Back

Anonymous

Hey I am on Medial • 9m

7. The Data of Macroeconomics GDP (Gross Domestic Product): Definition and components (consumption, investment, government purchases, net exports). Unemployment: The different types (frictional, structural, cyclical) and how they are measured. Inflation: Consumer Price Index (CPI) as a measure of inflation, and the effects of inflation on purchasing power. 8. The Real Economy in the Long Run Economic Growth: Focus on factors that drive long-term growth, such as capital accumulation, technology, and human capital. Savings and Investment: Role of savings in the economy and the trade-off between consumption and investment. 9. Money and Prices in the Long Run Money Supply and Inflation: The relationship between the money supply and price levels. Over time, inflation erodes money's value. The Quantity Theory of Money: Explains how inflation is linked to an increase in the money supply. 10. Short-Run Economic Fluctuations Business Cycles: Causes of short-term fluctuations in GDP and employment. Aggregate Demand and Aggregate Supply: How these curves interact to determine overall economic output and price levels. Monetary and Fiscal Policy: Tools the government and central banks use to influence the economy (taxes, government spending, interest rates). 11. The Influence of Monetary and Fiscal Policy The Federal Reserve (Central Banking): How central banks manage the money supply to control inflation and influence interest rates. Fiscal Policy Tools: Government spending and taxation used to stabilize the economy during recessions or booms. 12. Trade and Global Economics Benefits of Trade: How trade allows countries to specialize and increase overall efficiency and production. Trade Barriers: Tariffs, quotas, and their impact on international trade and economies. Exchange Rates: How currency values fluctuate and affect imports/exports. Summary Takeaways: Efficiency vs. Equity: Markets are often efficient but may not always be equitable, prompting government intervention. Rational Decision-Making: Most economic decisions involve weighing marginal costs and marginal benefits. Market Dynamics: Supply and demand, trade-offs, and incentives shape the economy. Macroeconomic Stabilization: Governments and central banks play key roles in managing inflation, unemployment, and economic growth.

More like this

Recommendations from Medial

Vishu Bheda

•

Medial • 7m

In 2023, Argentina was dying: • Central Bank $12B in debt • 50% poverty rate • 7,500% inflation Then Javier Milei became President. 11 months in, he's pulling off the greatest economic turnaround ever. In a 2-hour pod with Lex Fridman, he reveale

See More

Vivek kumar

On medial • 6m

baki ke strugle karo Government announces 8th Pay Commission for central government employees The Commission has been set up to revise salaries of central government employees and allowances of pensioners

Shubham Khandelwal

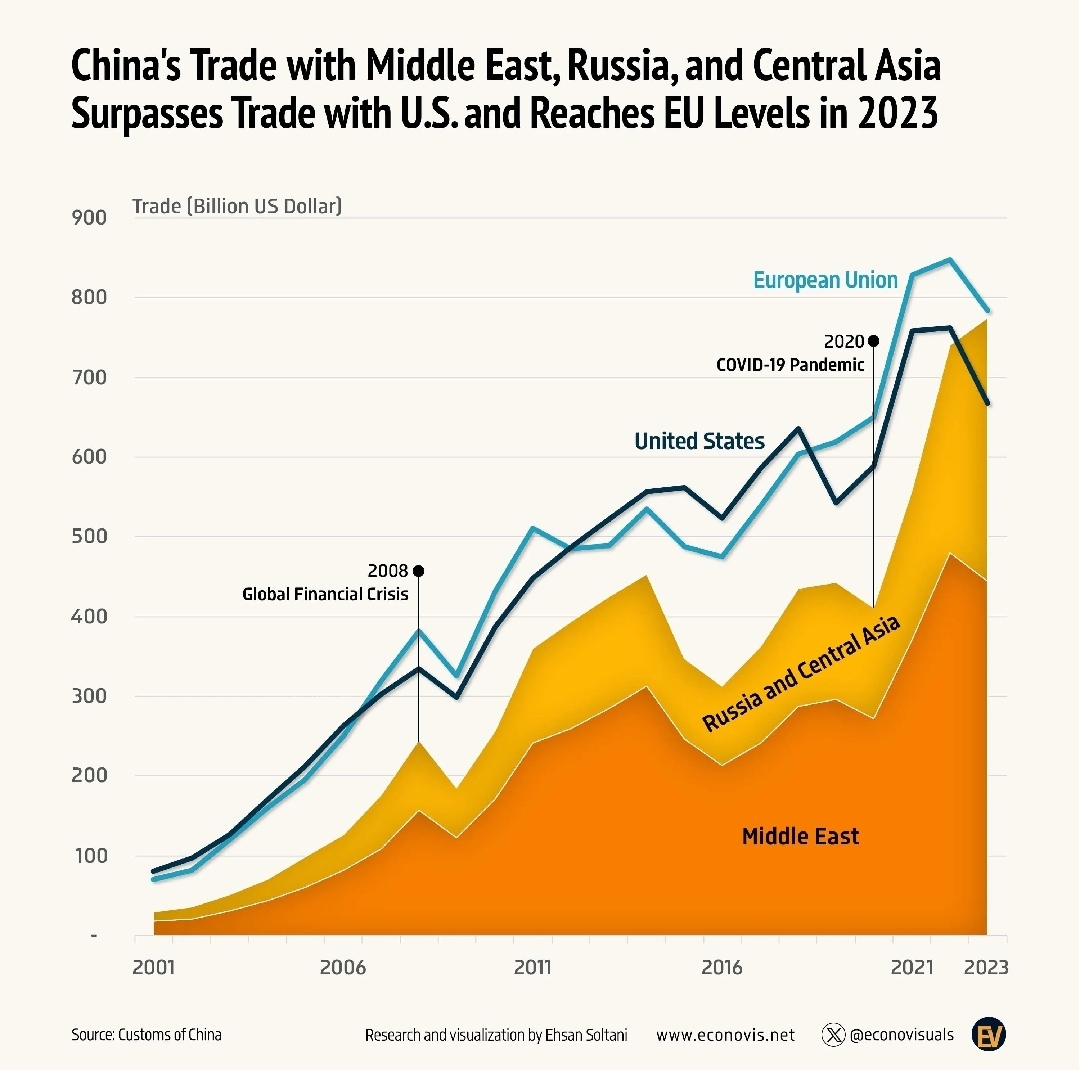

Software Engineer • 1y

China's Trade with Middle East, Russia, and Central Asia Surpasses Trade with US and Reaches EU Levels in 2023. It shows Middle Eastern and Central Asian Countries shift from West towards China.

Atharva Deshmukh

Daily Learnings... • 1y

Have studied about Monetary Policy in short and it's effect. The monetary policy is a tool through which the Reserve Bank of India (RBI) controls the money supply by controlling the interest rates. RBI is India’s central bank. While setting the int

See MoreShubham Khandelwal

Software Engineer • 1y

Argentina is going through a massive Economic Turmoil: Argentina’s economy update: 🔹Inflation: 300% 🔹GDP: will *shrink* 2.8% this year (huge recession) 🔹Poverty rate: 58% 🔹Massive privatization around the corner.

SHIV DIXIT

CHAIRMAN - BITEX IND... • 9m

📖 DAILY BOOK SUMMARIES 📖 🚀 12 Lessons from 👉 🔥 Essentials Of Economics 🔥 ✨ By N - Gregory Mankiw ✨ 1. Ten Principles of Economics Mankiw starts by introducing the ten basic principles that form the foundation of economic thinking • Peo

See More

Kimiko

Startups | AI | info... • 2m

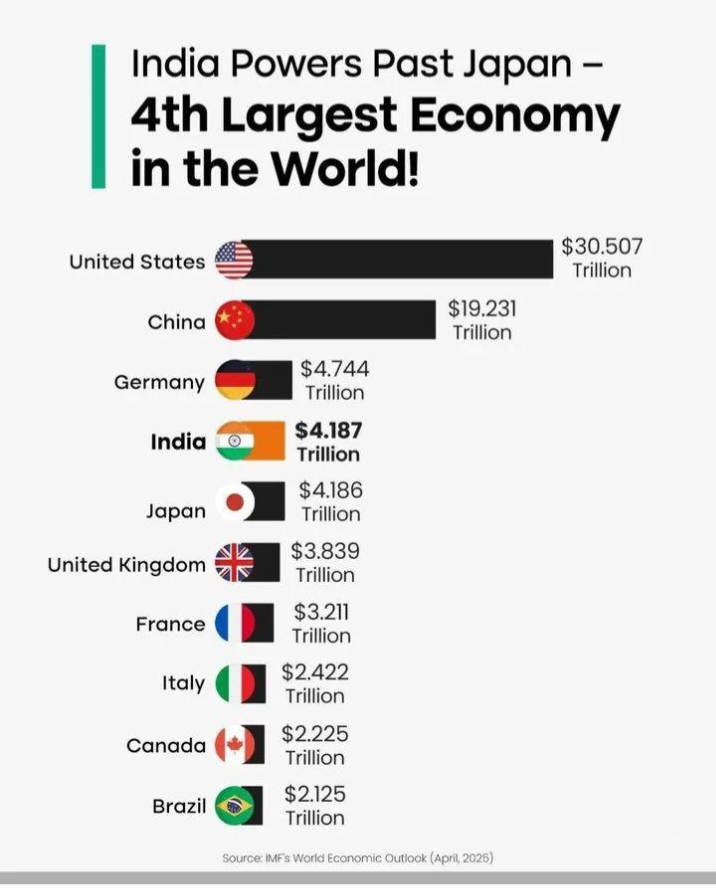

According to the International Monetary Fund's April 2025 World Economic Outlook, India is projected to become the world's fourth-largest economy in 2025. The IMF anticipates India's nominal GDP for the fiscal year 2026 to reach $4.187 trillion, sl

See More

Tushar Aher Patil

Trying to do better • 2m

Exploring Negative Interest Rate Policy (NIRP) Have you ever wondered about central banks setting interest rates below zero? This is known as Negative Interest Rate Policy (NIRP). Here's a quick look at this unconventional monetary tool: ✍️ What is i

See More

financialnews

Founder And CEO Of F... • 7m

Wall Street Update: US Stock Indices Trade Mixed Amid Fresh PCE Inflation Data Wall Street Update: Dow Rises, S&P 500 and Nasdaq Slip Amid PCE Inflation Data **US Stocks Mixed as Investors Digest PCE Inflation Data** US stock indices were mixed on

See MoreRabbul Hussain

Pursuing CMA. Talks... • 5m

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MoreDownload the medial app to read full posts, comements and news.