Back

Ramesh Chartered Accountant

Investor in start-up... • 8m

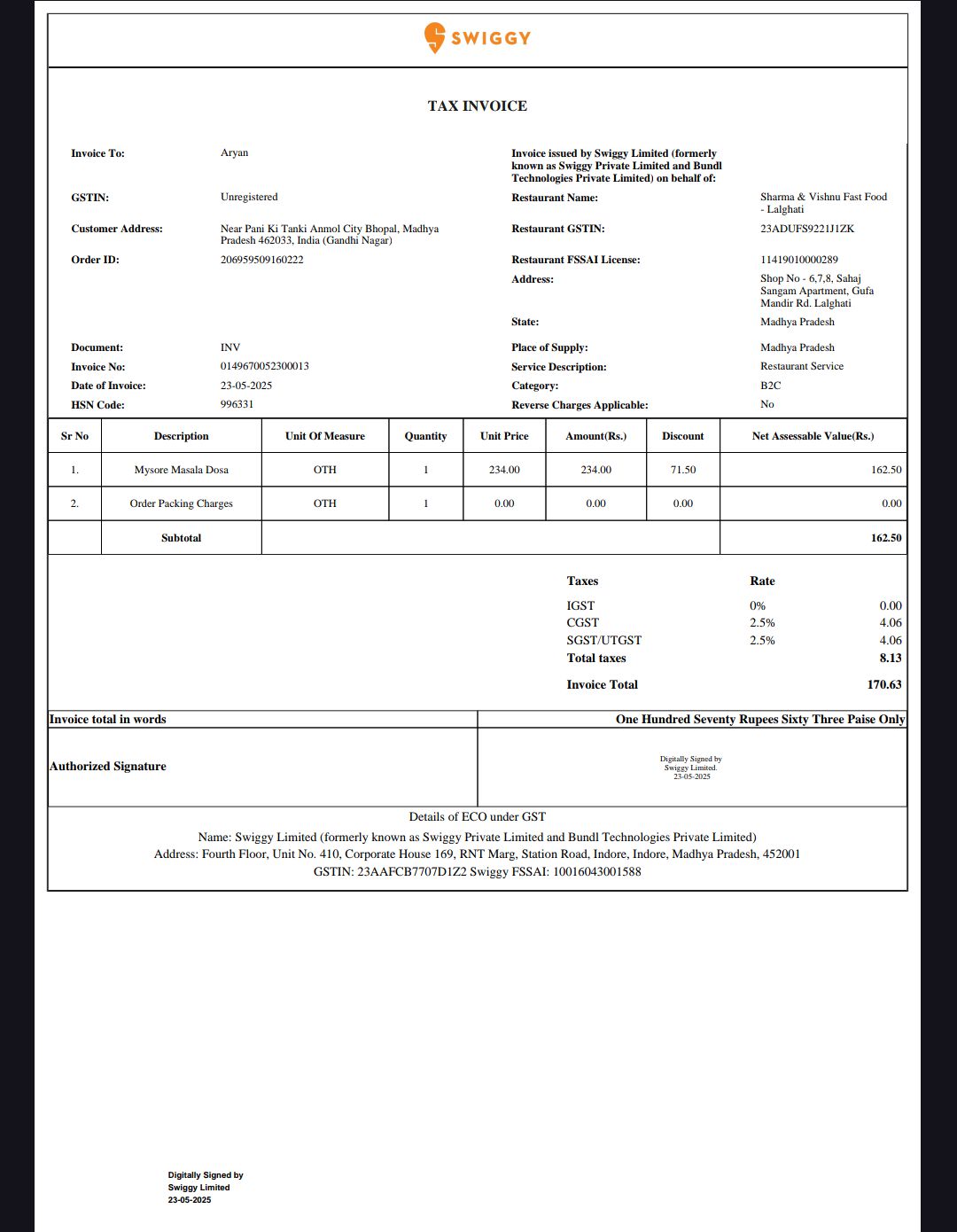

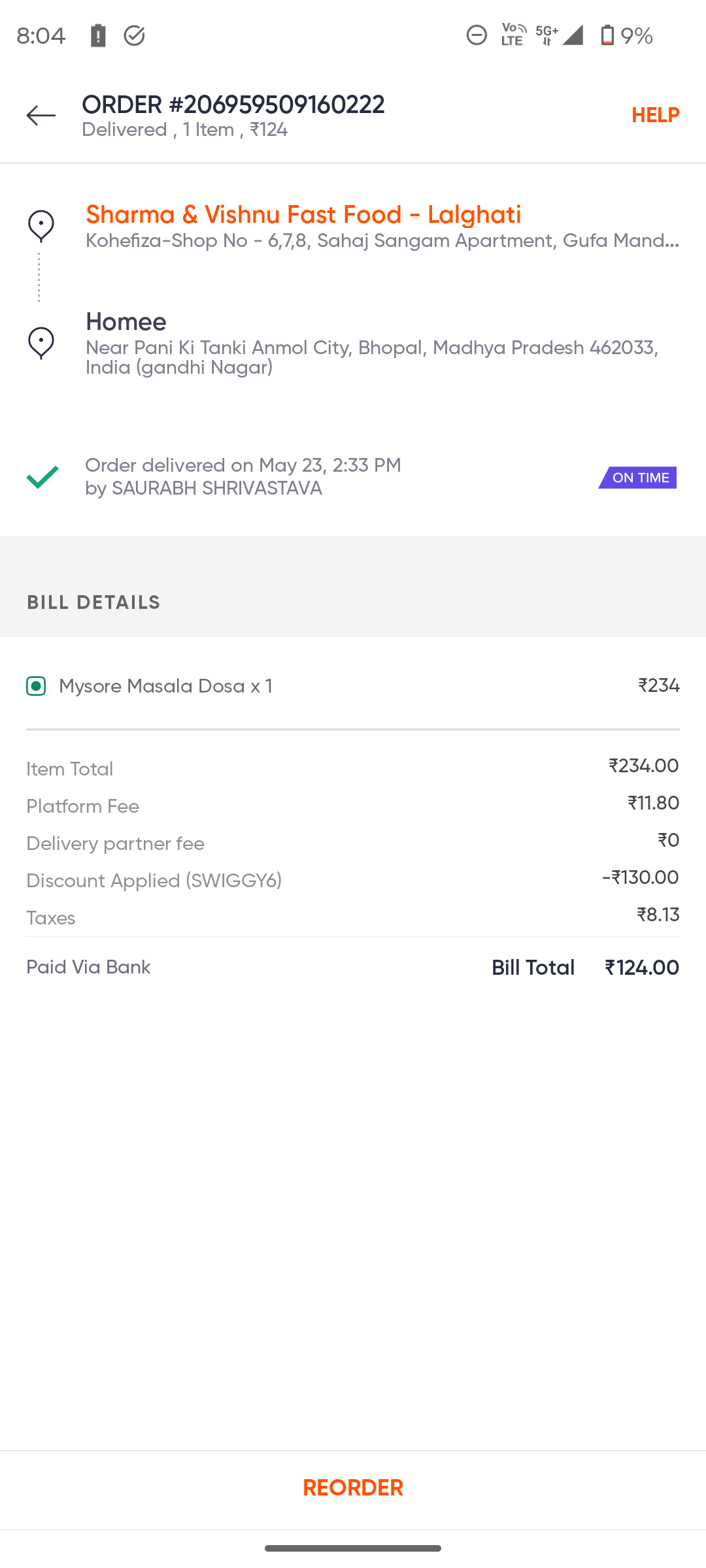

he has reached from 50lak order value in aug 24 to 1 cr in Jan25..so it's a monthly order value...and these are reflected in the GST returns once invoice is raised

Replies (1)

More like this

Recommendations from Medial

CA Kakul Gupta

Chartered Accountant... • 9d

GST Rate Change – Important Clarification The Govt. has clarified that new GST rates will apply on all deliveries made on/after 22nd September. 👉 Even if you have booked your order, issued invoice, or made advance payment pehle, the new rate will

See MoreDinesh H

Mission to Quit 9 to... • 3m

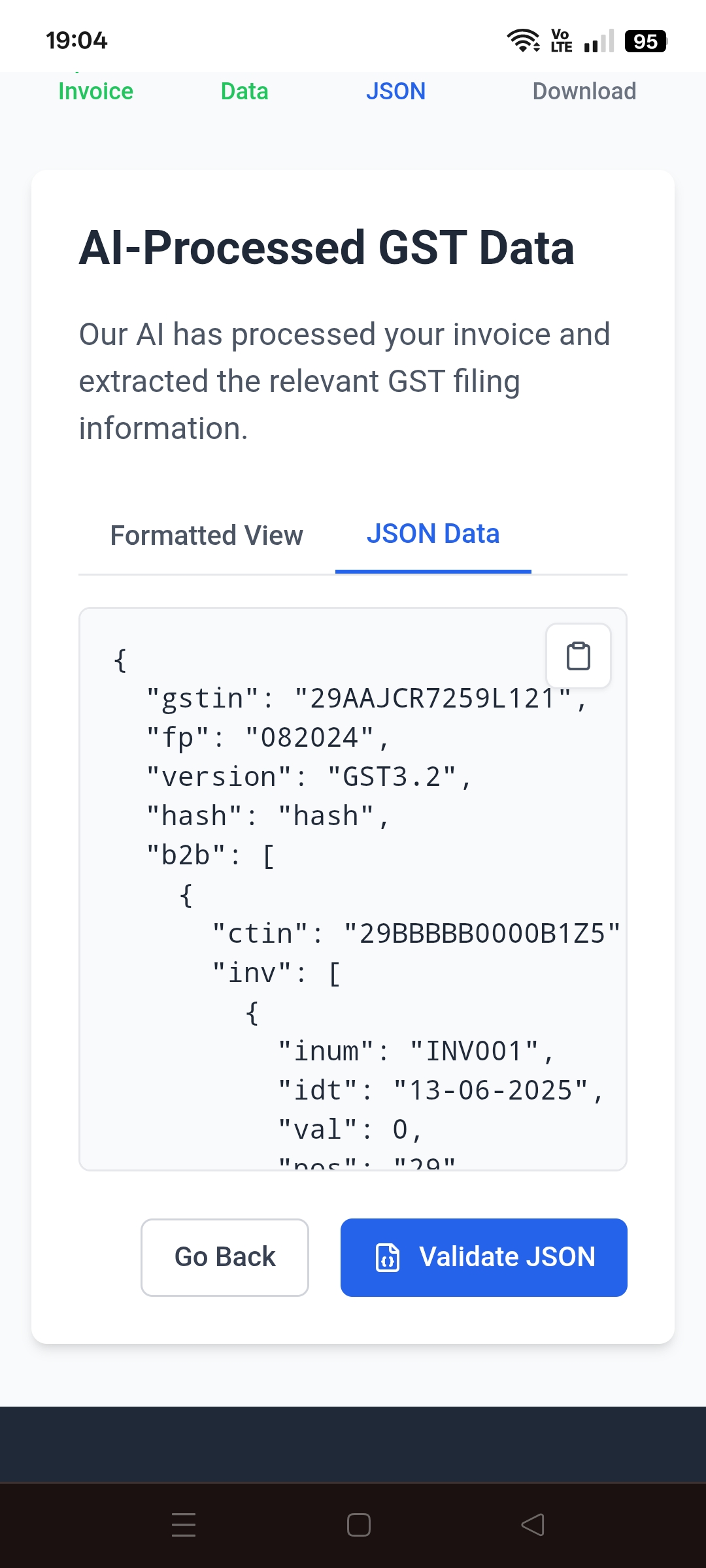

I am looking for some funding to my SaaS startups. so are there any hackathons or some competition to participate and get funds related to Fintech and Gst solution products ? my product is: AI GST Filling Automation helps the gst filling process si

See More

Mesride Tech

Software hamara, bus... • 1y

Must have softwares for startups : 1. CRM : Manage your relationship with customers 2. Accounting : have a check on in & out financials 3. Invoice : to make invoices fast 4. GST billing : to manage GST 5. HR Management: to manage your human resource

See MoreAASHIRWAD DEVELOPER GROUP

The business should ... • 10m

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Download the medial app to read full posts, comements and news.