Back

CA Saloni Jaroli

Grow & Glow • 6m

Smart Tax Planning = More Savings & Zero Stress! Are you overpaying taxes or struggling with compliance? Many high-income individuals and large businesses miss out on legal tax-saving opportunities and end up paying more than necessary. At Saloni Jain & Associates, we specialize in Income Tax & GST return filing with a focus on: ✅ Maximizing tax efficiency – so you save more ✅ Complete & accurate documentation – reducing risks of notices ✅ Competitive pricing – premium service without the premium cost 💡 Why wait until the deadline? Stay compliant, save money, and avoid last-minute stress. 📩 DM us or comment "TAX" to know how we can help you optimize your tax filings today! #TaxPlanning #GST #IncomeTax #ComplianceMatters

More like this

Recommendations from Medial

Saurabh Mishra

Building a tech gian... • 2m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreSai Vishnu

Income Tax & GST Con... • 5m

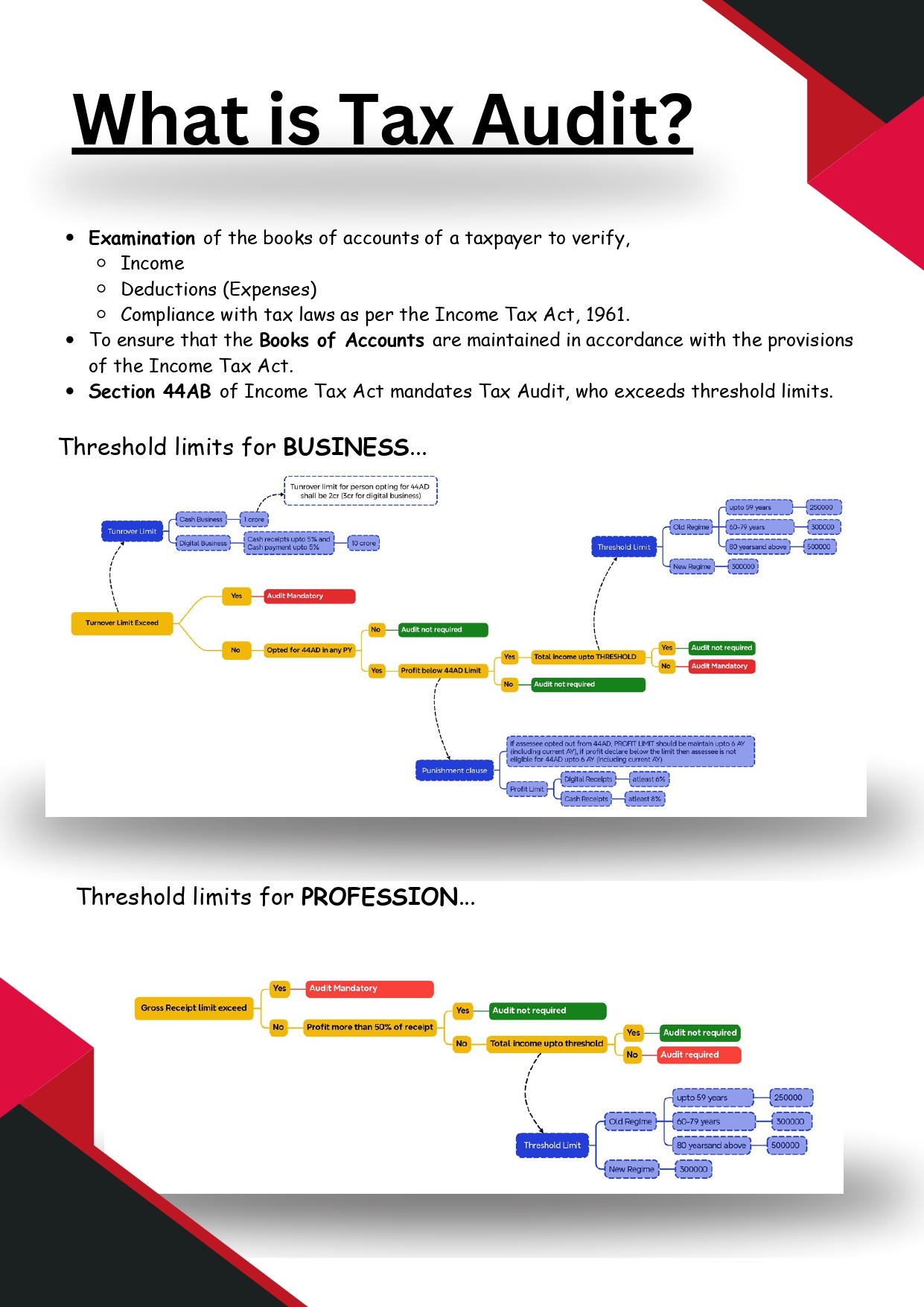

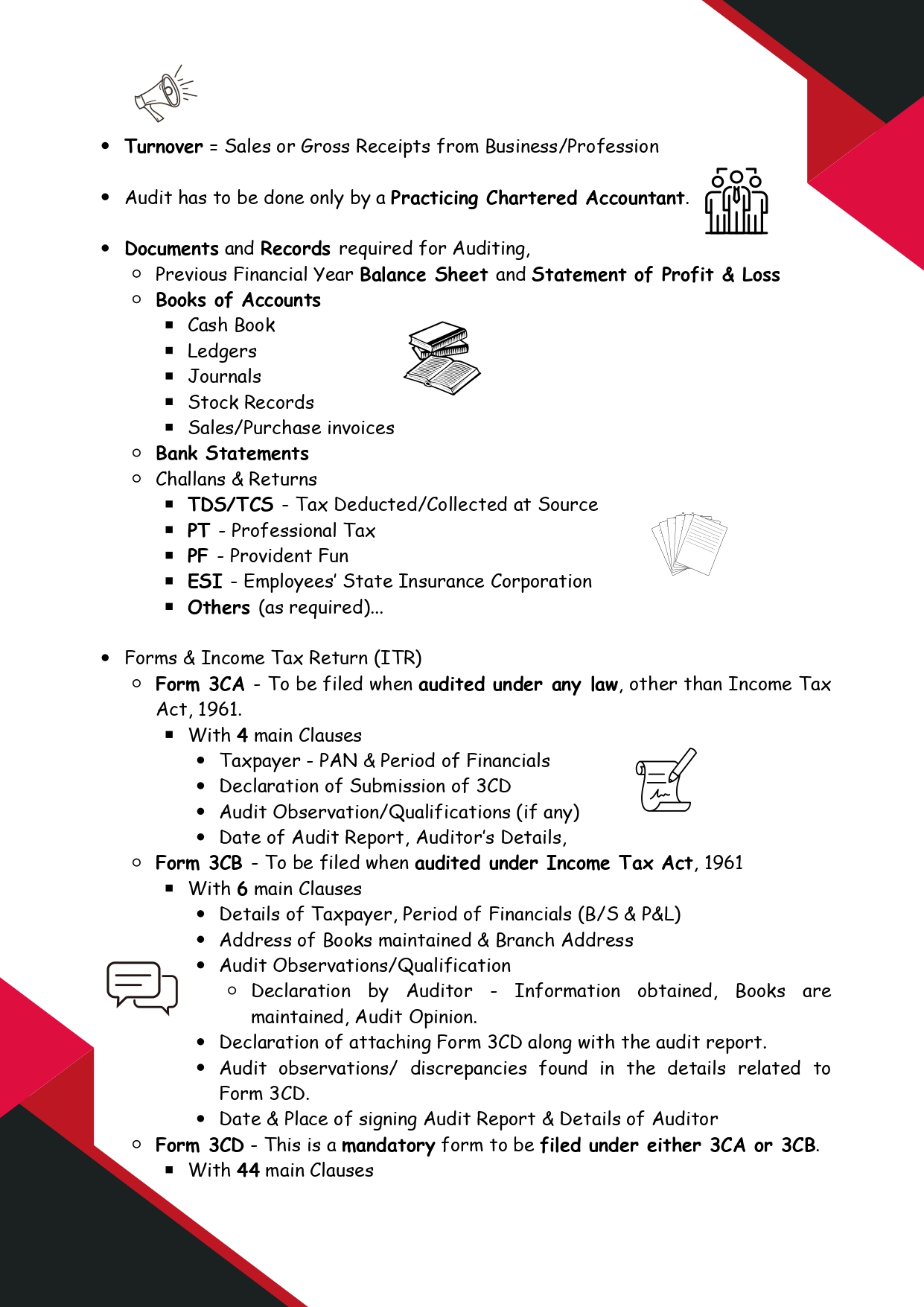

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

Hiral Jain

Content writer • 1y

Greetings everyone! Let's learn about our tax system! The Indian tax system is divided into two categories: Direct (income tax) and Indirect (GST)it's an unfair tax tbh. It's because everyone pays the same tax regardless of their income. For example

See More

Download the medial app to read full posts, comements and news.