Back

Vamshi Yadav

•

SucSEED Ventures • 3m

Venture capital, in its utter importance in recent days, is on the threshold of change—namely, tech private equity. This turning point in venture capital is a giant one because the great names in Silicon Valley-Lightspeed, a16z, Sequoia, and Thrive-are probably the very stalwarts of the new era of tech-ized private equity, and does that even matter? The Existential Crisis of Old-School VC It slowly rots away on the very stake of its weakness. 🔹 20% Rule: VCs could only allocate 20% to non-startup assets, such as public stocks, secondaries, and buyouts, along the way. 🔹 Liquidity Jail: Ample 10-plus years in a holding pattern waiting on IPOs or exits. 🔹 Passive Governance: Inability to exercise control within portfolio companies. The RIA Revolution The very registration as Registered Investment Advisors turned Lightspeed into an actor with a clout like that of private equity: ✅ Unlimited Asset Flexibility: Public stocks, secondaries, roll-ups, buyouts ✅ Active Ownership: Build, buy, and run companies (not just advising them) ✅ Liququidity Engineering: Ride the wave of the secondary market, which is booming to $100B+ • Hired ex-Goldman MD Jack Fowler to lead its secondary strategy • a16z (RIA since 2019) operates across crypto, wealth management, and PE-style governance The New Playbook 1️⃣ Build AI-Native Roll-Ups Buy traditional companies → Rebuild with AI (Thrive's $1B "AI factory") General Catalyst was buying a hospital system to test healthcare AI at scale. 2️⃣ Evergreen Funds Sequoia has eliminated the ten-year fund model in favor of a pool of permanent capital. 3️⃣ Vertical Domination Build sector-dedicated platforms (fintech, healthtech) versus spreading munitions. 4️⃣ Public Market Crossovers Pre-IPO investment → Post-IPO holding → An activist governance What’s Next? • Death to all mid-tier VCs: Only scalable RIAs will survive • Tech-enabled PE: Algorithms sourcing deals, AI optimizing portfolios • Caution, Founders: VCs now compete with you using their own built ventures The Bottom Line There is a merging between VC and PE. This means for founders: ✔️ New capital partners (with broadened time horizons) ✔️ Ruthless competition expected from rival investors-built competitors ✔️ Exit routes beyond IPO/M&A (secondaries, roll-ups) Source: @TheIcahnist

More like this

Recommendations from Medial

Vamshi Yadav

•

SucSEED Ventures • 3m

The VC Playbook Is Getting Rewritten, So Here's What's Next The biggest names in Silicon Valley—Lightspeed Ventures, a16z, Sequoia, and Thrive—are no longer mere veil of ventures. They are morphing into tech-powered private equity titans with seism

See MoreNitin Rai

Atyant - The path of... • 5m

Stay Fresh Without Water! 🚀 Let’s be honest—life is hectic, and sometimes, taking a bath isn’t always possible. Whether you're stuck in traffic, rushing between meetings, or traveling non-stop, staying fresh can be a challenge. That’s why we’re wor

See More

Thakur Ambuj Singh

🚀 Entrepreneur | Re... • 4m

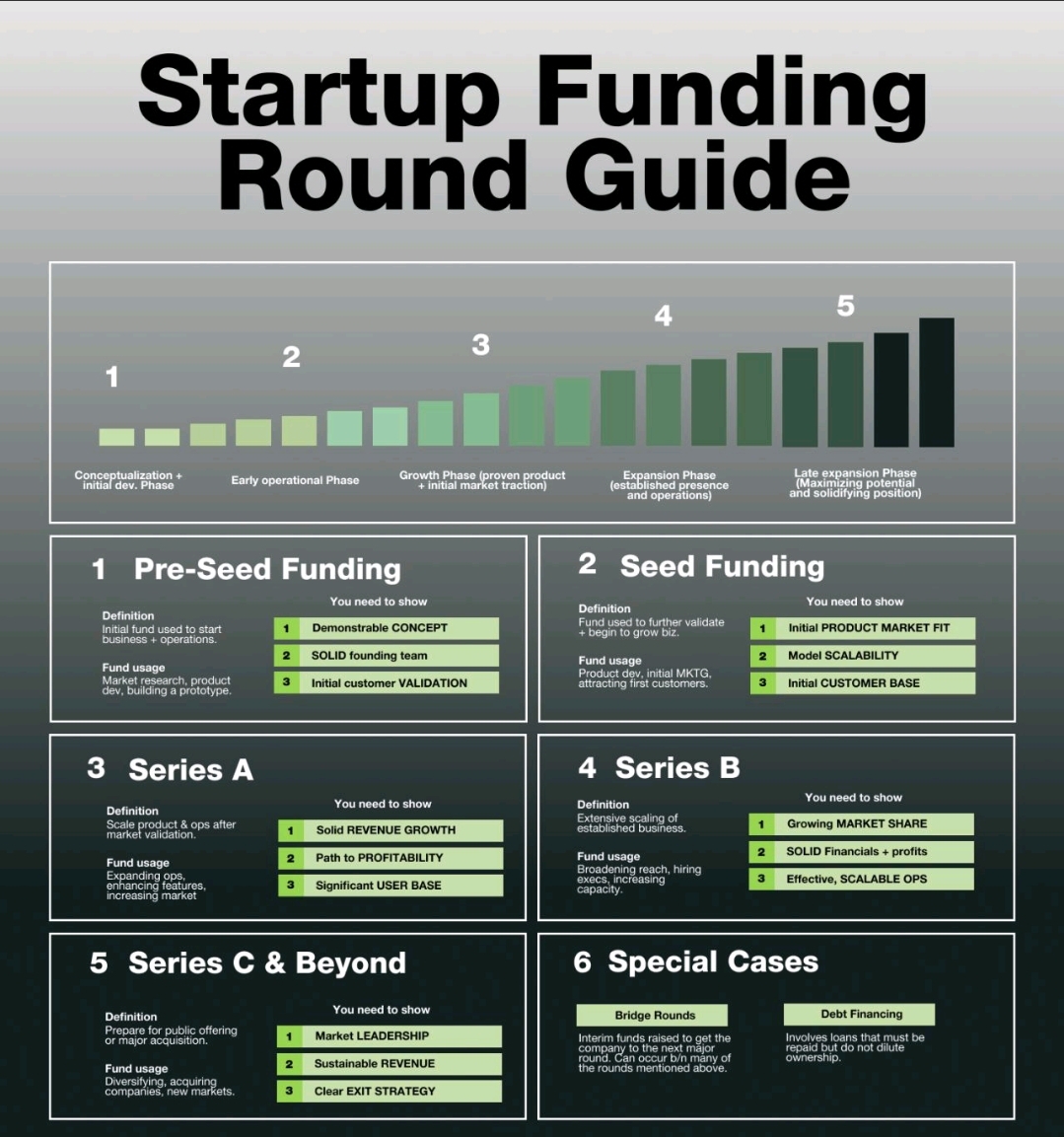

Startup Funding Guide: From Idea to Growth 🔹 Pre-Seed – Building a concept & team 🔹 Seed – Validating market fit 🔹 Series A – Scaling revenue & profitability 🔹 Series B – Expanding market share 🔹 Series C & Beyond – Preparing for IPO & market l

See More

Aroneo

| Technologist | ML ... • 5m

Machine Learning vs. Deep Learning: What’s the Real Difference? 🤖⚡ Machine Learning (ML) and Deep Learning (DL) are both AI-driven, but they’re not the same! While ML relies on algorithms to learn from data, DL uses artificial neural networks to pr

See MoreShamsuddin Essa Hamdule

Full Stack Software ... • 7m

🎉 Welcome to the Future of Digital Excellence! 🎉 🌐 SE Software & Web Developers 🌐 🚀 Transform Your Ideas into Reality with Us! 🚀 ✨ What We Offer: ✔️ Stunning, Customizable Websites for All Businesses ✔️ Mobile-Friendly and Fully Responsive De

See MoreSatyam Kumar

"Turning visions int... • 1m

Service-Based vs Product-Based Startups in 2025 Still confused what to build? Read this before you burn out. 🔹 Service Startup ✔️ Instant cash flow 💸 ✔️ Faster to start ✔️ You trade time = you earn ❌ Hard to scale ❌ Every client = a new boss ❌ “We

See MoreBusiness karo India

Business karo India ... • 4m

Hey everyone, I’m working on an exciting business classified website and app, and I’m looking for a passionate and skilled tech co-founder to join me on this journey. 🔹 What’s Built? The platform is already developed with the help of a third party

See More

Download the medial app to read full posts, comements and news.