Back

Anonymous 3

Hey I am on Medial • 5m

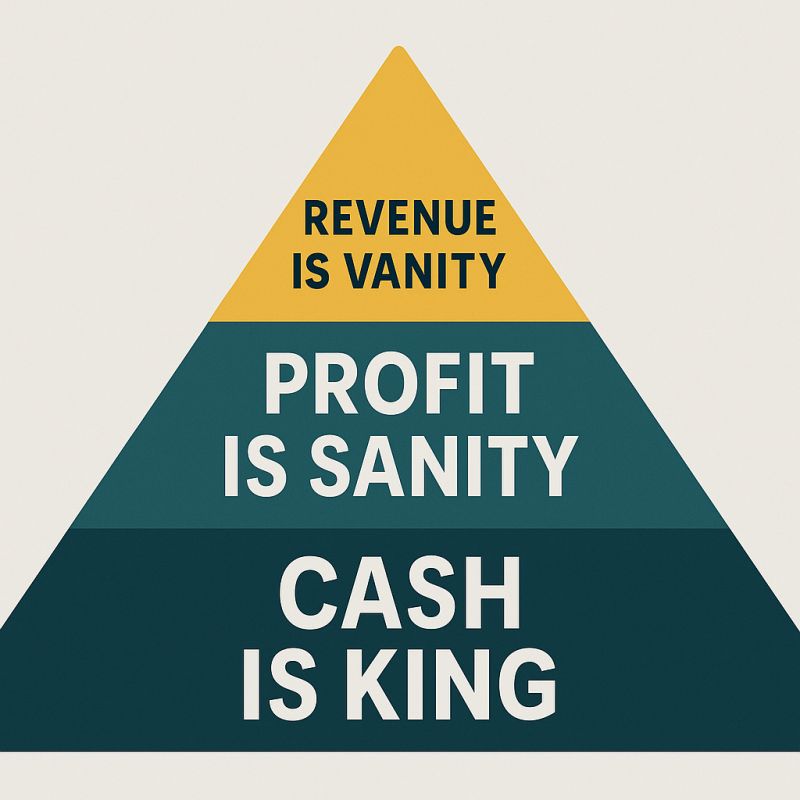

Facts. Cash flow > vanity metrics. Too many startups chase user numbers and end up dead because they can’t even pay server bills.

More like this

Recommendations from Medial

Mr Shiva Raj

Challenging Norms, C... • 8m

💡 The Harsh Truth About Business 90% of startups fail within 3 years. Why? ❌ They chase funding, not customers ❌ They build products, not solutions ❌ They ignore cash flow If you want to succeed, focus on: ✅ Solving real problems ✅ Generating profit

See MoreSomeone you will know

Founder, Builder, Ob... • 2m

🚀 Post 1: “Startups don’t die from lack of funding — they die from lack of alignment.” Most first-time founders think fundraising is all about creating a sleek pitch deck and blasting it out to 50+ VCs. But here’s the truth: 🧠💣 That deck? It’s ju

See MorePavan Kumar Ennamuri

Hey I am on Medial • 1m

🚨 What the heck is Funding-Market Fit? I learned it the hard way. When I started building my travel-tech idea, I got pulled into “startup paperwork mode”: 👉 Should we register as Pvt Ltd or LLP? 👉 What about compliance costs? 👉 Do we need a CA o

See MoreSourav Mishra

•

Codestam Technologies • 4m

The quiet part of building something: Nobody talks about how lonely it gets. You're surrounded by people, but your mind is somewhere else— in product decisions, bugs, feedback loops, cash flow, that one angry user email you can’t stop thinking abou

See MoreRam Pavan

Building TravelTech ... • 1m

🚨 What the heck is Funding-Market Fit? I learned it the hard way. When I started building my travel-tech idea, I got pulled into “startup paperwork mode”: 👉 Should we register as Pvt Ltd or LLP? 👉 What about compliance costs? 👉 Do we need a CA o

See MoreDownload the medial app to read full posts, comements and news.