Back

Adithya Pappala

G.P Seed-VC|Investin... • 10m

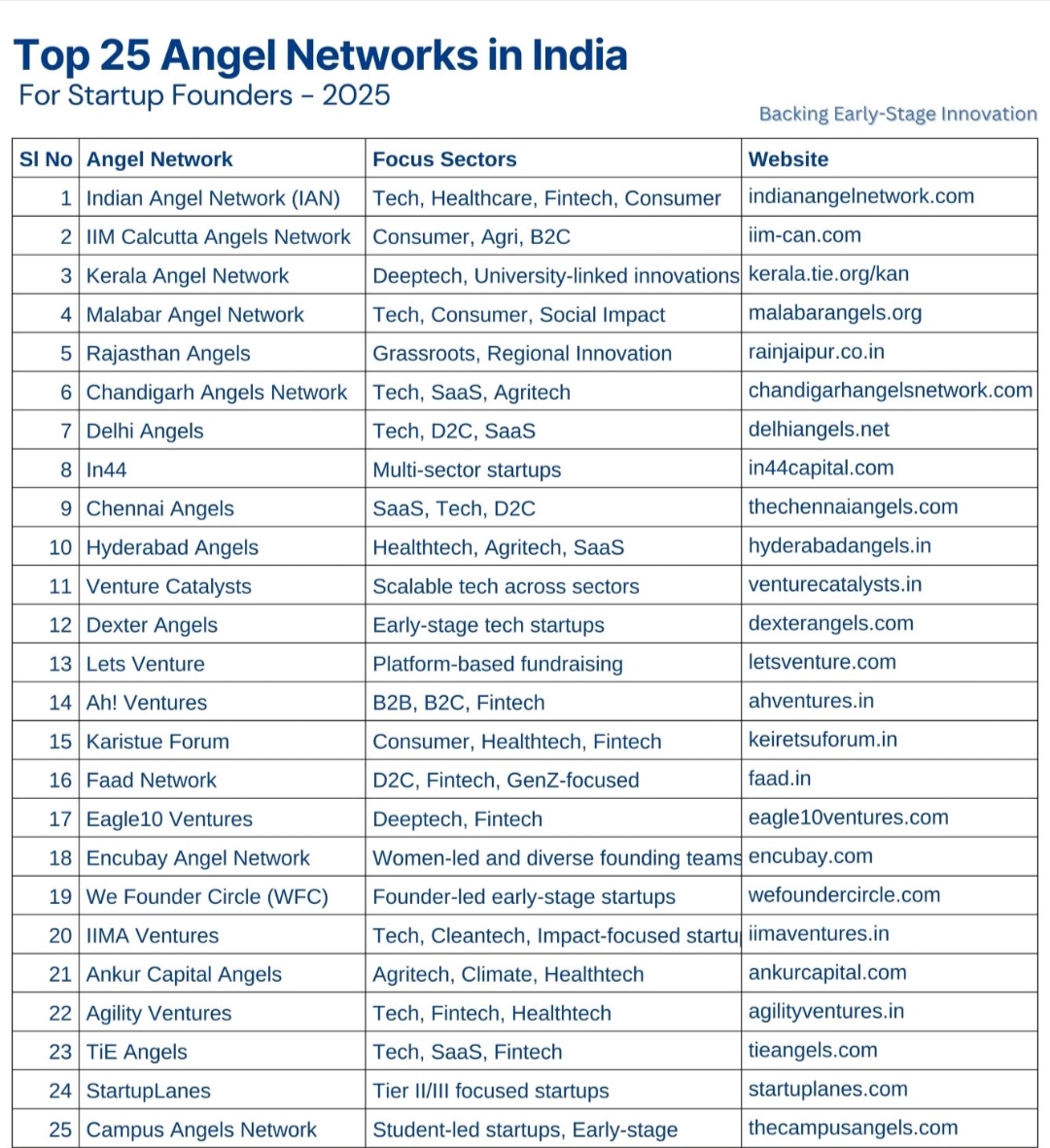

#9TDAYVC-DAY-4 Types of AIF’S Suitable for Startups? What is Mezzanine Capital? 🎯Types of AIF’S: These are divided based on Investment Strategies & AUM(Asset Under Management).VC's are defined as investments in Unlisted securities such as Startups & new businesses which shall include Angel fund.Cannot invest in Stock listed companies at the time of Investment.VCF’s are the first financial institutions financing after an anel fund raised successfully by Startups.VCF are mostly applicable in asset light businesses(Means Startups who takes external sources more to build) 🎯Angel Fund:Sub Category of VCF- Angels mean who is an individual Investor with following conditions: 1) INR 2 crores in assets without principle residence including 2) Early Stage Investment Experience or Serial Entrepreneur or Senior Executive with 10 Years of exp in the financial domain. 🎯 Mezzanine Capital: The Startups that raises funds in mix of Equity & Debt. Know more in Comments👇

Replies (6)

More like this

Recommendations from Medial

Adithya Pappala

G.P Seed-VC|Investin... • 10m

#9TDAYVC-DAY-3 First VC-Backed Company in India?? Guess!! Today’s VC Topics are: Trends Post 2008? Categories of AIF? 🎯Trends: The Industry was down until 2012 & Picked up again in 2012 by SEBI Regulations ACT. Transforming Years can be

See MoreDownload the medial app to read full posts, comements and news.