Back

Replies (1)

More like this

Recommendations from Medial

Tushar Aher Patil

Trying to do better • 3m

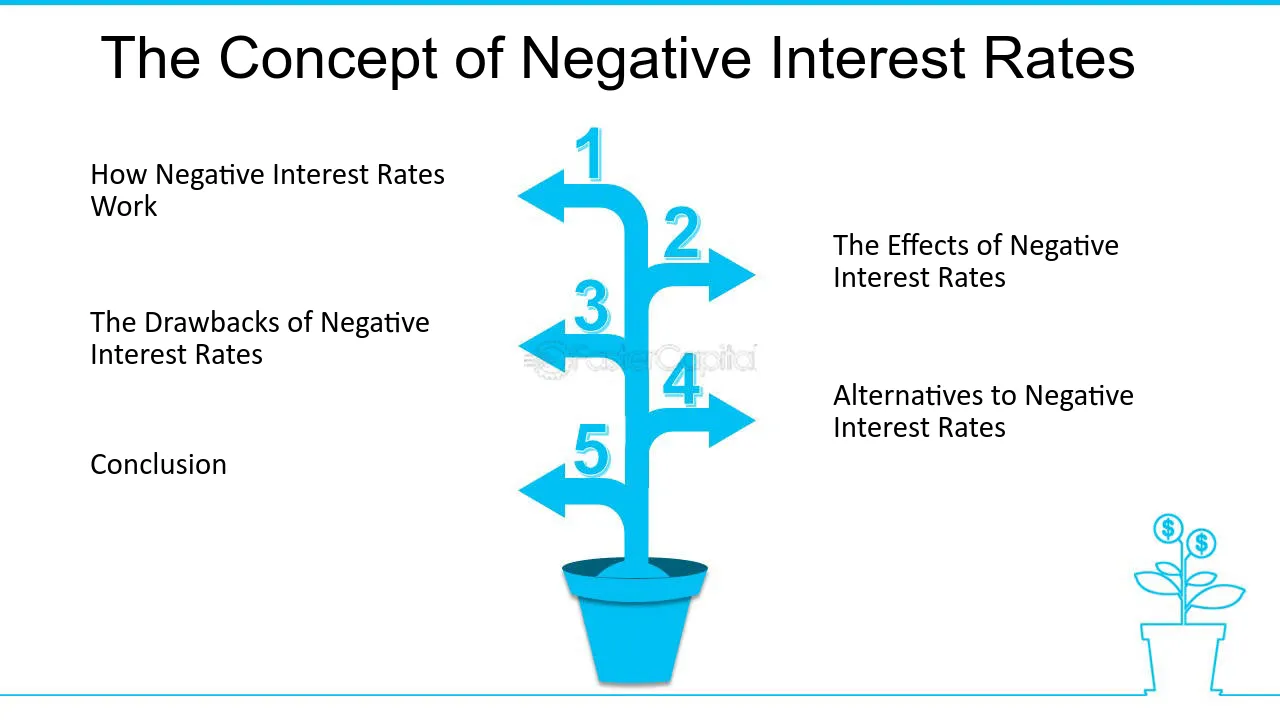

Exploring Negative Interest Rate Policy (NIRP) Have you ever wondered about central banks setting interest rates below zero? This is known as Negative Interest Rate Policy (NIRP). Here's a quick look at this unconventional monetary tool: ✍️ What is i

See More

Pulakit Bararia

Building Snippetz la... • 5m

We think of banks as places that store our money and keep it safe. But that’s not really what’s going on. When a bank gives out a loan, they don’t get poorer. They simply type new money into your bank account. It’s brand-new money that never exis

See MoreAnurag Bhardwaj

ECE student | Entre... • 3m

Today’s insight: Use other people’s money! 🚀 The rich get richer by leveraging— Banks lend for assets like properties. Landlords buy homes, Airbnbs cash flow. It’s not their money—it’s the bank’s! They profit while others pay the loan. How will you

See MoreTushar Aher Patil

Trying to do better • 9m

Day 4 About Basic Finance Concepts Here's Some New Concepts Financial Markets and Institutions Stock Markets: Where shares of publicly traded companies are bought and sold (e.g., New York Stock Exchange) Bond Markets: Markets where debt securitie

See More

Rohan Saha

Founder - Burn Inves... • 1m

These days some mutual funds are slowly cutting down their investments in bank stocks and putting more money into NBFCs there could be many reasons behind it but one of them might be that banks are finding it a bit more expensive to borrow money now

See MoreRabbul Hussain

Pursuing CMA. Talks... • 6m

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MoreDownload the medial app to read full posts, comements and news.