Back

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 11m

Wall Street Update: US Stock Indices Trade Mixed Amid Fresh PCE Inflation Data Wall Street Update: Dow Rises, S&P 500 and Nasdaq Slip Amid PCE Inflation Data **US Stocks Mixed as Investors Digest PCE Inflation Data** US stock indices were mixed on

See MoreAtharva Deshmukh

Daily Learnings... • 1y

Have studied about Monetary Policy in short and it's effect. The monetary policy is a tool through which the Reserve Bank of India (RBI) controls the money supply by controlling the interest rates. RBI is India’s central bank. While setting the int

See MoreTushar Aher Patil

Trying to do better • 5m

Exploring Negative Interest Rate Policy (NIRP) Have you ever wondered about central banks setting interest rates below zero? This is known as Negative Interest Rate Policy (NIRP). Here's a quick look at this unconventional monetary tool: ✍️ What is i

See More

Rajan Paswan

Building for idea gu... • 1y

Bad News: Rupee falls to record low 83.60/$ Here are negative impacts of falling Rupee: 1) Increased Costs for Imports: Many Indian businesses rely on imported goods and raw materials. A weaker rupee means they will have to pay more for these impor

See MoreAakash kashyap

Building JalSeva and... • 12m

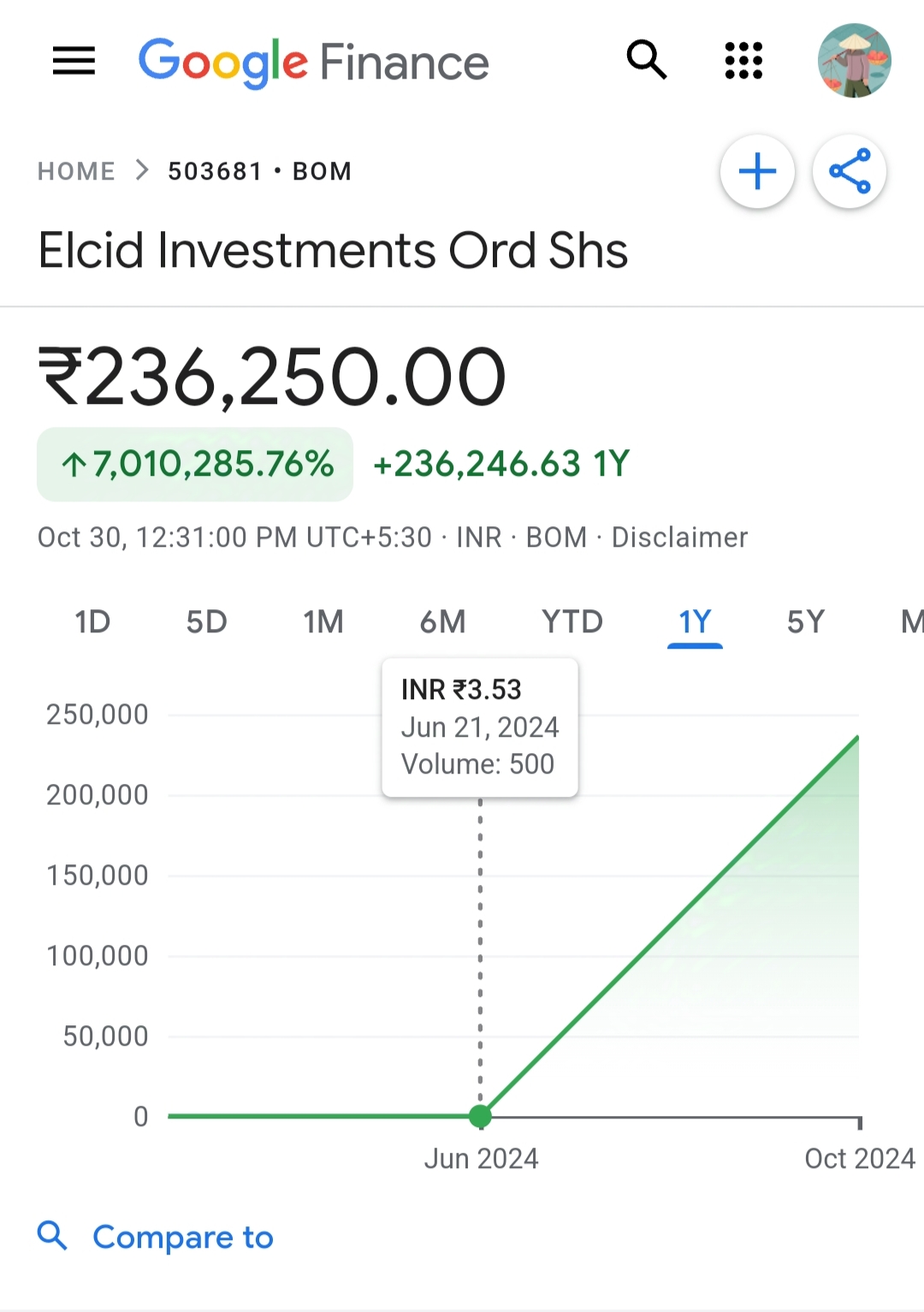

Elcid Investments Ltd's share price skyrocketed to ₹2,36,250 after its relisting on the Bombay Stock Exchange in October 2024.🔥 Elcid Investments Ltd operates as an investment holding company. It primarily holds stakes in other companies, with a si

See More

Vamshi Yadav

•

SucSEED Ventures • 6m

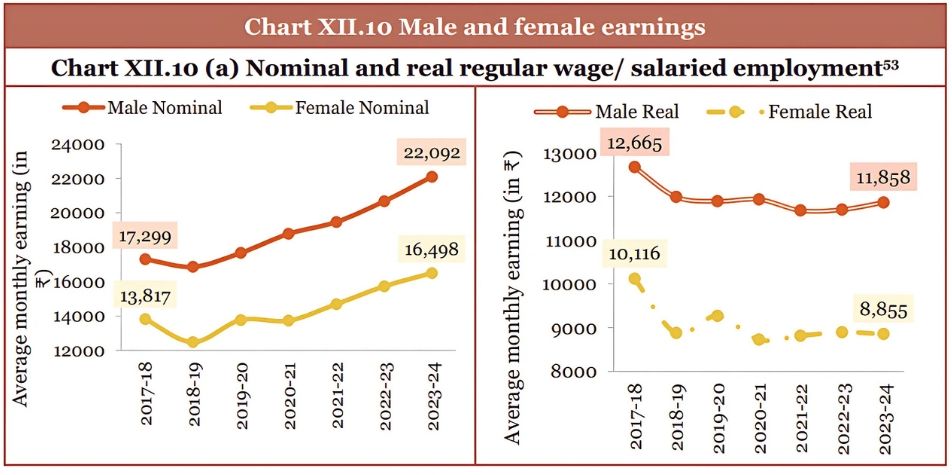

"Pakoda VC" is now a trend & I can understand why! It's India's broken system The numbers tell a grim story: middle-class incomes are shrinking as inflation (~6%) outpaces wage growth (~4%). While labor participation has risen to 60%, most new worke

See More

Download the medial app to read full posts, comements and news.