Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 6m

But Why only on Petroleum Product, there are other supplies that comes under state excise duty and vat, gov should hike rates on tobacco and alcohol as well.

More like this

Recommendations from Medial

project sankalan

advertise on India m... • 1y

A sin tax is an excise tax levied on goods and services like tobacco, alcohol and gambling, which are deemed harmful to people. The tax aims to reduce or eliminate the use of such products by making them more expensive to buy. The government is expec

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreAditya Arora

•

Faad Network • 1m

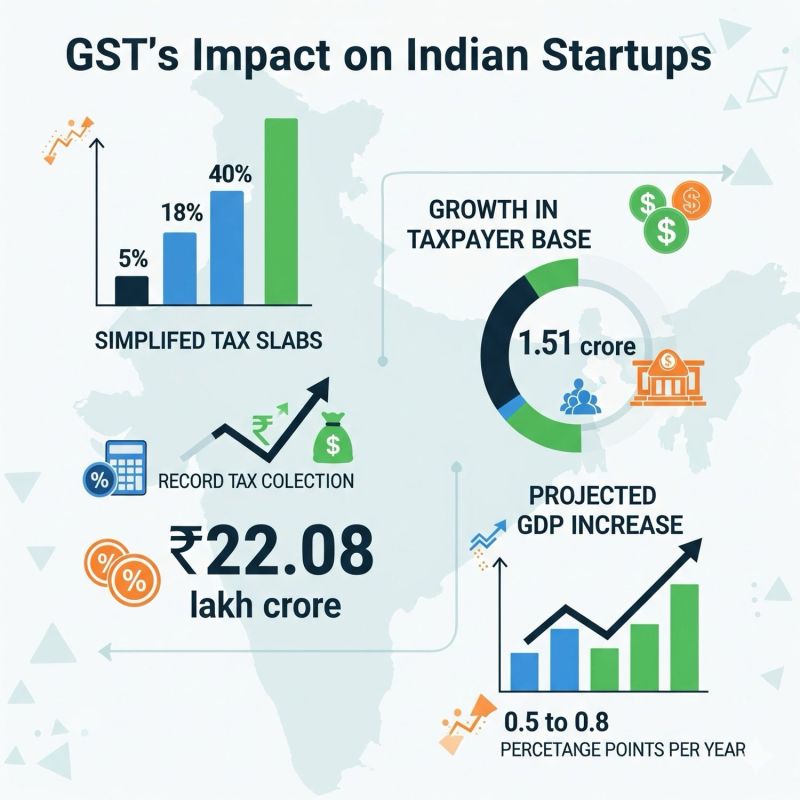

Why are the latest GST reforms being rightly called the Next Gen GST reforms for Startups and MSMEs? Here's why. ⬇️ In 2017, the government rolled multiple taxes (excise, VAT, service tax, entry tax, etc.) on differentiated products into "One Natio

See More

Dr Sarun George Sunny

The Way I See It • 1m

📌Starting 22nd September 2025, India’s GST structure has been simplified into three key slabs: 💸 GST Slabs Simplified👉 🟢 0% GST (Exempted) • Food & Beverages: Ultra-High Temperature (UHT) milk, chena/paneer (pre-packaged and labelled), pizza

See MoreJayant Mundhra

•

Dexter Capital Advisors • 6m

Govt did right by hiking excise duty on petrol and diesel, for now 🙏🙏 No offence to anybody, but this will only make sense to ones who weigh context over emotions. Those who read my work regularly would know, I am no fan of the present Govt. So,

See More

Download the medial app to read full posts, comements and news.