Back

Jayant Mundhra

•

Dexter Capital Advisors • 8m

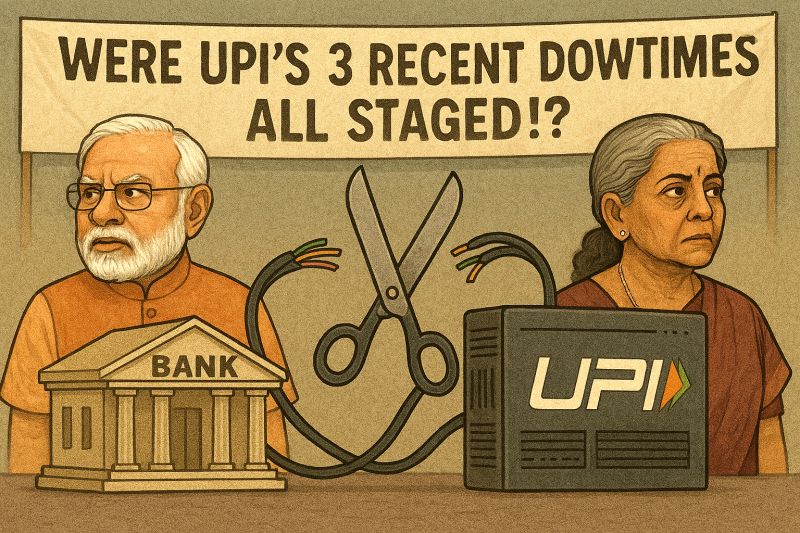

Days ago I posted this viral theory on how UPI going down thrice in a week - 26 & 31 March and 2 April - was most likely a staged drama! 🙏🙏 Following a kind update from supergood NPCI folks about how technical failures caused the outages, I decided to pull it down. However, now that it has happened again, for 4th time in 14 days - no offence to NPCI or anyone else - but probably banks, fintechs, and maybe even the Govt deliberately pushed the system to downtime, to build the much-demanded case for Merchant Discount Rates (MDR) on large merchants (Rs 100cr+ turnover). Let’s connect the dots. .. UPI, handling 18bn transactions in March 2025 (NPCI data), is the backbone of India’s digital economy, with 83% of retail payments (RBI, 2024). Yet, it’s crashed 4 times in 14 days - That’s more than half of the 7 times it has ever gone down, apart from individual bank-related issues! Now, look at the chronology. .. On 19 March, the Govt slashed UPI subsidies from Rs 3.5k crore (FY24) to Rs 1.5k crore (FY25), a 57% cut! - Banks and fintechs, already bleeding Rs 10k crore annually to run UPI (PCI estimate), cried foul - On 24 March, the Payments Council of India wrote directly to the Prime Minister’s Office, demanding a 0.3% MDR on large merchants’ UPI transactions, arguing it’s the only way to fund infra upgrades for UPI’s growth And then - bam! - UPI fails four times in 14 days. .. Coincidence? Maybe. But, I am not convinced at heart. Banks and fintechs, from PhonePe to Paytm, have long pushed for MDR to offset costs. - And those outages, impacting millions could be a staged tantrum to pressure the Govt - Or, maybe, the Govt, already sold on MDR, needed public outrage to justify the move? Four outages right after the subsidy cut announcement screams ORCHESTRATED. During these downtimes, the internet has been full of posts, tweets, reels and videos of how small businesses lost sales and users were stranded - some even suggested carrying cash again. And I know this is a theory, but it all perfectly adds up.

Replies (3)

More like this

Recommendations from Medial

Jayant Mundhra

•

Dexter Capital Advisors • 1y

Paytm shareholders are ignoring this? 📛📛 The fintech giant was the only UPI app to be making money on UPI. And now that’s no more possible. Here's all you should know! .. The thing is, NPCI (via Govt grants) compensates the banks to up keep the

See MoreAccount Deleted

Hey I am on Medial • 11m

NPCI, the name behind UPI & RuPay, plans to take its brand recognition to new heights in 2025! 🚀 Key updates: 📍 Big push for rural UPI adoption with Pankaj Tripathi as ambassador 💳 RuPay gears up to challenge global giants 📺 IPL sponsorship & di

See More

Gyananjaya Behera

Helping an Idea to S... • 1y

UPI Transactions Jump 5% MoM In May To 1,404 Cr Monthly Growth: UPI transactions rose 5% month-on-month in May to 14.04 billion, with transaction volume increasing 4.1% to INR 20.45 lakh crore. Yearly Growth: Year-on-year, transaction count surged

See More

Account Deleted

Hey I am on Medial • 10m

Google Pay now charges 0.5% to 1% (plus GST) for bill payments made via credit and debit cards, while UPI bank transfers remain free. Competitors like PhonePe and Paytm also charge similar fees. Fintech firms face high UPI processing costs, totaling

See More

Download the medial app to read full posts, comements and news.