Back

Chirag Singla

I work on Contract D... • 1m

Ever been promised ₹1 crore for your startup — only to realise later it’s coming in 3 parts, each with a different “condition”? That’s what happens when your Investment Amount and Payment Terms aren’t crystal clear. As a founder, always push for a single installment — because multiple tranches = more control, shifting goalposts, and funding delays when you need cash the most. And if it’s an international deal? Use USD with a floating exchange rate — so your funding doesn’t shrink due to currency swings. Don’t just chase the cheque — define your runway. I’m breaking down more founder-first legal tips in this Term Sheet series — follow along!

Replies (2)

More like this

Recommendations from Medial

VCGuy

Believe me, it’s not... • 5m

Tom Perkins, founder of VC Firm Kleiner Perkins, offered an intriguing analogy: tackle your 'white hot risks' in the first 9 months of raising your first cheque. White hot risks → existential, high-stakes risks that can break your startup. "If you

See MoreMohd Talib

Roadside Developer a... • 1m

A few weeks ago, I started building something that I wished existed when I first explored funding as a founder. Too many tabs. Too many dead ends. No clear matches. 🔍 So I began working on Fundalytics — a platform to help founders find relevant:

See MoreNikhil Raj Singh

Entrepreneur | Build... • 5m

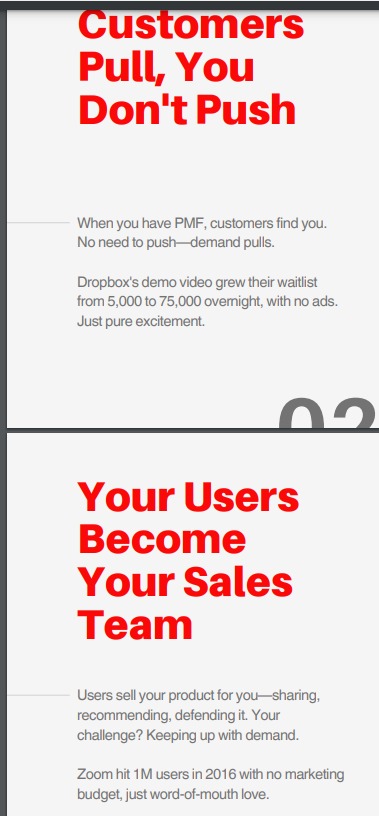

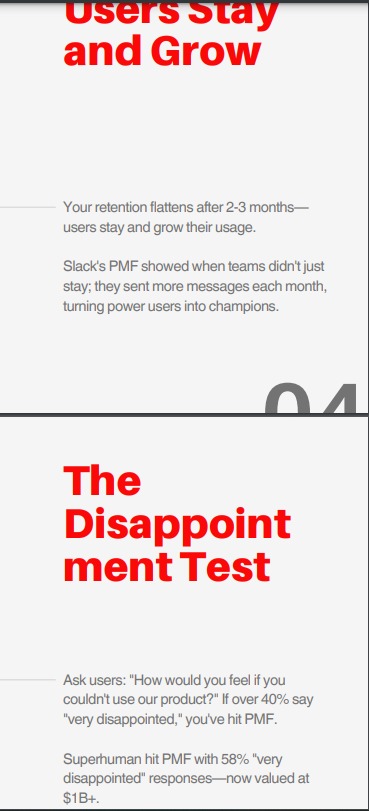

Product-Market Fit: When Your Startup Stops Chasing and Starts Leading Customers pull, you don’t push – Demand grows organically when PMF is real. Your users become your sales force – Advocacy replaces advertising. Retention isn’t just staying, it

See More

Download the medial app to read full posts, comements and news.