Back

More like this

Recommendations from Medial

AjayEdupuganti

I like software and ... • 1y

Do you use a RuPay credit card with UPI? How often does your credit card bill exceed your expectations? Are you spending more because of your credit card? I just want to understand whether this could become another potential debt trap for Indians

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 7m

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

Have you read the book "Rich Dad, Poor Dad" written by "Robert Kiyosaki" . he is a genius. He admitted to having more than $1.2 billion in debt 🤯. you might have watched his yt Shorts claiming that. He views this debt as a strategic move and a par

See More

Anirudh Gupta

CA Aspirant|Content ... • 2m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreShubham Khandelwal

Software Engineer • 1y

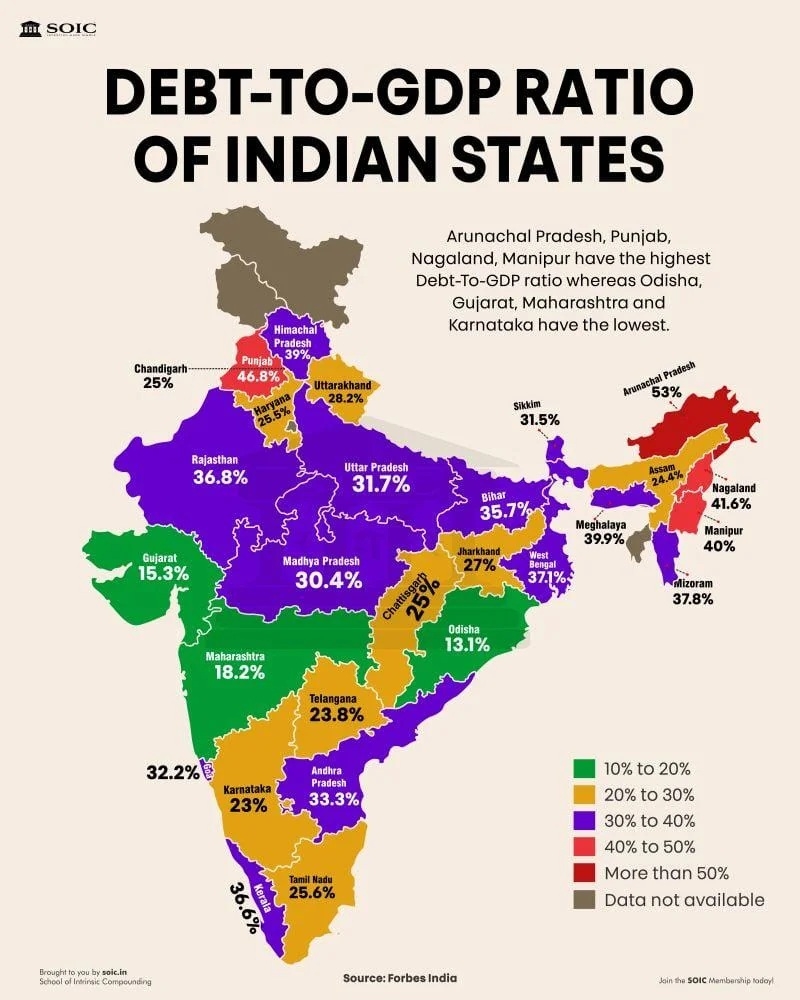

Debt to GDP Ratio of Indian States. Arunachal Pradesh, Punjab, Nagaland, Manipur have the Debt to GDP Ratio whereas Odisha, Gujarat, Maharashtra and Karnataka have the lowest Debt to GDP Ratio. Freebies in Poll Promises by Political Parties is the

See More

Download the medial app to read full posts, comements and news.