Back

Greg

👤 • 4m

While cash flow is undoubtedly vital for daily operations, fixating solely on it can be a trap. ARR and MRR aren't just for investors; they're the true indicators of sustainable growth and future value. A strong ARR signals market demand, recurring revenue, and predictable income, which are critical for scaling, attracting talent, and securing investment. Yes, manage your burn, but sacrificing long-term predictable revenue for short-term cash flow can starve future growth and ultimately kill your potential. ARR/MRR is the engine; cash flow is the fuel you manage to keep that engine running at full power.

More like this

Recommendations from Medial

Karthik Sreedharan

Fintech CEO | Revolu... • 1y

Cash flow management and control is one of the biggest pain points of startup founders, stakeholders and CFOs. Would you like try out an AI Copilot that enables you manage and control your cash flows and manage your finance team through approval work

See MoreManu

Building altragnan • 5m

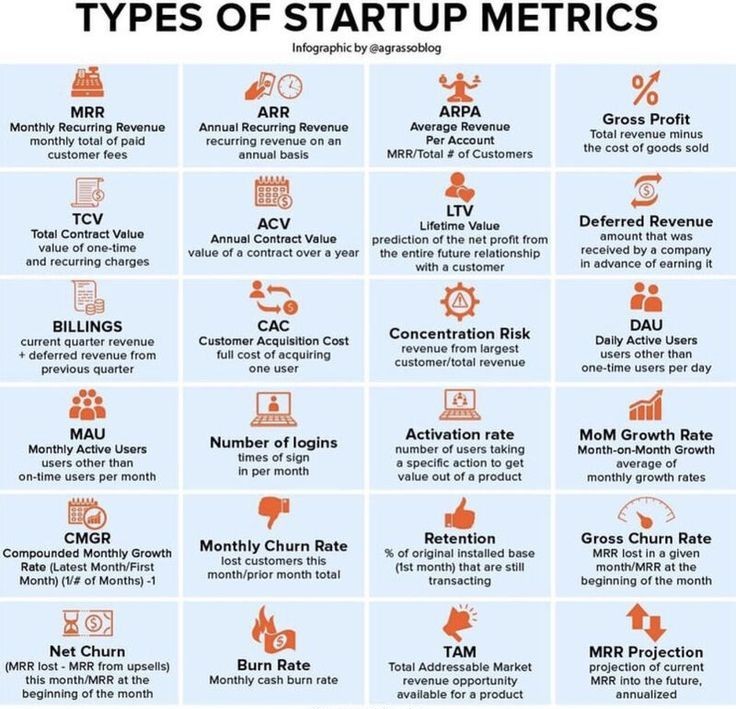

This infographic shows key startup metrics. MRR is monthly recurring revenue, while ARR is annual recurring revenue. ARPA shows average revenue per customer. Gross Profit is revenue minus costs. TCV and ACV measure contract values. LTV predicts total

See More

Vivek Joshi

Director & CEO @ Exc... • 5m

Facing cash flow issues? You're not alone! In this video, we share “10 innovative ways” to troubleshoot common cash flow challenges that can hinder your business's success. From negotiating payment terms and invoicing promptly to diversifying revenue

See MoreVikas Acharya

Building WelBe| Entr... • 6m

The A-Z Survival Guide to Entrepreneurship! C – Cash Flow Profitability sounds great, but if you run out of cash, your business dies—no matter how good your idea is. I learned the hard way that revenue doesn’t equal survival. Managing cash flow is

See MoreManiraj N G

Marketing & Systems ... • 9m

📊 Why Revenue Modeling is Critical for Your Business – Backed by Data 📊 Revenue modeling isn’t just a forecasting exercise – it’s a roadmap for growth, stability, and innovation. Here's why it matters, with data to back it up: 1️⃣ Predicts Future

See MoreSandip Kaur

Hey I am on Medial • 1y

Mastering Cash Flow: Simple Strategies for Indian Startups Cash flow can either make or break your startup, and managing it well is critical. Here are some practical tips to help your startup thrive financially: 1.Separate Business and Personal Fina

See MoreSwapnil gupta

Founder startupsunio... • 4m

✅ Must for Business Students 🥇10 Most Important metrics that are asked by investors. 1. Revenue Growth Rate 2. Monthly Recurring Revenue (MRR) 3. Burn Rate 4. Cash Runway 5. Gross Margin 6. Customer Acquisition Cost (CAC) 7. Customer Lifetime Val

See MoreDownload the medial app to read full posts, comements and news.