Back

Replies (1)

More like this

Recommendations from Medial

CA Kakul Gupta

Chartered Accountant... • 6m

The Central Board of Direct Taxes (CBDT) has specified that no tax deduction at source (TDS) under Section 194Q of the Income Tax Act, 1961, will be required for purchases made from units of International Financial Services Centres (IFSC), provided b

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1m

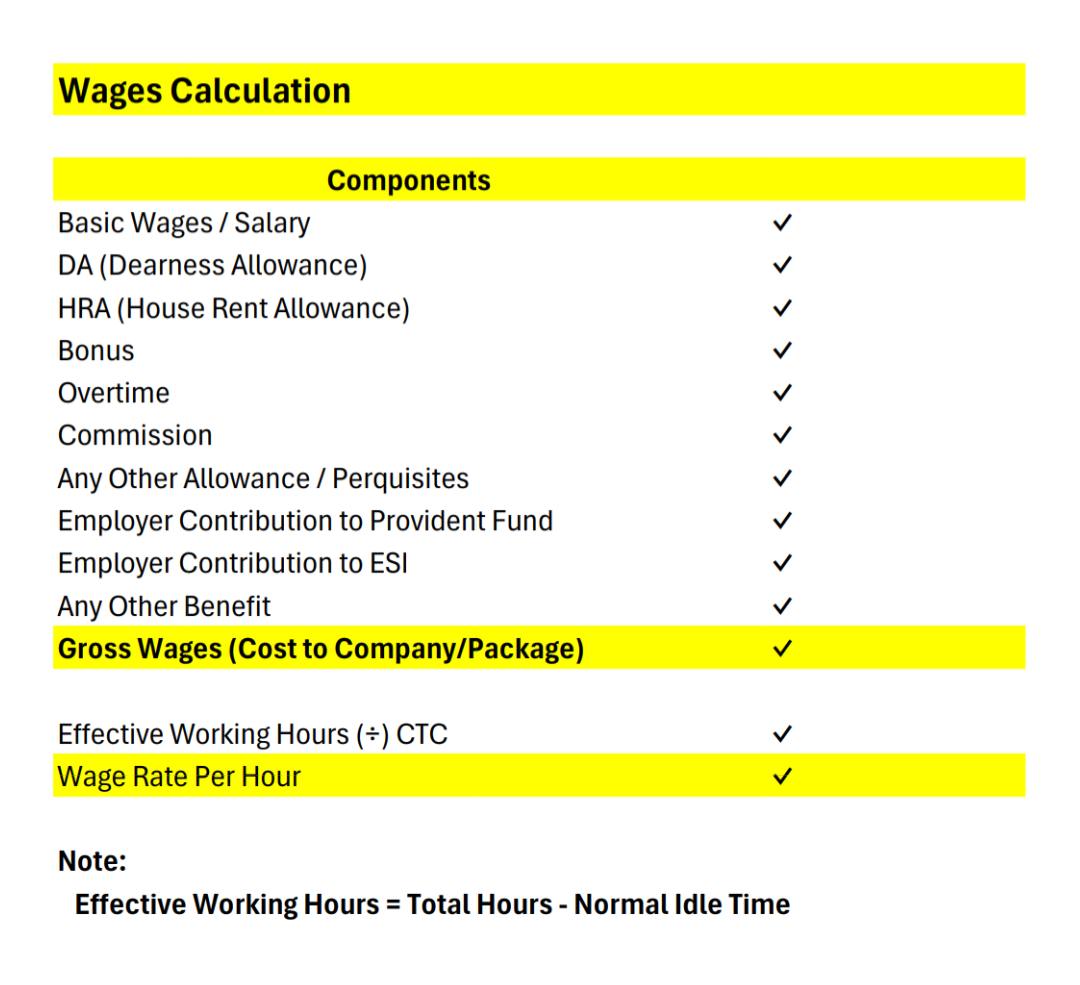

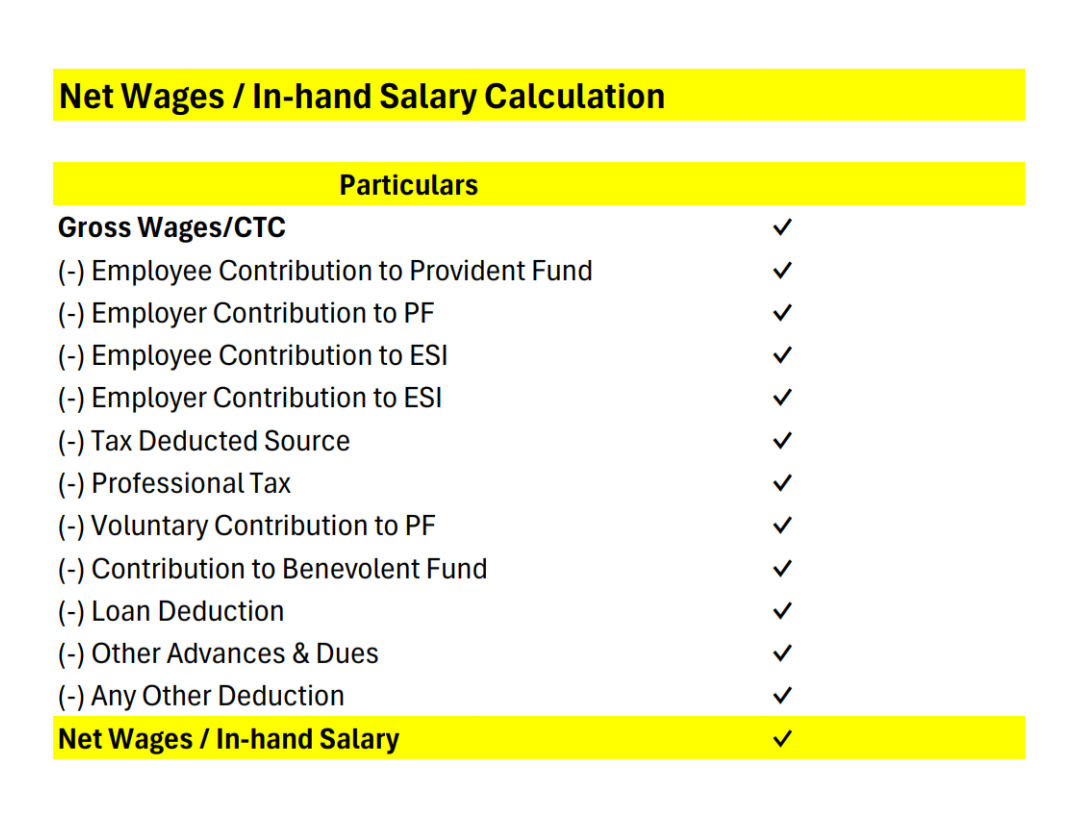

How to Calculate Employee Cost to Company (CTC) & Understand In-Hand Salary. 🤔 1️⃣ Cost to Company (CTC): CTC represents the total amount a company spends on an employee annually. It includes: + Basic Salary + Dearness Allowance (DA) + House Rent

See More

Niket Raj Dwivedi

•

Medial • 11m

Union Budget 2024-25: Key Highlights for Startups and MSMEs 🚀 Finance Minister Nirmala Sitharaman mentioned 'startup' just twice in her speech, but there's plenty for the startup ecosystem, manufacturing, and MSMEs in this budget! Here's the scoop:

See MoreRohan Saha

Founder - Burn Inves... • 3m

Today, suddenly, I remembered the Mumbai Gullies game. I don't know why, but I thought, 'It’s been a long time since any update about the game has come—maybe I should check once.’ Then, after checking, I realized that not a single chapter of the game

See MoreVikas Acharya

Building WelBe| Entr... • 5m

Rapido announces first ESOP liquidity program Ride-hailing firm Rapido has announced its first-ever Employee Stock Ownership Plan (ESOP) liquidation program for its current and former employees. Through this initiative, employees are eligible to

See More

Download the medial app to read full posts, comements and news.