Back

Anonymous 1

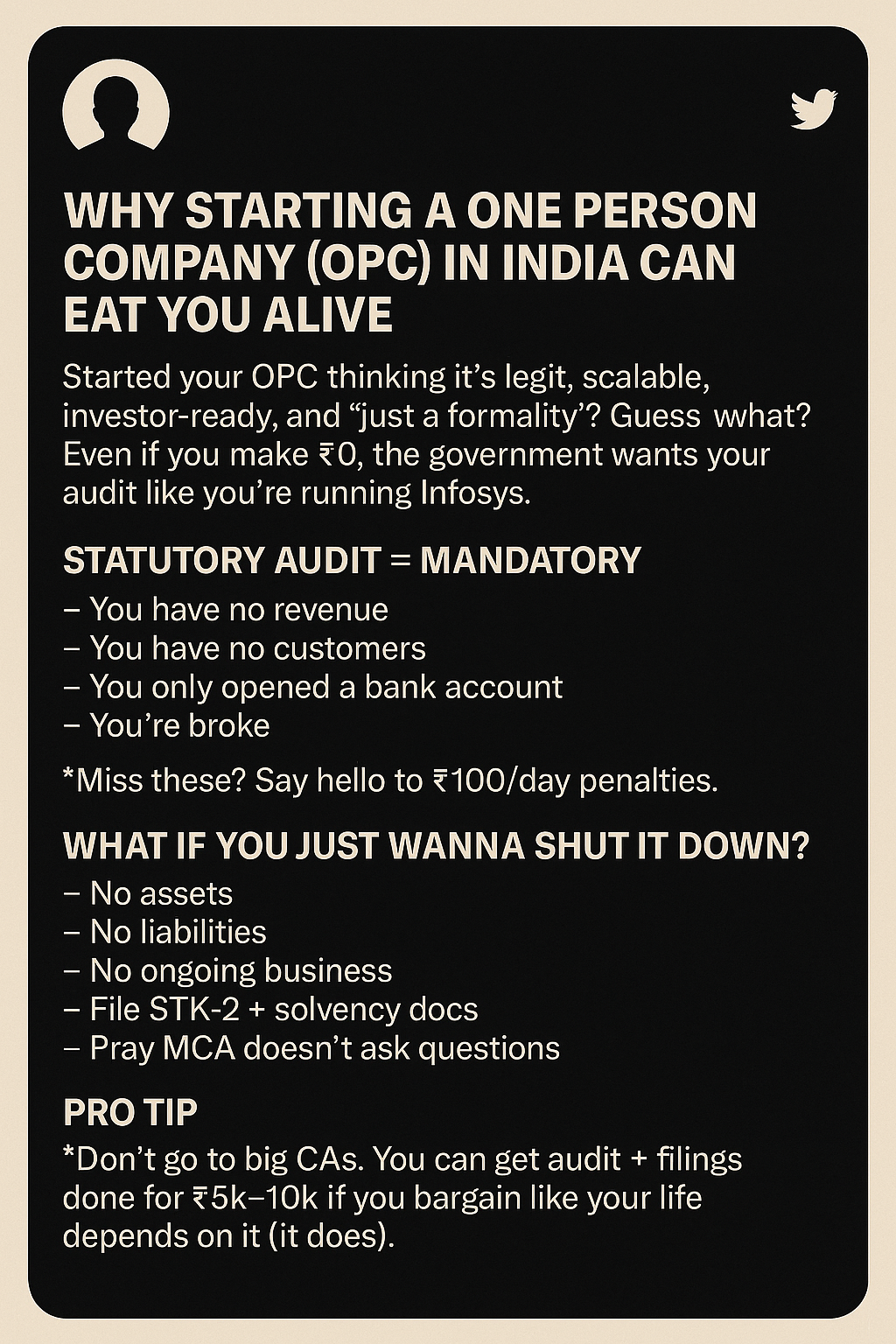

Hey I am on Medial • 8m

've been through this exact hell. What the post doesn't mention is that these compliance requirements are just the tip of the iceberg. Try dealing with GST filings (monthly/quarterly), TDS, PF/ESI if you have employees, and the list of forms multiplies endlessly. What's more absurd is how the government simultaneously runs "Startup India" campaigns while maintaining this regulatory jungle that absolutely crushes innovation. The real cost isn't even the audit fees, it's the mental bandwidth these processes consume when you should be building your product or finding customers.

Replies (1)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 7m

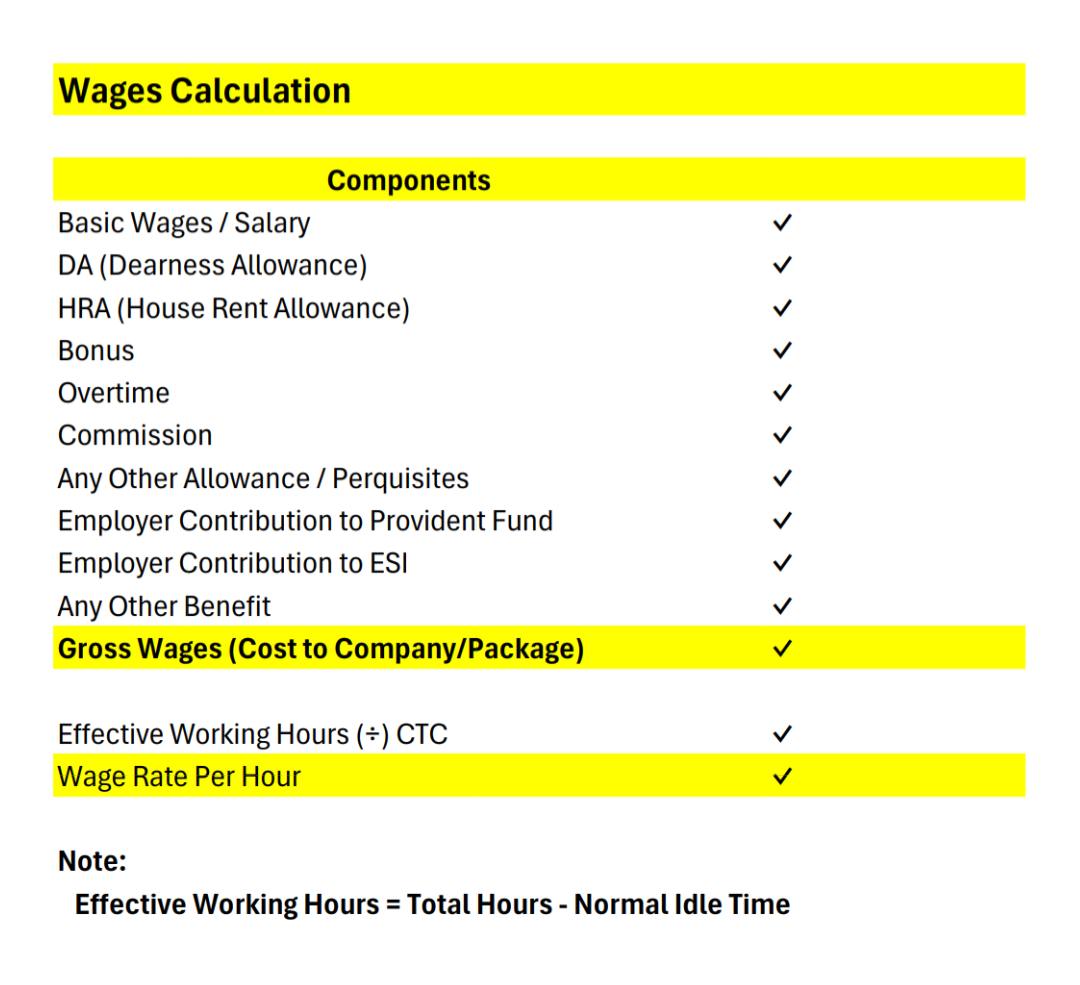

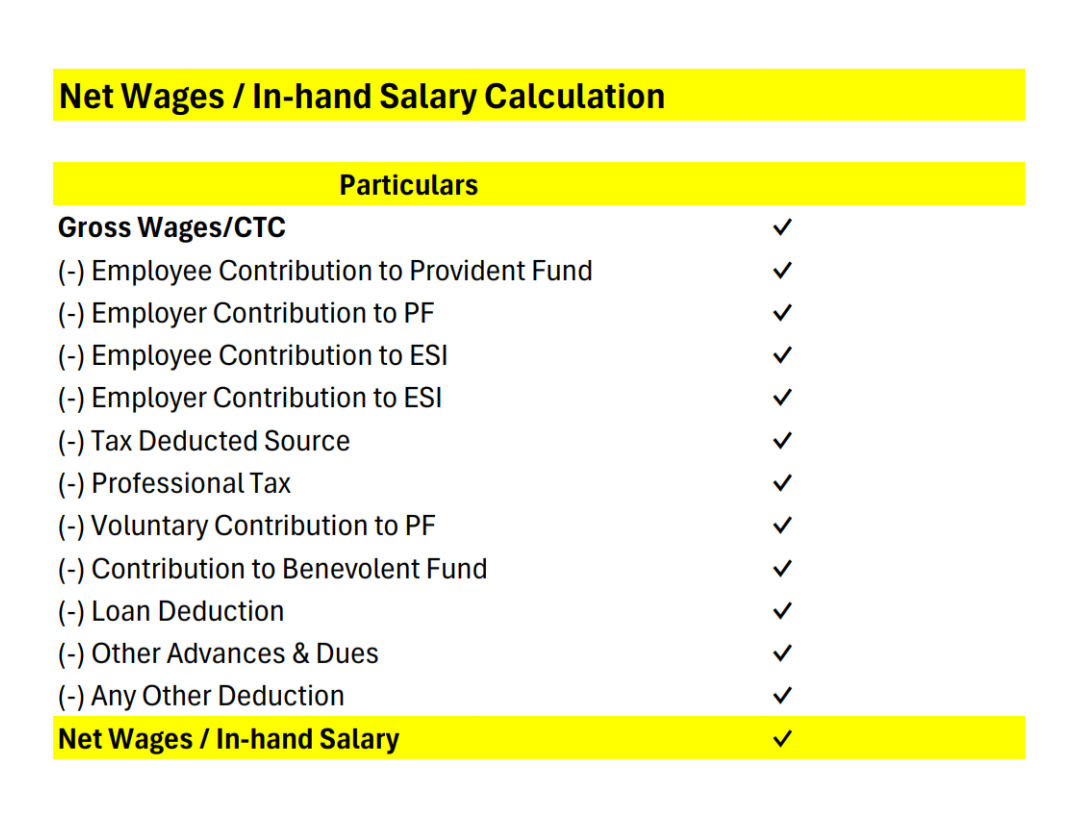

How to Calculate Employee Cost to Company (CTC) & Understand In-Hand Salary. 🤔 1️⃣ Cost to Company (CTC): CTC represents the total amount a company spends on an employee annually. It includes: + Basic Salary + Dearness Allowance (DA) + House Rent

See More

Ravi Kumar Mishra

Hum hai Aapke Busine... • 6m

ITR 23-24 24-25 25-26 Compution,Balancesheet with Ca Certified 1. GST Registration 2. GST return Filing 3. MSME Registration 4. Tds FILLING 5. Company, NGO & Partnership Reg. 6. Importer Exporter Code 7. ISO Non-Iaf/IAF Registration 8. Start up

See MoreBishesh Kasera

Founder and Chairman... • 2m

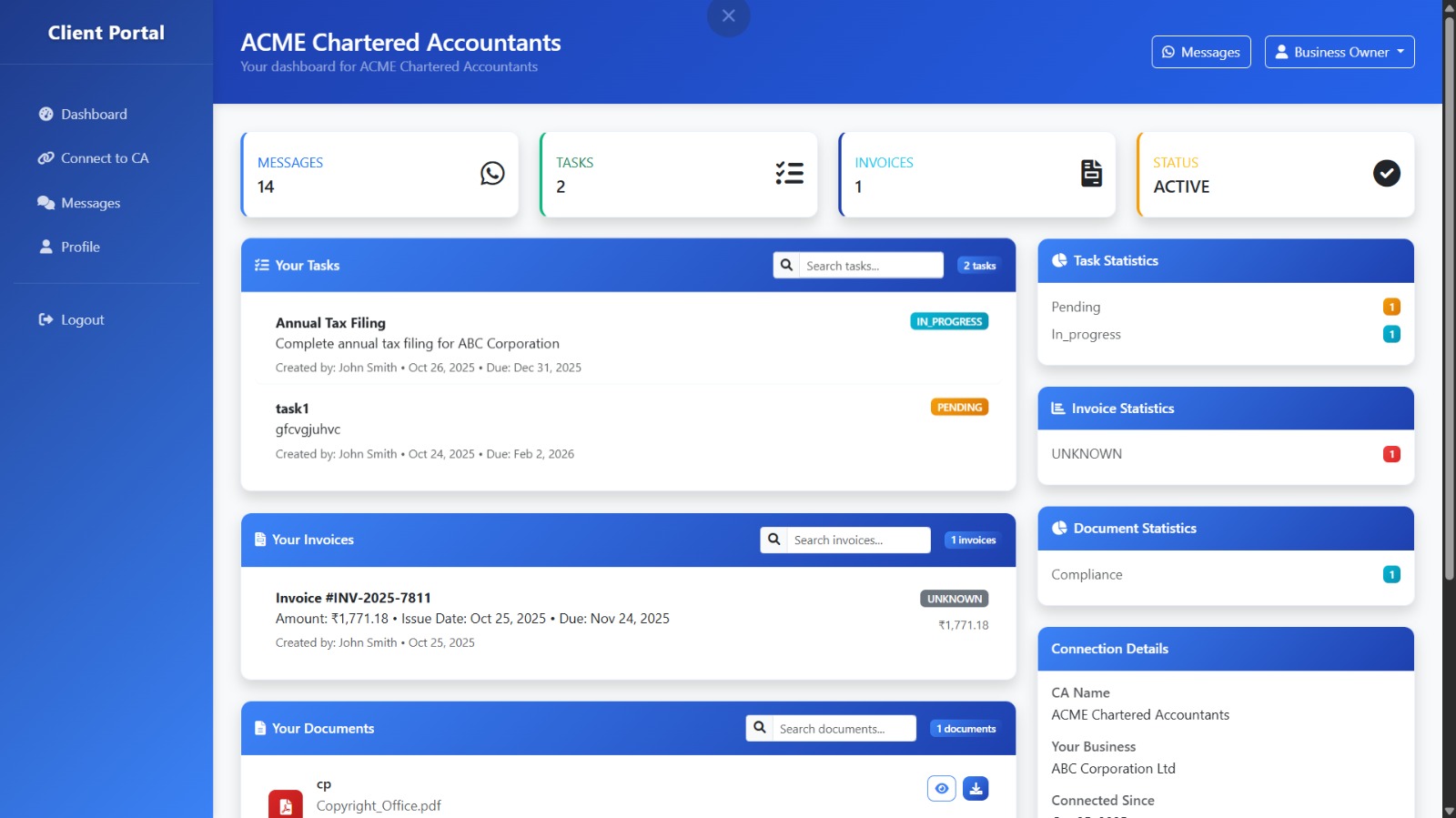

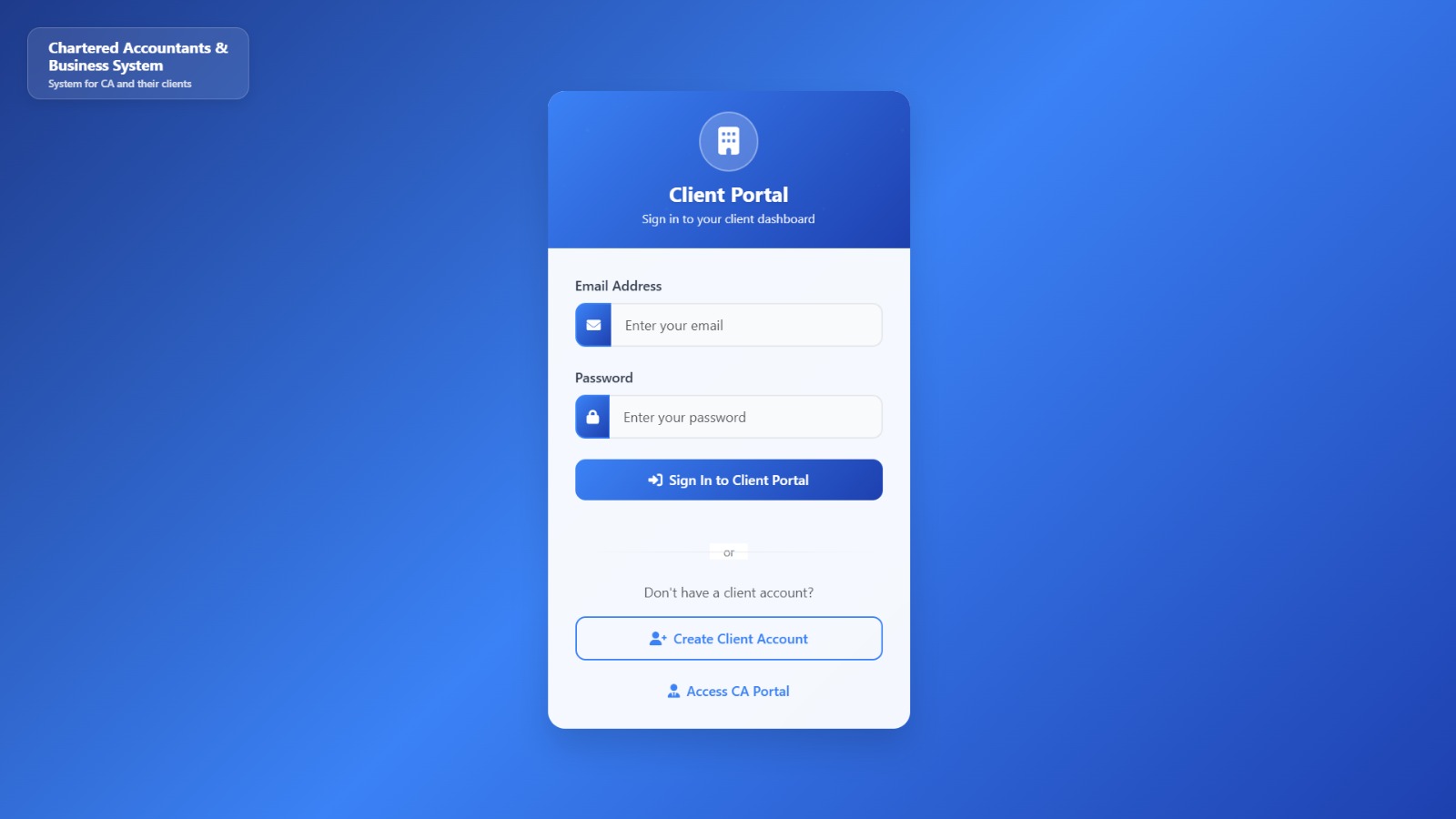

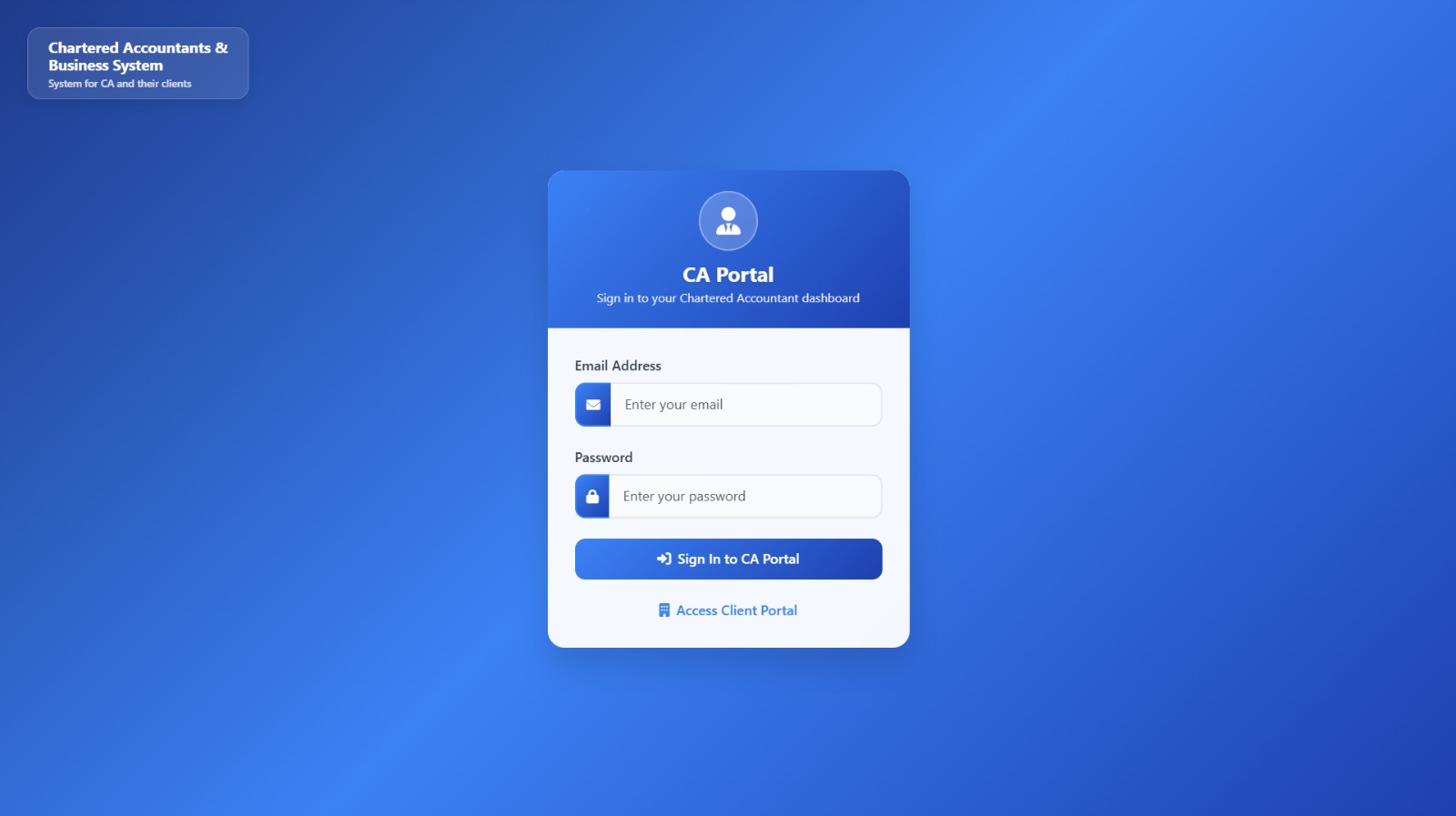

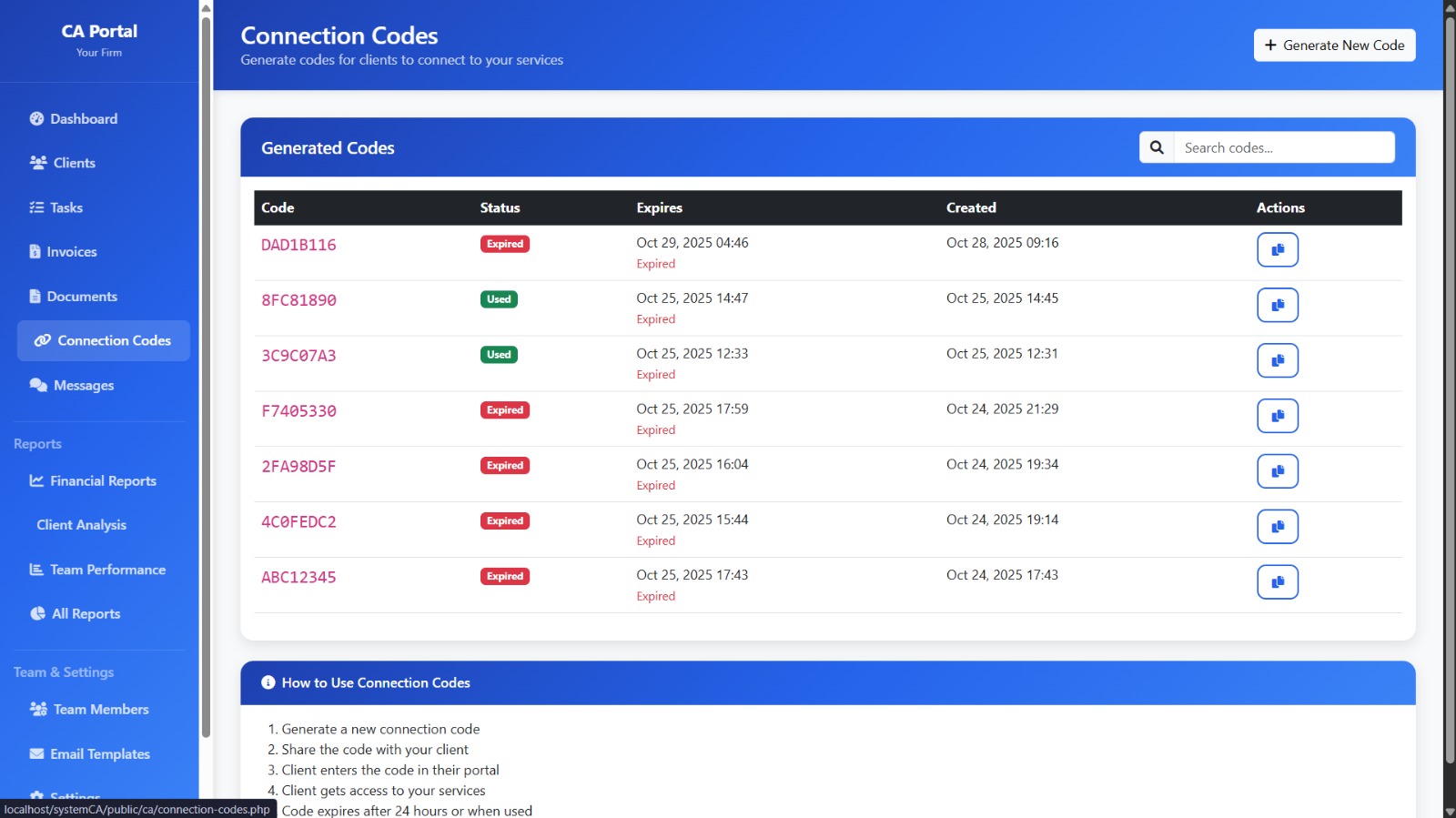

Chartered Accountants have dozens of clients — GST, TDS, IT, ROC filings, billing, invoicing, documentation. So I was thinking one day… why does an expert like a Chartered Accountant work inefficiently? For all their tasks, they use 5 to 6 different

See More

Chirag

•

Elev8 & Pickle8 • 2m

From India’s favorite craft beer to an employee petition: What really happened at Bira 91? Bira 91 started in 2015 and built a cult brand that sold over nine million cases across 550 towns and reached 18 countries by 2023. It became the poster child

See More

CA Chandan Shahi

Startups | Tax | Acc... • 9m

Here are 10 important accounting tasks to complete before 31-03-2025 to ensure a smooth financial year-end closing and compliance: ✅ 1. Reconcile All Bank Accounts Ensure that bank statements match the books of accounts. Resolve any discrepancies b

See MoreRushikesh Shinde

Hey I am on Medial • 6m

🧾 The Curious Case of Unused Billions in India In June 2024, SEBI ordered Jane Street to return ₹4,843 crore earned via alleged Nifty expiry manipulation. But even if recovered, the money won’t go to investors—it’ll sit in SEBI’s Investor Protection

See MoreDownload the medial app to read full posts, comements and news.