Back

Vishwa Lingam

Founder of Simulatio... • 1m

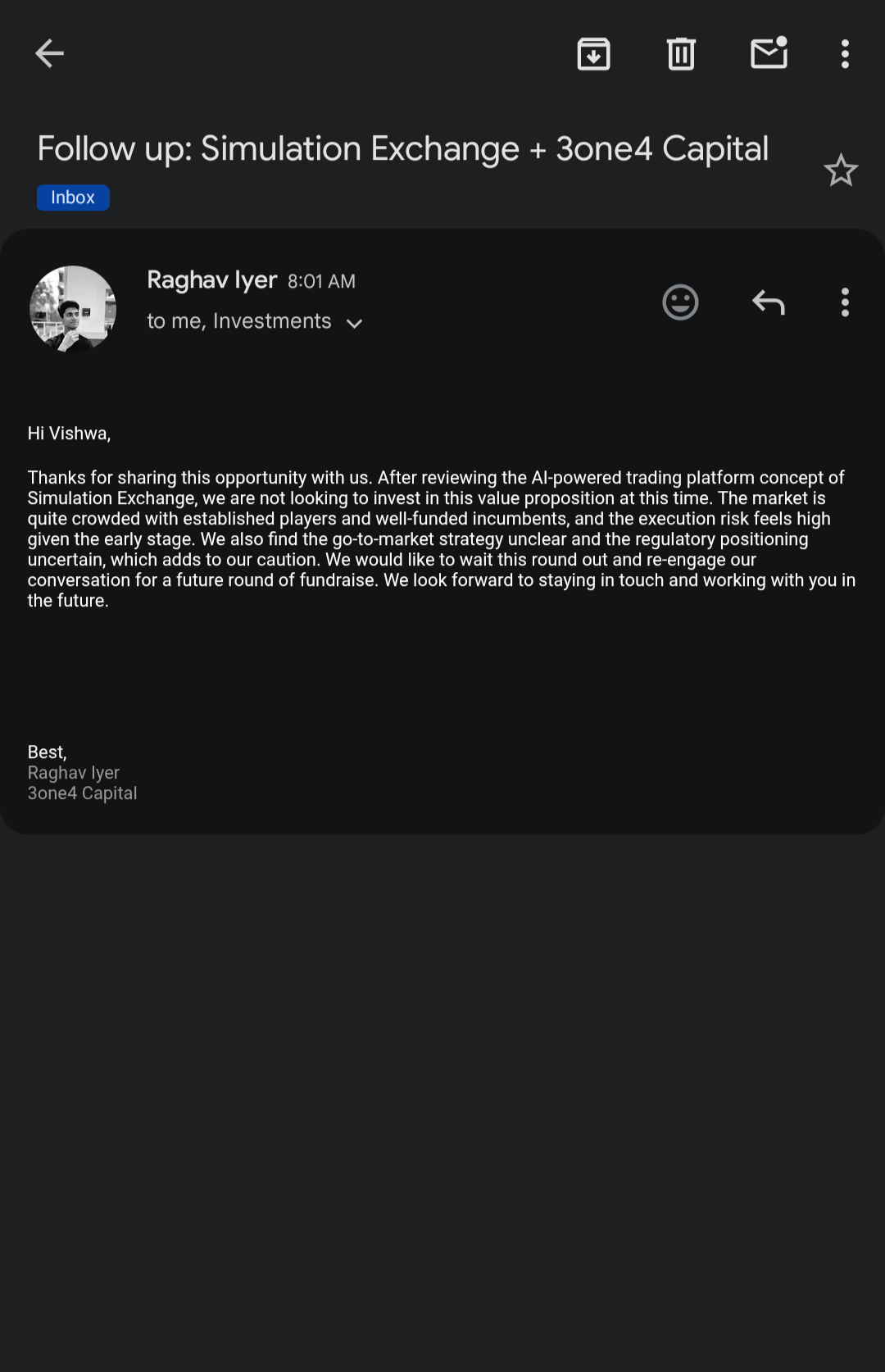

Got my first Rejection email from a VC. IDK How many of them I have applied for are reviewing or ghosted me. But well, I knew that the Market I am entering is full of well funded and established incumbents and yes mine is early stage start-up. But that doesn't mean my UVP stands in the market like mouse standing in a elephant herd. And yes, My GTM is not clear because everything are estimates because after doing extensive Market research, even I was unclear about how much users I can bring to my platform and how much I would have to spend on each user at that moment. Also even I don't know the regulatory position as what SEBI and FIU would think of my startup. But This all doesn't demotivate or stop me from believing in Simulation Exchange. Lessons to be learnt by Founders, Investors and VC:- 1) Founders :- when I was working in slice, I understood that regulatory positioning of slice was uncertain when it started (In fact before merging with NESFB, slice got screwed so heavily from RBI that RBI said Bank Bano ya Bandh karke Chalo) . But still slice got huge investments before all that because it's founder was an IITian and Product team guy in Flipkart. But that doesn't mean elite tagging can stop you from getting investments, move on until you get an investment based on your vision and never give up. Also never be shy or demotivated about your early stage of your startup when your idea is too big to be rejected by some VCs as they think about risk of thinking that big. Pre revenue funding was made to invest in vision more than stage of progress of your startup. 2) Investors and VCs :- Please don't just read and review the pitch decks as a PPT or PDFs, Pitch decks are not resumes, It's a roadmap. Duly ask for explanations from founders, then only you can properly understand vision, mission and passion behind the startup. In fact it is easy to describe SIM as AI powered trading platform. But if they would have gone through the MVP link and checked out the platform, they would have understood what is that AI powered UVPs beyond the description. And I would suggest to not believe a venture to invest in an early stage start-up with a big idea is risky. Risk is everywhere, In fact 90% of the ventures go into loss and even your portfolio will also have one of them. However It's better to invest in a garage based start-up with great roadmap than Investing in a passionless half baked startup with a headquarters in middle of the city. Also I appreciate 3one4 capital for it's fast reply and professional way of conveying reason for not moving forward with my application. Anyways, It's a great start for Simulation Exchange in the VC industry.

More like this

Recommendations from Medial

HigherLevelGames

Learning | Earning • 1y

And she called me a Misogynist.. XD This is an incident that took place when I was studying in 12th- We had a lesson in English named "LOST" At the end of the story, the protagonist which was a woman hits a guy with Whip (The guy was going behin

See More

Anonymous

Hey I am on Medial • 9m

In my previous org, the ceo was doing a lot of micro management, it was way too much e.g.frequent cross checking and manually going through the entire data work, that was one of the main reasons I left the job. when I put down my paper the scrutiny w

See MoreDownload the medial app to read full posts, comements and news.