Back

Saket Sambhav

Adjuva Legal • 6m

Are Indian startups truly innovating, or are we stuck in the "fancy ice cream and grocery delivery" trap? As someone passionate about India’s entrepreneurial journey, let’s unpack the bigger picture. 👍 The Good: India’s startup ecosystem is booming—160,000+ startups, 120+ unicorns, and 5,000+ DeepTech ventures, as our Minister Mr Goyal highlighted. Initiatives like Startup India have brought tax exemptions (3-year income tax holiday under Section 80IAC), easier compliance, and IPR fast-tracking for DPIIT-recognized startups. The government’s push for DeepTech in AI, semiconductors, and green tech is a step toward global competitiveness. 👎 The Reality Check: But for every unicorn, there are thousands of startups in smaller cities facing unreliable power supply, bureaucratic red tape, and bribe demands. Entrepreneurs are often forced to travel miles for basic approvals—where’s the "Digital India" for them? While tax benefits exist, eligibility criteria (e.g., turnover under ₹100 crore, innovation focus) exclude many. Funding is another hurdle—despite $11.3B in VC funding in 2024 (a 43% rise), domestic capital remains scarce, leaving startups reliant on foreign investors. 🪴 What’s Needed: Goyal’s call for innovation is spot-on, but it must be backed by action. We need: ✅ Reliable infrastructure (24/7 electricity, etc.) ✅ A bribe-free, streamlined bureaucracy ✅ More domestic capital to fuel DeepTech dreams ✅ Support for startups beyond metros—innovation should thrive in every district! India’s entrepreneurial spirit is unstoppable, but it’s time for the government to match that energy with real, on-ground support. Let’s not just build for Bharat—let’s empower every entrepreneur to innovate for the world. What’s your take? Are Indian startups getting the support they need to go global? Drop your thoughts below!

Replies (2)

More like this

Recommendations from Medial

Mohammed Zuber Ahamad

Founder @Techzipe | ... • 2m

BIG WIN for Startups in India! 🇮🇳 The Govt is offering ₹0 Income Tax for 3 Years to eligible startups! 🙌 ✅ Boost for innovation ✅ Support for entrepreneurs ✅ Massive growth opportunity If you’re building the future, this is your moment. 🔥 #Start

See More

gray man

I'm just a normal gu... • 7m

Big news for India’s startup ecosystem! Prime Venture Partners has raised $100 million in its latest fund to back early-stage startups across deeptech, AI, and global SaaS. With initial investments ranging from $2-4 million (scaling up to $12M), th

See More

CA Jasmeet Singh

In God We Trust, The... • 8m

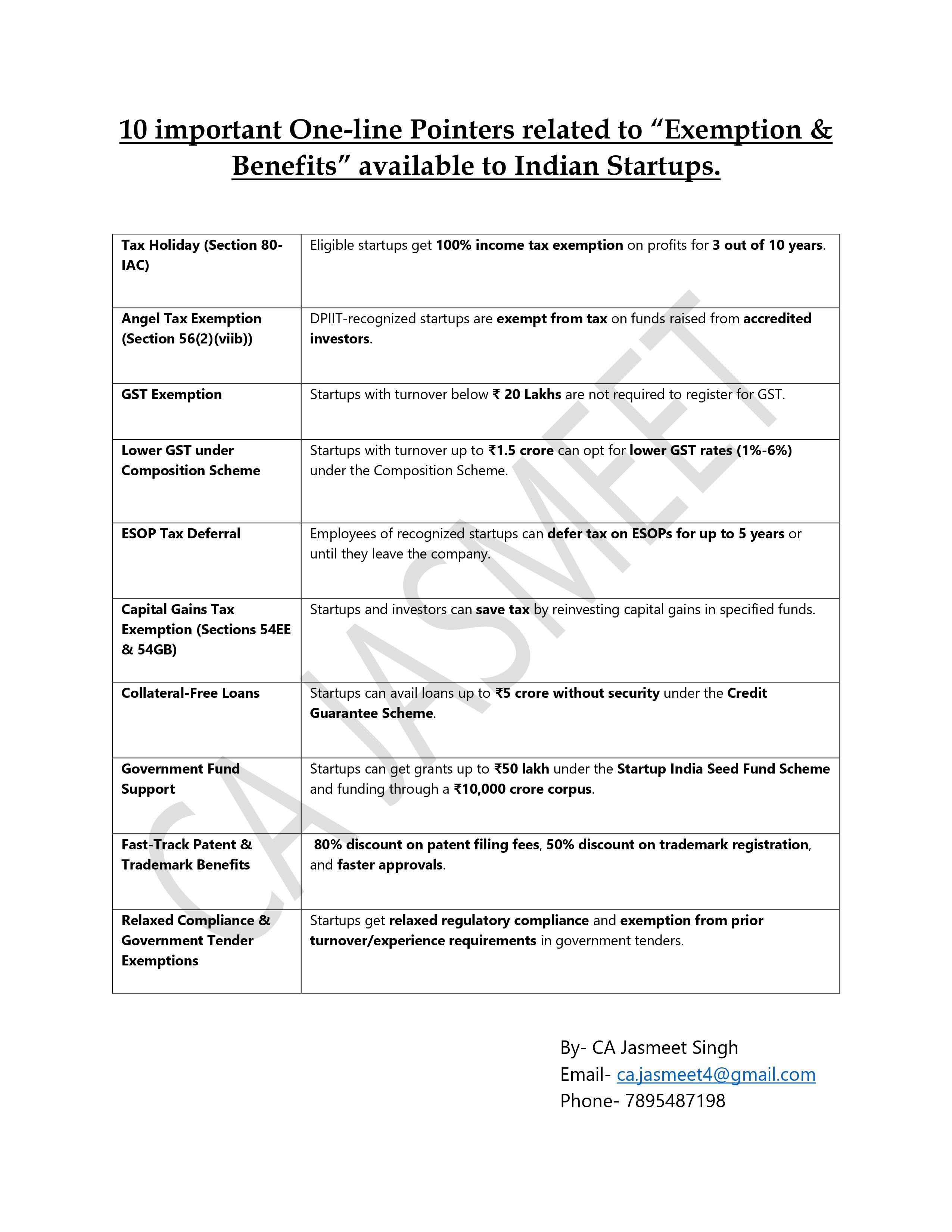

🌟 Big News for Startups! 🚀💼 Did you know Indian startups get amazing tax breaks, funding support, and compliance relaxations? 🏦📊 From 100% tax exemptions to collateral-free loans, here are 10 key benefits every entrepreneur must know! 💡✅ 🔥 C

See More

CA Jasmeet Singh

In God We Trust, The... • 6m

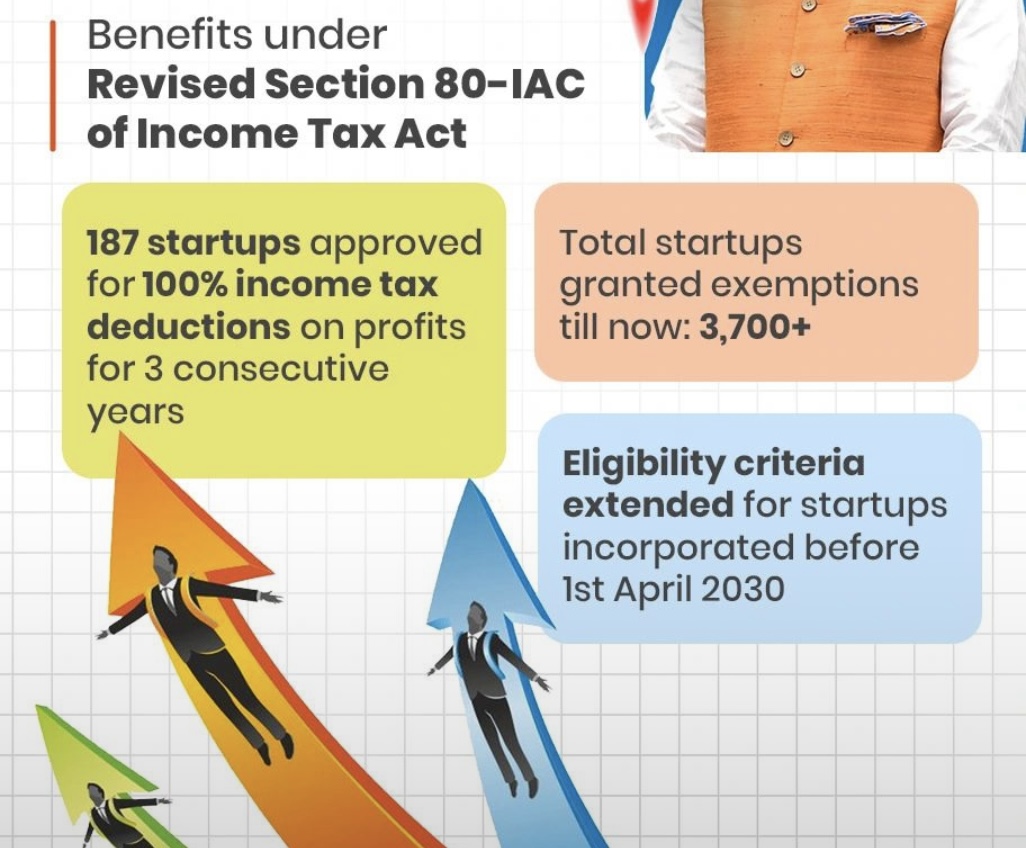

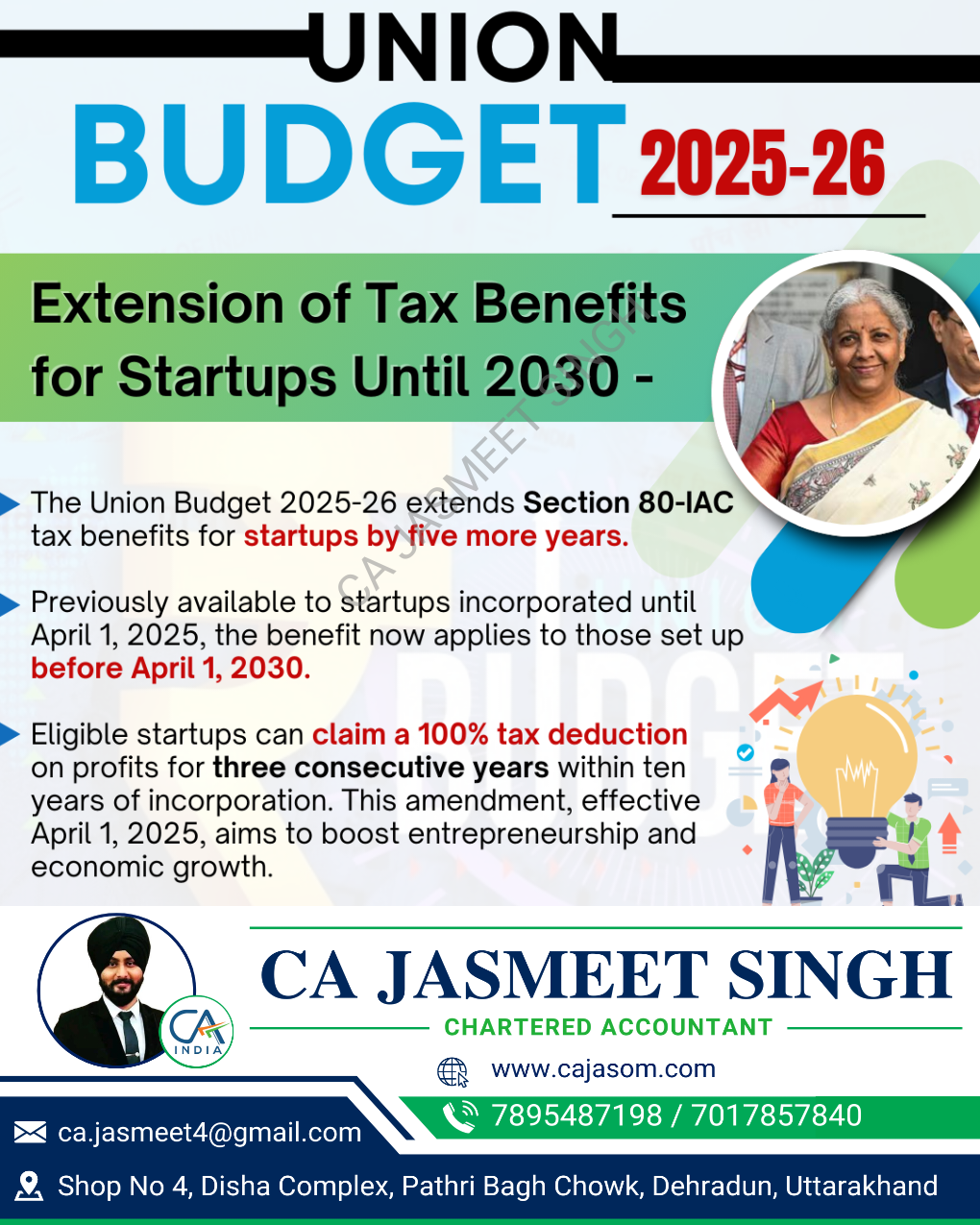

🚀 Section 80-IAC: Tax Exemption for Startups! 💡 If you're a startup recognized by DPIIT, you can claim a 100% tax deduction on profits for 3 consecutive years out of the first 10 years! 🎉 📌 Eligibility: ✅ Incorporated as a Private Ltd. Co. or L

See More

Saurabh Mishra

Building a tech gian... • 3m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreThree Commas Gang

Building Bharat • 5m

💥 India’s Startup Reality Check: What No One Tells You (But Should) Think Indian startups only fail because of competition? Think again. From broken unit economics to brutal GST shocks—what really derails promising ventures? In our latest article,

See MoreDownload the medial app to read full posts, comements and news.