Back

Jayant Mundhra

•

Dexter Capital Advisors • 23d

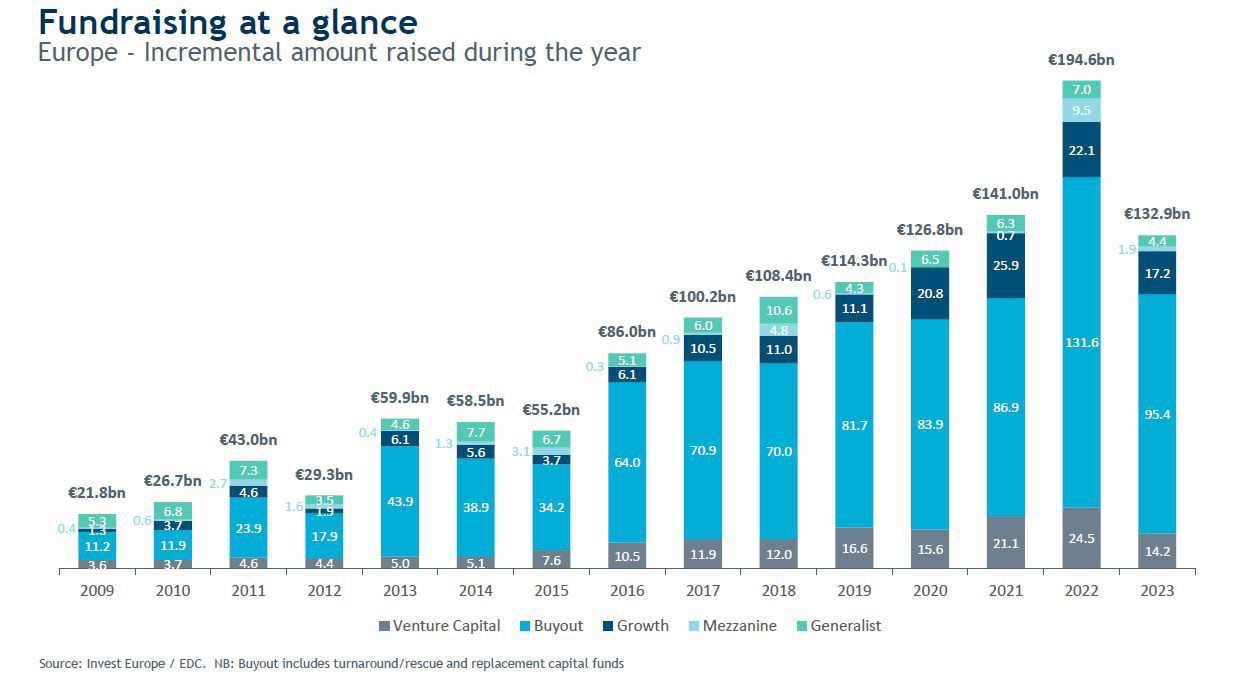

This is REALLY SCARY for global VC ecosystem. For the first time in the history of venture capital, more than 50% of all global VC dollars went into a single industry! 🙏🙏 As per Bloomberg, VCs have already funnelled a record-shattering $192.7 bn into AI startups this year so far. That's not a typo. $192.7 BILLION. .. The numbers are just WILD. - Globally, AI companies hoovered up 53.2% of all capital - In the US, it's a staggering 62.7% Think about the implications. Every other sector - from biotech to fintech to consumer goods - is fighting for the scraps. .. This has created a "bifurcated" market. I call it the Great AI Wall. You are either on the AI side of the wall, or you are not. There is NO in-between. The rules are simple. If you are a big, established AI firm, the money is endless. Anthropic, OpenAI and xAI are raising billions at a time, pulling up the drawbridge behind them. They are becoming gravity wells of capital, distorting the entire landscape. But if you're a promising non-AI startup? Or even a smaller, unproven AI company? You're left out in the cold. .. The fallout from this concentration of capital is brutal. And it goes way beyond just the startups. The entire venture funding machine is seizing up. The total number of companies getting any funding at all is on track to be the lowest in years. The pipeline of innovation is thinning out FAST. And the VCs themselves? They're in trouble too. .. Why do I say that? As per Bloomberg, globally, the number of venture firms successfully raising new funds has fallen off a cliff. Look at this decline. - So far in 2025: 823 funds raised a combined ~$80bn - The 2022 peak: 4,430 VCs raised an enormous ~$412bn That is a catastrophic drop. The LPs who back these funds are being extremely deliberate, focusing ALL their firepower on a few proven AI-focused firms. This isn't a healthy, diversified innovation engine. It’s a casino where everyone has piled their chips onto a single number. And it’s super scary. What do you think?

Replies (6)

More like this

Recommendations from Medial

Mayank Kumar

Strategy & Product @... • 1y

The Impact of Venture Capital on Innovation! Venture capital (VC) plays a crucial role in driving innovation. By providing the necessary funds, VCs enable startups to scale and develop groundbreaking technologies. Think of companies like Uber, Air

See MoreSairaj Kadam

Student & Financial ... • 1y

Exploring Venture Capital: Fueling Startup Growth Hello again, everyone! Today, let’s take a closer look at a powerful funding method that’s been behind some of the world’s most successful startups—Venture Capital (VC). If you’re aiming for rapid g

See MoreSanthosh Gandhi

Venture Capital Focu... • 1y

Venture Studio vs Pre-Seed VCs Venture Studios and Pre-Seed VCs have different approaches. While Pre-Seed VCs invest in existing businesses with potential in a very early stage, Venture Studios creates new startups from scratch, providing operation

See More

Download the medial app to read full posts, comements and news.