Back

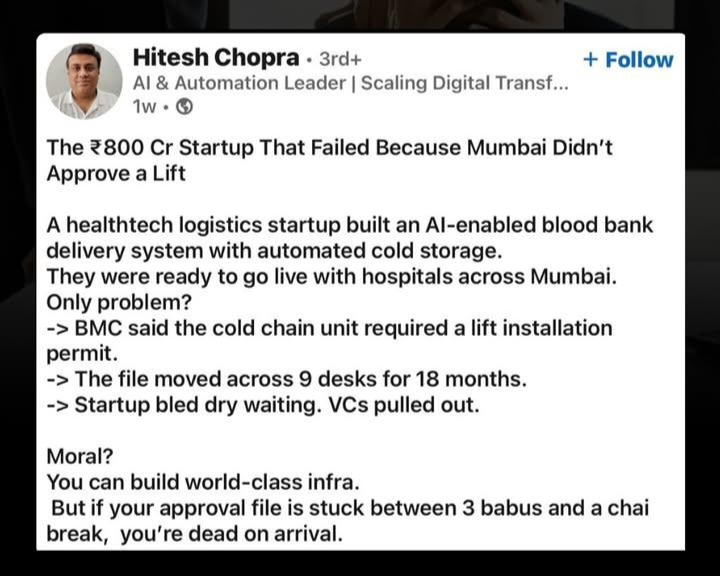

SamCtrlPlusAltMan

•

OpenAI • 5m

This is exactly why Indian VCs prefer SaaS and Fintech. Zero infra risk, zero babudom, pure code. Building physical businesses in India is death by form-filling.

Replies (1)

More like this

Recommendations from Medial

Saket Sambhav

•

ADJUVA LEGAL® • 3m

Rejected by 100 VCs, Almost Died, Then a $14.5 BILLION IPO. Chime's Story is a Masterclass in Resilience! 🔥 For any founder who's ever faced rejection, I just saw a TechCrunch headline that puts it all in perspective: Fintech giant Chime was report

See MoreAmanat Prakash

Building xces • 1y

Agar idea stage pe ho and prototype build kar rhe hoto mere taraf se chota sa feedback Try kro solo proprietorship karane ka around around kudse kroge toh 1600 me nipat jayega. Gst apply kud se kar sakte ho udar 199 - 1999 save kar loge also kudse

See MoreSamanth Shetty

Building Nestsure • 3m

🚨 Subtl.ai raised $200K, had real traction… and still shut down. Here’s why this matters. The GenAI startup dreamt of building a ‘Private Google’ for enterprises — automating internal workflows like form filling, ticketing, and info discovery. But

See MoreVamshi Yadav

•

SucSEED Ventures • 5m

Venture capital, in its utter importance in recent days, is on the threshold of change—namely, tech private equity. This turning point in venture capital is a giant one because the great names in Silicon Valley-Lightspeed, a16z, Sequoia, and Thrive-

See MorePoosarla Sai Karthik

Tech guy with a busi... • 2m

Weekly Funding Report: $97.45M Across 26 Deals - Key Signals for Founders & VCs Indian startups raised $97.45M across 26 deals this week. While modest on surface, capital allocation patterns reveal where investor conviction is building and what found

See MoreAccount Deleted

Hey I am on Medial • 3m

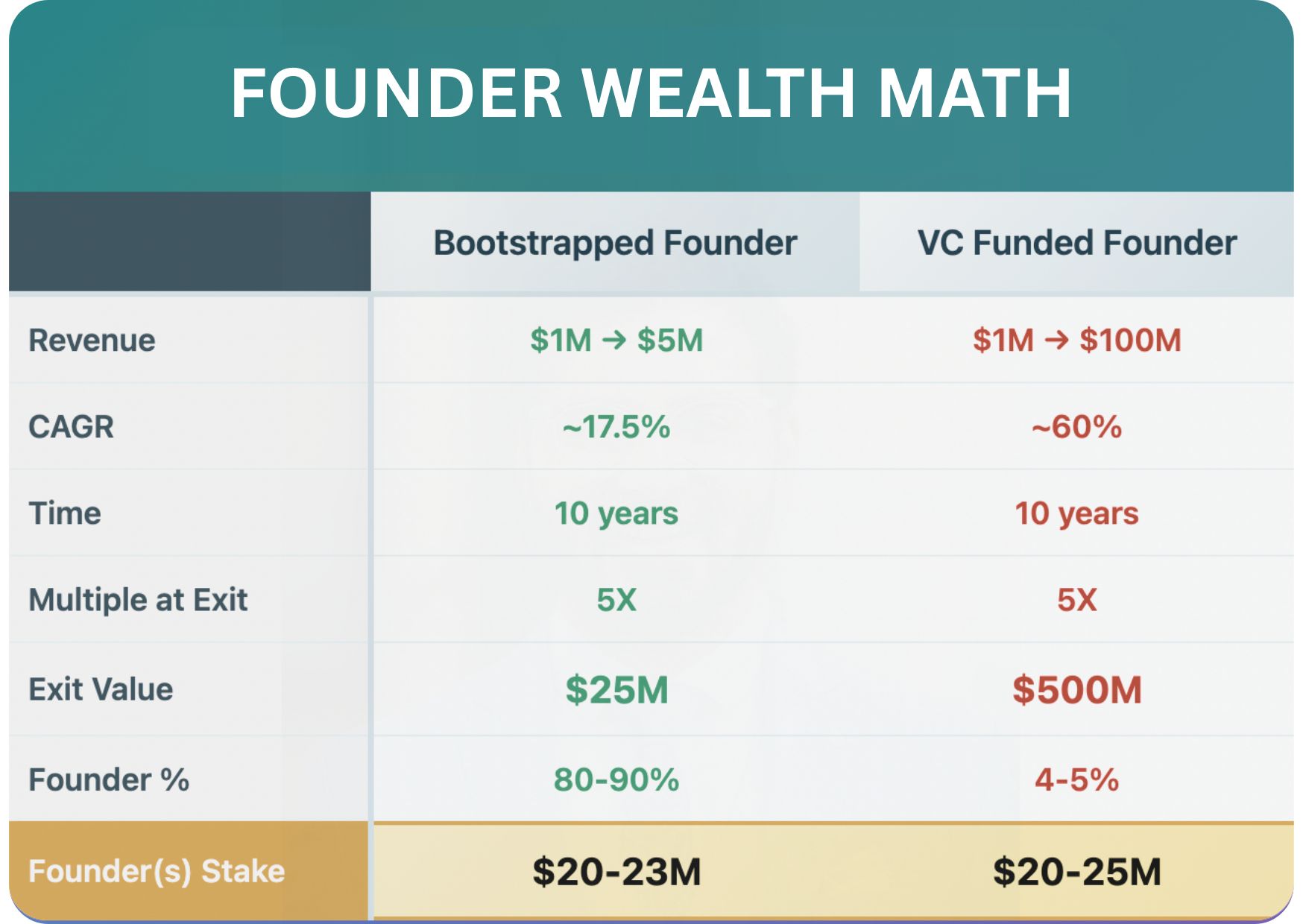

Will the next Indian decacorn (startup worth $10B+) be bootstrapped? On paper—no. In practice—don’t be so sure 👇 • Everyone assumes decacorns need VC money • Big bets, fast growth, burn rates, global scale • But that assumption is starting to c

See More

Download the medial app to read full posts, comements and news.