Back

Nid Best Solutions

Start Here,Lead Ahea... • 9m

DID YOU KNOW? With an 80IAC certificate, eligible startups can save taxes on profits for up to 3 years. DM us to know if you qualify!

Replies (5)

More like this

Recommendations from Medial

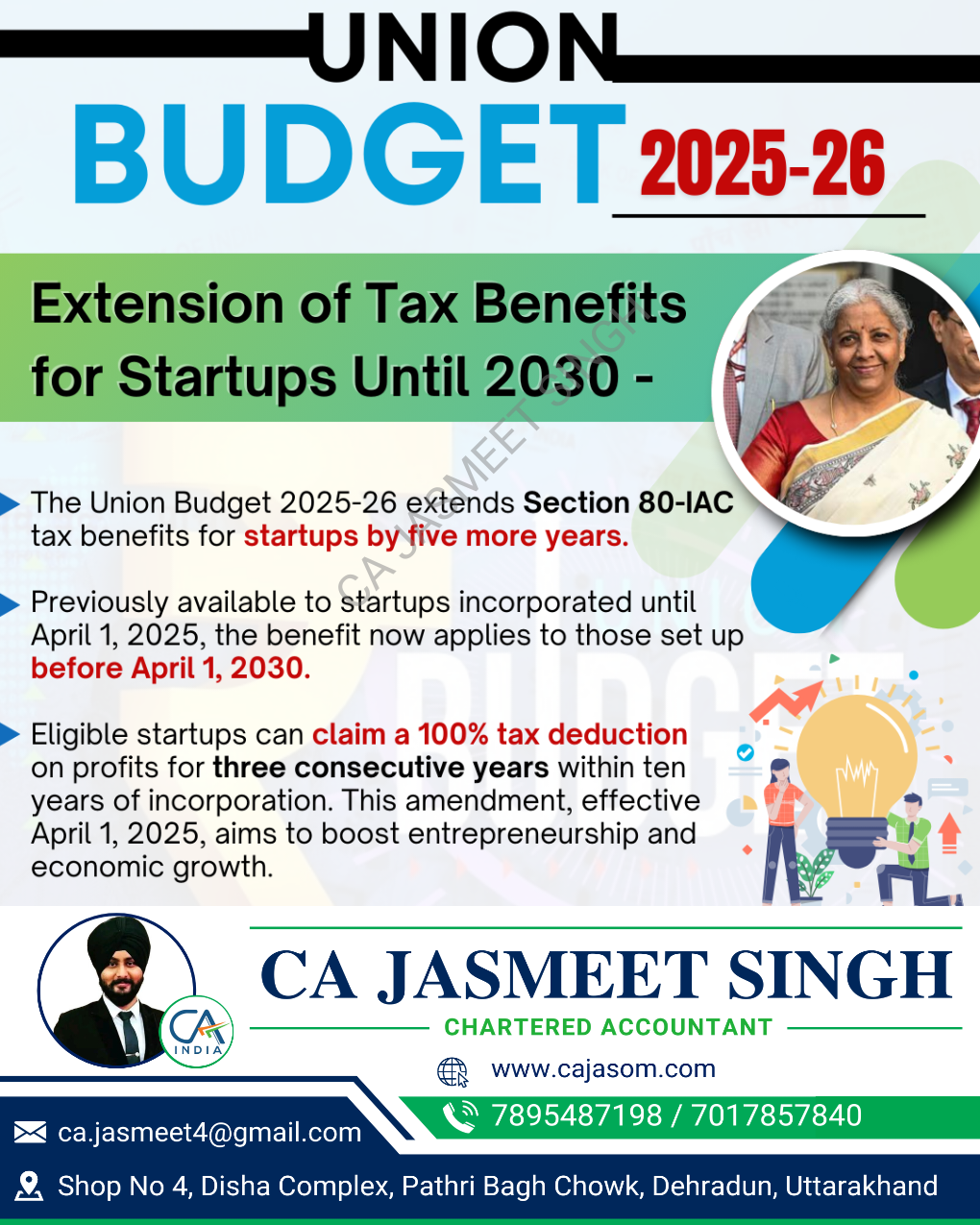

CA Jasmeet Singh

In God We Trust, The... • 6m

🚀 Section 80-IAC: Tax Exemption for Startups! 💡 If you're a startup recognized by DPIIT, you can claim a 100% tax deduction on profits for 3 consecutive years out of the first 10 years! 🎉 📌 Eligibility: ✅ Incorporated as a Private Ltd. Co. or L

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 8m

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Nawal

Entrepreneur | Build... • 8m

Reality of startup india scheme Core Features of the Startup India Initiative according to the Government of India: Ease of Doing Business: Simplified compliance, self-certification, and single-window clearances streamline processes for startups.

See More

Download the medial app to read full posts, comements and news.