Back

Ankush Sharma

Business Consultant ... • 3m

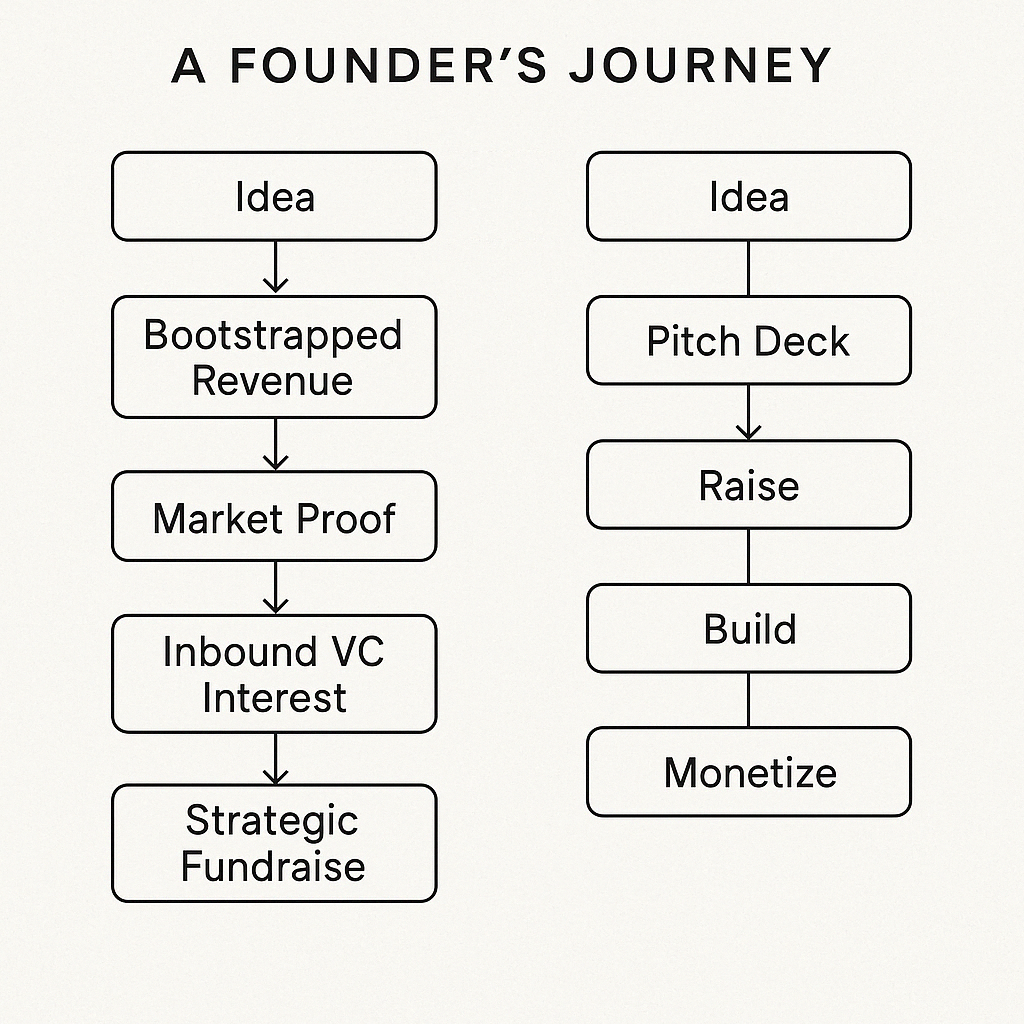

If your business is performing well, forget fundraising. Here’s the thing: Venture Capital is not looking for good to great companies. They're looking for outliers. We're talking: → 100x–1000x potential → Category creators → Can this become a monopoly? If your company is: doing well, growing steadily, and has strong fundamentals That’s a red flag for most VCs. Because they don’t back steady, they back explosive. Here’s how I break it down for founders: → Doing $500K ARR and growing 20% YoY? You’re a solid business, not a VC-backed rocket ship. → Have great margins, brand love, and cash flow? You might be better off bootstrapped, or with strategic capital, not VC. → Your product is built for 10,000 customers, not 10 million? That’s not a scale play. That’s a niche win. VCs ask one brutal question: → Can this company return our entire fund? That’s billions, not millions. So if you’re profitable, growing, and in control maybe the best move is not raising. Fundraising is not validation. It’s fuel. (but only if you’re building a rocket)

Replies (1)

More like this

Recommendations from Medial

Manik Gruver

•

Macwise Capital • 3m

You spend months understanding your customer's pain, but VCs skip your problem slide in 30 seconds for XYZ reasons. Since VCs rush through problem statements, how can founders ensure that VCs understand the depth of problem? #39 # Started #VC #Fundr

See MoreVicky

Ask yourself the que... • 5m

What If Bootstrapping Is the New Fundraising? Here’s a contrarian thought: in 2025, bootstrapping isn’t the opposite of VC funding—it’s becoming a new kind of pitch. Startups with solid revenues, loyal customers, and zero external capital are now m

See More

Download the medial app to read full posts, comements and news.