Back

Nimesh Pinnamaneni

•

Helixworks Technologies • 6m

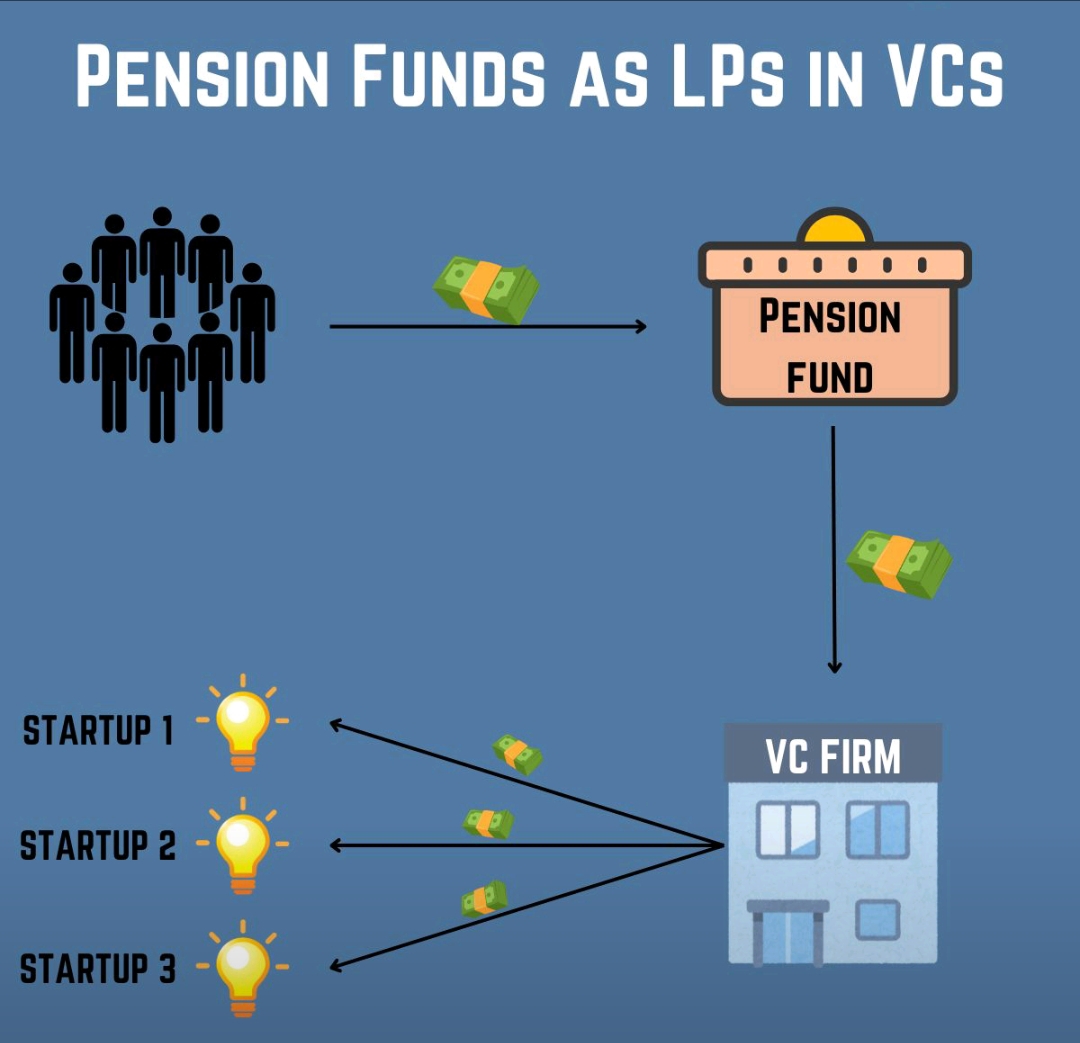

Startups don’t need to be profitable early—just valuable. Most fail, but VCs don’t need all of them to succeed—just a few outliers. Venture returns follow a power law: a tiny percentage of startups generate nearly all the returns. A typical VC fund invests in 50 companies—40 will fail, a few will break even, and 1-2 will be massive hits that return the entire fund. That’s why VCs chase high-risk, high-reward bets. They’re not looking for steady profits—they’re hunting for unicorns (or Indicorns). Also, VCs get paid regardless. They earn management fees (2% per year of the fund size) and take 20% of the profits (carry) from exits.

More like this

Recommendations from Medial

Vishwa Lingam

Founder of Simulatio... • 1m

🚫 Why VCs Reject Your Pitch — Even If It’s a Solid One 💡 You're not alone if your startup pitch got rejected by a VC. But here's the hidden truth most won’t tell you: VCs have limited capital from their LPs (Limited Partners) & they’re under pre

See MoreAyush

Let's build together... • 6m

Was talking to a founder few days back. Had a healthy talk and there was a line that deeply resonated in me - "VCs don’t fund ideas. They fund inevitabilities. Make your startup something the world can’t ignore." Niket Raj Dwivedi, you are the bes

See MoreIncorpX

Your partner from St... • 4m

🚀 Introducing Indicorns 2025: India's New Vanguard of Profitable Startups In a bold move to redefine startup success, Titan Capital (backers of Ola, Urban Company, Mamaearth) has unveiled the Indicorns 2025 List at India Internet Day. This initiati

See MoreAccount Deleted

Hey I am on Medial • 3m

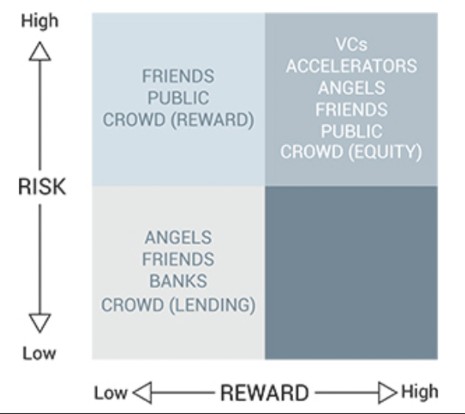

Before You Pitch Your Startup to Anyone, Ask These 2 Questions Most founders don’t raise money because their startup is bad. They fail because they’re pitching to the wrong kind of investor. Here’s what I mean. There are different kinds of investo

See More

Adithya Pappala

G.P Seed-VC|Investin... • 9m

#9TDAYVC-DAY-16 🎯What is High Watermark in VC? 🎯What are Distributions/Waterfall? Apart from hurdle rate, Some consider also “high watermark” This is more common practice in hedge funds. This market denotes the highest value recorded by the f

See MoreDownload the medial app to read full posts, comements and news.