Back

gray man

I'm just a normal gu... • 2m

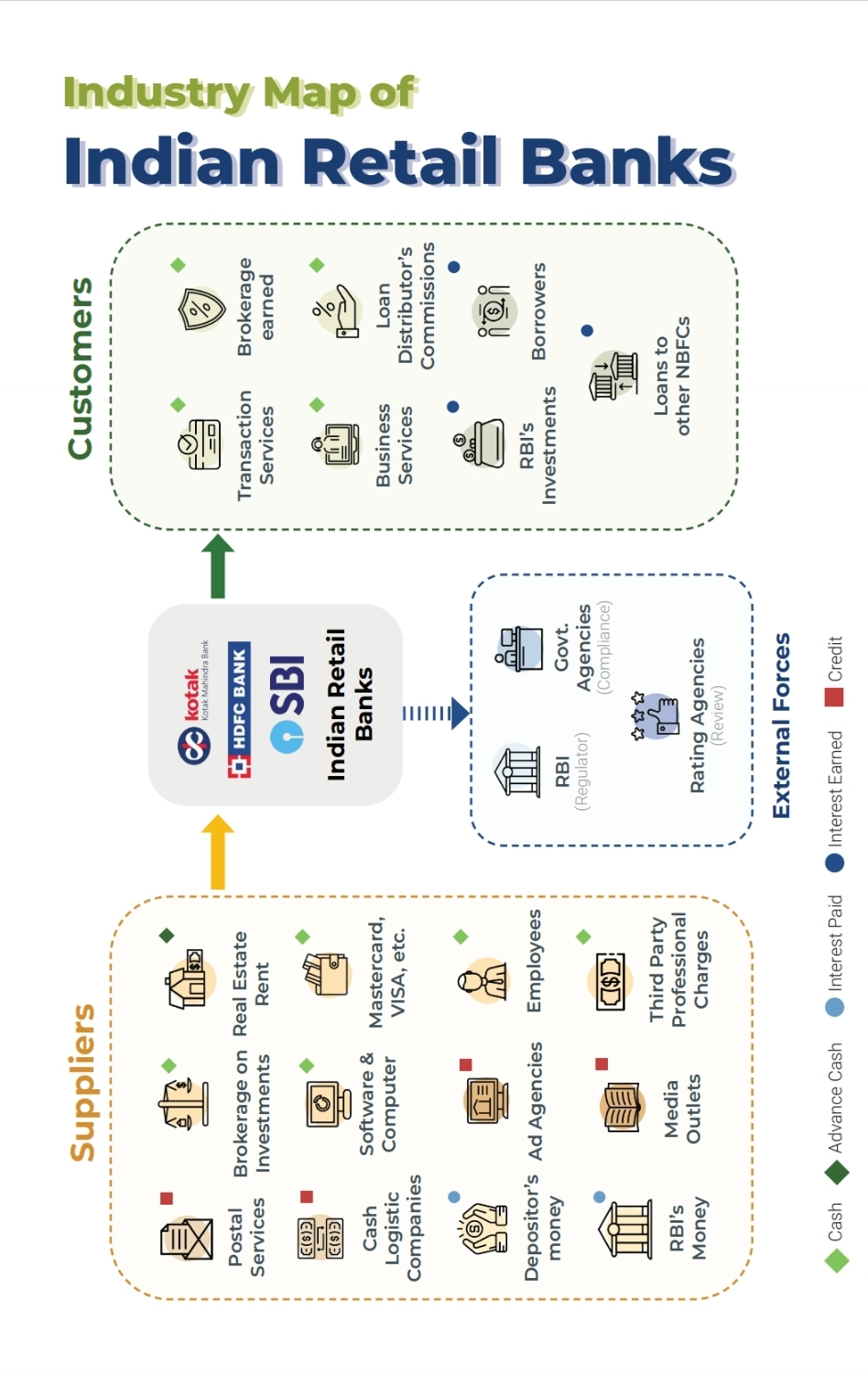

The Reserve Bank of India (RBI) has mandated that all Indian banks must transition their existing websites to the new ‘.bank.in’ domain by October 31, 2025. This move is aimed at enhancing the security and trustworthiness of digital banking platforms. The new domain is expected to offer better protection against phishing and other cyber threats, ensuring a safer online experience for customers. Banks are advised to begin the migration process well in advance to meet the deadline smoothly.

More like this

Recommendations from Medial

Download the medial app to read full posts, comements and news.