Back

Jayant Mundhra

•

Dexter Capital Advisors • 1d

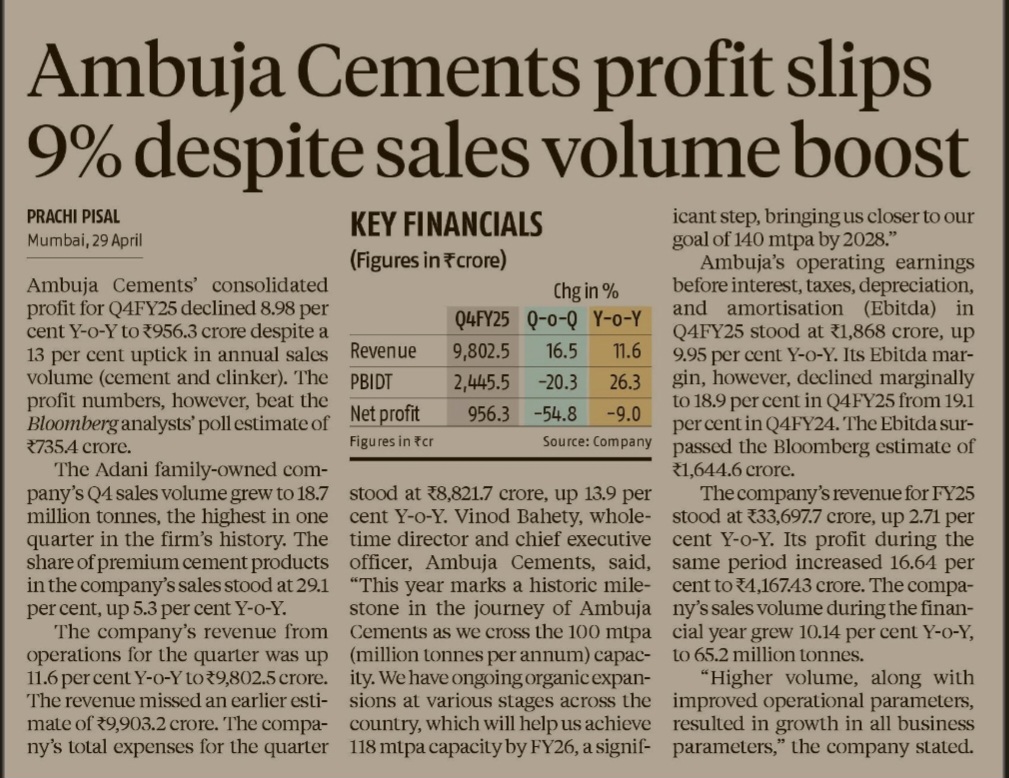

Nobody talks about this, but if the Adani group achieves its FY28 target for Ambuja Cement, it will be a massive disruption for the entire Indian cement industry. What target? The group is targeting an 18% cut in Ambuja Cement’s operating cost per ton by FY28 - From Rs 4,460 to just Rs 3,650 🙌🙌 This is a declaration of war on inefficiency and a bold strategy to achieve cost leadership in the Indian cement industry. But, more importantly, how will this be achieved? That’s what this deepdive is all about! .. The plan is multi-pronged and deeply integrated. - To start with, a staggering Rs 10k crore is being invested in green power projects alone - The goal is to power ~60% of their operations with renewable energy by FY28, up from just 21% in FY25. This has already jumped to 26.1% in Q1FY26 - This move is projected to single-handedly cut power costs by Rs 90 per tonne - 11% of the target .. Additionally, Adanis are also aggressively increasing the use of alternative fuels, targeting a thermal substitution rate of 23% by 2030, a significant leap from the current 9%. Progress on this front includes increasing waste heat recovery capacity, which, along with increased green power use, helped cut Ambuja’s power and fuel costs by a massive 22% in FY25! 🙌🙌 .. Then there's the logistics revolution. The company is making a decisive shift to sea transport, which it calculates is ~30% cheaper than rail and a whopping ~60% cheaper than road (as per management). With a growing fleet of 14 sea vessels (and 10 more planned) and 11 coastal terminals, they are re-wiring their entire distribution network to favour this cheaper, greener alternative, with an ambition to shift 10% of all shipments to sea by FY28. The efforts have already yielded a 5% reduction in logistics cost in FY25, and the company is betting big for more savings here 🙌🙌 .. And driving it all is the synergies with group firms. - About 65% of Ambuja's total costs are now business-to-group companies in power, coal, and ports - This provides a level of cost control and supply security that is simply unavailable to standalone competitors And if you think of all of the aforementioned details in sync, this isn't just a cost-cutting exercise. By weaving together sustainability, logistics innovation, and group synergies, Ambuja is fundamentally rebuilding its operations. And for its size, this is no mean task. What do you think?

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 8m

"Adani Group Loses ₹2.2 Lakh Crore in Market Cap as Stocks Drop 20% Amid US Bribery Allegations" "Adani Enterprises Leads Market Crash with 22.6% Drop; Adani Energy Solutions and Adani Green Energy Follow Suit" Adani Group's listed companies experi

See MoreRohan Kute

Business | infograph... • 3m

🤝 Tata Power & Tata Motors Join Hands for Green Energy Boost Big Green Project in the Works Tata Power Renewable and Tata Motors have teamed up to build a 131 MW wind-solar hybrid project. This setup will power six Tata Motors plants in Maharash

See More

Mahendra Lochhab

Content creator • 1y

The Aditya Birla Group has achieved a market valuation of $100 billion. The group's portfolio includes UltraTech Cement, Grasim, Hindalco, Aditya Birla Capital, Aditya Birla Sun Life AMC, Vodafone Idea, Aditya Birla Fashion & Retail, TCNS Clothing,

See More

Download the medial app to read full posts, comements and news.