Back

Chirag

•

&OTHERS • 1m

“Another one leaves Peak XV.” But this time… it’s not just another. Two key team members — Suraj Agarwalla (VP, Growth) and Vedant Trivedi (Surge) — have now exited the firm. This marks the fifth high-profile exit in less than a year — following Shailesh Lakhani, Abheek Anand, Piyush Gupta, and Anandamoy Roychowdhary. What’s really going on inside India’s most powerful VC firm? Is this just natural reshuffling after the Sequoia → Peak XV split? Or are young investors rethinking their career paths altogether? Across the board, mid-level VCs are either turning founders, launching solo funds, or joining startups to drive impact from the ground up. And in a market where fundraising is slow and scrutiny is high — even Peak XV had to cut its growth fund by $465M last year — maybe it’s not just founders who are pivoting. Is the VC dream losing its shine? Or are we witnessing the next evolution of Indian venture capital? Is this the new normal? Or a sign of deeper shifts to come?

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

Guys What do you think, Which is the Best VC Firm In the World? 1.SoftBank 2.Sequoia Capital 3.Tiger Global Management 4. Y Combinator 5.LightSpeed

VCGuy

Believe me, it’s not... • 4m

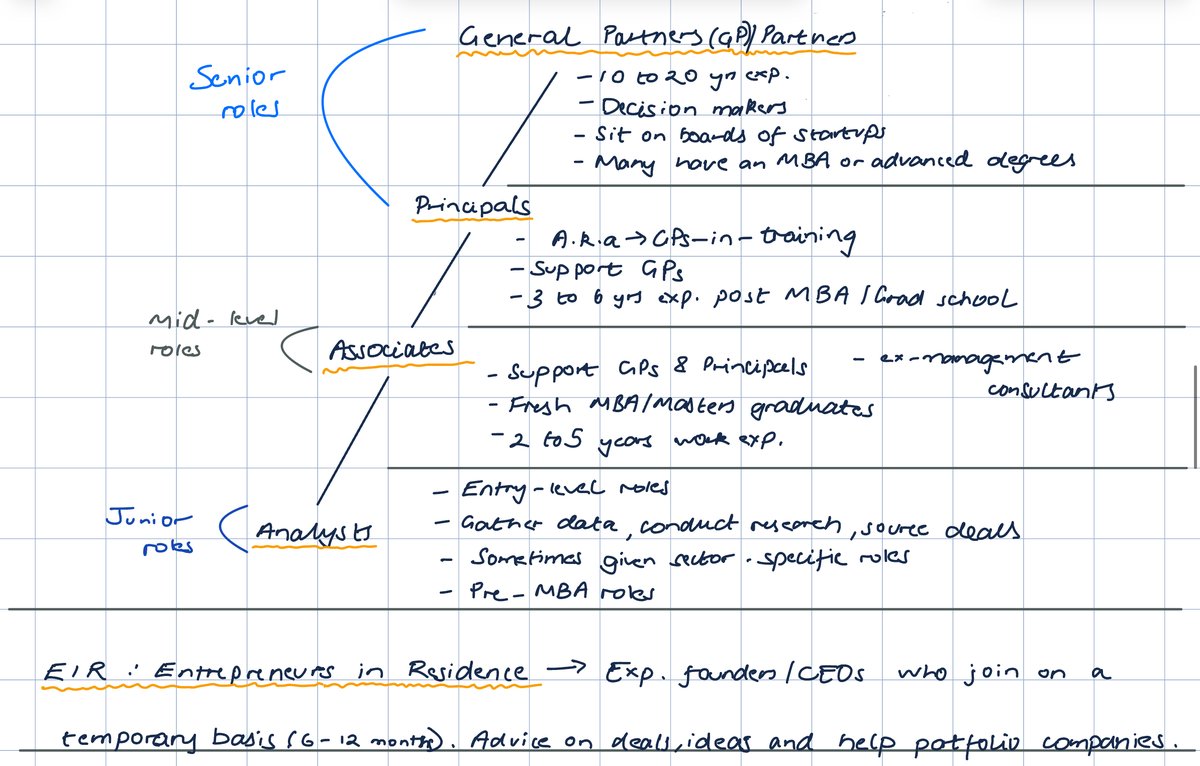

'What are the different roles in Venture Capital?' is a question commonly asked. VC Firms are structured very differently. Each role works → to source deals, evaluate investments and support portfolio companies. Mapped out the structure of a VC

See More

Vrishank

Startups/VC/tech • 1y

There are more than 800 VC firms in India, but do you know about India's oldest VC firm? 👇 VenturEast is often labeled as the first full-fledged VC firm founded in India. - Founded by Sarath Naru in 1997, VenturEast currently manages assets worth

See More

Adithya Pappala

Zero Fund-VC|Investi... • 5m

Only 1 Secret that you must know to raise funds from VC'S but sadly no-one is talking about.. It's very often that we show these 👇 to the Investors when raising funds: Problem Solution Product Market Gap Team Customers Revenue Achievements Et

See More

Prince Donga

Each and every secon... • 14d

Calling All Finance MBAs in VC! Hey everyone, I'm looking to connect with anyone who pursued an MBA in Finance and then transitioned into a role at a Venture Capital (VC) firm. I'm really interested in hearing about your experience, what that caree

See MoreThe next billionaire

Unfiltered and real ... • 6m

Worst VCs in India Who are some of the worst VCs in India? Here's my list: Vaibhav Domkundwar: has NEVER responded to any email I sent to him Prime Ventures: Same as above and also think they are God's gift to entrepreneurship (despite a meh portfo

See MoreVCGuy

Believe me, it’s not... • 5m

Peak XV will likely make a 11x return from Unilever's acquisition of Minimalist for ₹2,955 Cr. They hold a 27.43% stake in Minimalist, valued at ₹ 810 Cr. Starting with a ₹14.25 crore seed cheque in 2019, followed by a ₹60 crore infusion during t

See MoreDownload the medial app to read full posts, comements and news.