you get notic

See More

Account Deleted

•

Urmila Info Solution • 5m

Not every AI product needs funding. Some just need the right builders. You don't need VC money to build an AI product. You need: ✅ An AI-first dev team ✅ Scalable tech stack ✅ UI/UX that converts ✅ Speed > fluff That’s where we come in. At Opslify

See MoreMahesh chhanga

Neha enterprise • 9m

A VC is showing strong interest in our transport & logistics biz at a 40Cr valuation. We've got 1.5Cr revenue, 13% net profit, and a clear path to scale in an untapped market. Strong family biz background. Considering a pre-seed round. Thoughts on th

See MoreGiftiyo India

Hey I am on Medial • 8m

Are you looking to scale in the fast-growing retail and corporate gifting market or expand your footprint in Pune’s lifestyle/retail sector? Giftiyo.com—a digitally-driven gifting startup with an established network of 25+ trusted local brands (inclu

See Moreyashraj thite

B2B SaaS for Manufac... • 4m

🏗️ From Idea to Architecture: Partora's Growth Story Built something exciting over the past months! Partora now has: ✅ Complete software & business architecture ✅ Solid business plan with proven GTM strategy ✅ Early traction that's catching invest

See MoreVENTURE NAVIGATOR

INVESTOR | Start up ... • 9m

Invested in an Emotional Wellness App: Here’s Why! A strong team is the backbone of any startup, and this investment was driven by exactly that. The founder already has a successful digital marketing and consultancy business, which significantly red

See More

Download the medial app to read full posts, comements and news.