Back

financialnews

Founder And CEO Of F... • 11m

Wall Street Update: US Stock Indices Trade Mixed Amid Fresh PCE Inflation Data Wall Street Update: Dow Rises, S&P 500 and Nasdaq Slip Amid PCE Inflation Data **US Stocks Mixed as Investors Digest PCE Inflation Data** US stock indices were mixed on Wednesday as investors evaluated the latest Personal Consumption Expenditure (PCE) inflation report. The PCE, a key inflation gauge monitored by the Federal Reserve, showed a 2.3% rise year-over-year in October and a 0.2% increase month-over-month, indicating persistent but moderate inflation pressures. At 10:03 a.m. ET, the Dow Jones Industrial Average gained 47.83 points, or 0.11%, to 44,908.14. Meanwhile, the S&P 500 slipped 8.68 points, or 0.14%, to 6,012.95, and the Nasdaq Composite dropped 87.31 points, or 0.46%, to 19,088.26. **Economic Growth and Corporate Earnings Update** The US economy grew at a 2.8% annual rate in the third quarter, driven by strong consumer spending and .... if you want to know more click 👇 below the link

Replies (3)

More like this

Recommendations from Medial

Sairaj Kadam

Student & Financial ... • 5m

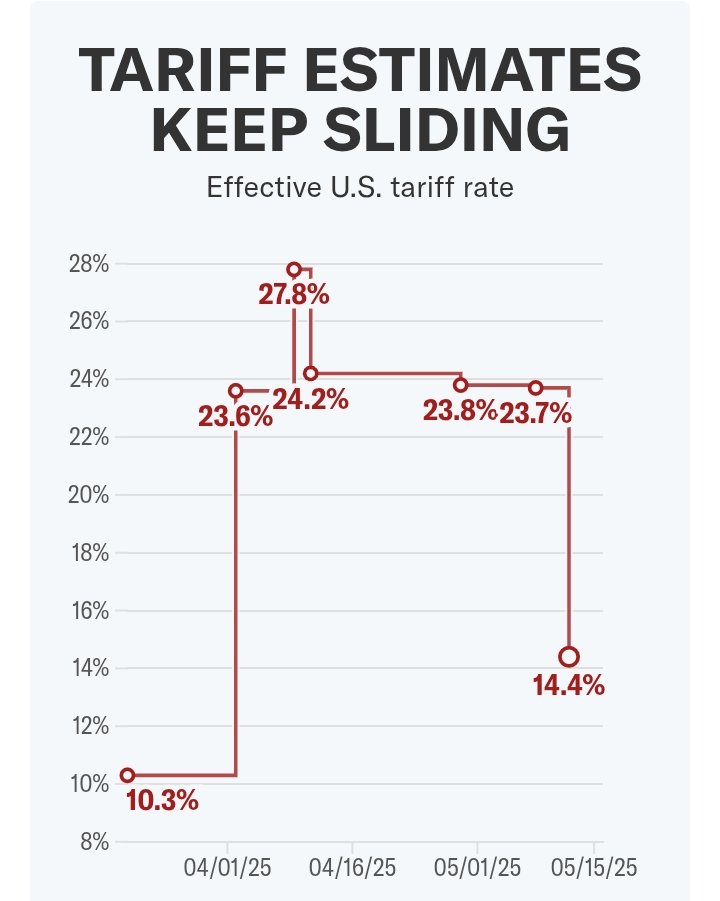

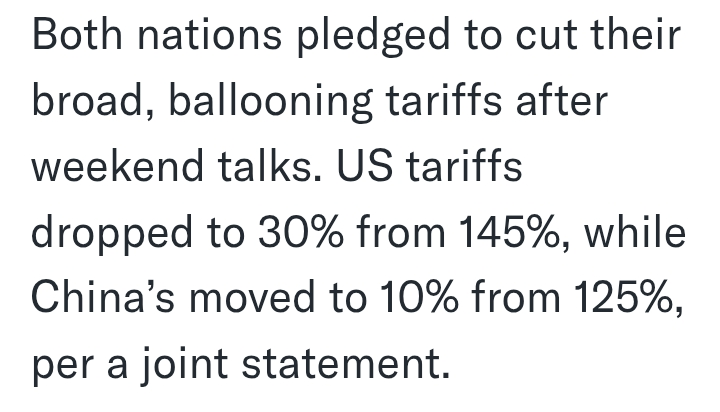

Tariffs are dropping fast, faster than Wall Street expected. Inflation? Never coming. Markets knew: a businessman is behind the deal. Nasdaq +7%, S&P 500 +5%. Eyes back on the companies we covered last. That’s not just smart investing, that’s better

See More

Sairaj Kadam

Student & Financial ... • 6m

Did we just overhype the US-China trade war? Tariffs dropped: US from 145% to 30%, China from 125% to 10%. Now both sides enter 90-day talks. Markets are green. Companies hit by China are bouncing back. Dow & NASDAQ up. Win-win? But you have to stay

See More

financialnews

Founder And CEO Of F... • 1y

"RBI Expected to Cut Repo Rate by 25 Basis Points to 6.25% in December Amid Concerns Over Volatile Food Prices" "RBI Likely to Cut Key Policy Rate by 25 Basis Points to 6.25% in December as Inflation Expected to Ease, Aiming to Boost Economic Growth

See MoreSairaj Kadam

Student & Financial ... • 5m

Moody’s just downgraded the U.S. credit rating from AAA to AA1 huge blow to confidence. Last week, Nasdaq surged 7%, S&P 500 5%, Dow 3% on tariff truce. But today? Futures drop: Dow -0.9%, S&P -1.2%, Nasdaq -1.6%. Debt fears now shaking markets hard.

See More

RootDotAi

From the ROOT to the... • 1y

Here's a Summary of the FED decision on March 20, 2024: 1. The Federal Reserve keeps interest rates steady at 5.50% for the fifth consecutive meeting. 2. The Fed maintains its anticipation of three interest rate reductions in 2024. 3. The proje

See MoreDownload the medial app to read full posts, comements and news.