Back

Ravi S

We builds future • 1d

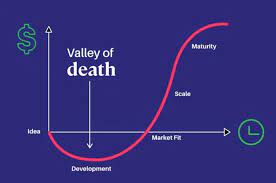

The "Death Valley Curve" is one of the most fragile phases in a startup’s life. It’s where many promising ideas fade haunted by silent killers like overconfidence, poor cash flow management, and internal misalignment. To survive this stage, startups need more than passion—they need discipline. Start with smart forecasting and regular stress testing to keep your cash flow stable and avoid unnecessary financial strain. Make sure everyone knows their role, establish clear communication channels, and encourage unified leadership to cut down on confusion and inefficiencies. Stay focused on your core mission. Trying to grow too fast can dilute your niche and stretch you too thin. Before you launch, validate that the market is ready and customers actually want what you're building. And once you’re out there listen. Continuously collect customer feedback and use it to iterate. The ability to adapt quickly is often the difference between fading out and breaking through. Learning from the missteps of others can save you from repeating them. Strategic planning, clear communication, and a relentless focus on execution are your best weapons to make it through the Death Valley Curve and come out stronger on the other side.

Replies (1)

More like this

Recommendations from Medial

Vikas Acharya

Building WelBe| Entr... • 3m

The A-Z Survival Guide to Entrepreneurship! C – Cash Flow Profitability sounds great, but if you run out of cash, your business dies—no matter how good your idea is. I learned the hard way that revenue doesn’t equal survival. Managing cash flow is

See MoreVivek Joshi

Director & CEO @ Exc... • 2m

Facing cash flow issues? You're not alone! In this video, we share “10 innovative ways” to troubleshoot common cash flow challenges that can hinder your business's success. From negotiating payment terms and invoicing promptly to diversifying revenue

See MoreKarthik Sreedharan

Fintech CEO | Revolu... • 1y

Cash flow management and control is one of the biggest pain points of startup founders, stakeholders and CFOs. Would you like try out an AI Copilot that enables you manage and control your cash flows and manage your finance team through approval work

See MoreCA Rajat Agrawal

EaseValue Advisors • 1m

One of my startup clients recently struggled with severe cash flow issues — something I see quite often, especially in AI-driven or tech-based startups. Despite having a great product and market fit, they were stuck because of delayed receivables an

See MoreVedant Patel

Hammer it until you ... • 1m

cash clarity tool I recently built a simple tool called Cash Clarity – it's designed for freelancers, solopreneurs, and startup founders who want to get a clear picture of their monthly inflows, outflows, and how long their cash will last. ✅ Track

See More

Sandip Kaur

Hey I am on Medial • 11m

Mastering Cash Flow: Simple Strategies for Indian Startups Cash flow can either make or break your startup, and managing it well is critical. Here are some practical tips to help your startup thrive financially: 1.Separate Business and Personal Fina

See More

Anonymous

Hey I am on Medial • 1y

How to start business ? From zero to infinity Means how to create business plans? Idea validation? Market research, founders, documentation, and controlling cash flow , schemes ,how to apply seed funding rounds? Initiatsteps to do in businesses? Giv

See MoreDownload the medial app to read full posts, comements and news.