Back

Mridul Das

Introvert! • 5m

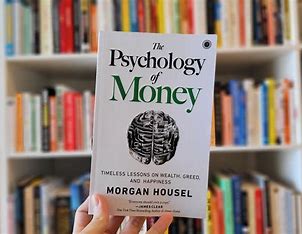

If you read this Medial post, you don’t need to buy the book "The Psychology of Money "💰 💡 Money isn’t just about numbers—it’s about behavior, mindset, and emotions. Let’s break down some golden lessons from this masterpiece! 🧵👇 1/ Saving > Earning Wealth isn’t what you make—it’s what you keep! A high income means nothing if you spend it all. The real key? Consistent saving & smart investing. 2/ Compounding is King 👑 Even small, consistent investments grow massively over time. Warren Buffett made 99% of his wealth after 50! Stay patient & let compounding work for you. 📈 3/ Avoid Lifestyle Inflation 🚨 Just because you earn more doesn’t mean you have to spend more! The rich stay rich by saving more than they spend. 4/ Behavior > Skill in Investing Markets are emotional. Control your emotions, and you’re already ahead of most investors. The biggest enemy? Your own panic. Stay calm & play the long game. 🎢 5/ Prepare for Crashes 📉 Every investor faces bad years. The winners? Those who stay the course. The market rewards patience. 6/ Personal Finance is PERSONAL What works for one person might not work for you. Find a strategy that fits your goals, risk tolerance, and values. 💡 7/ Risk & Reward Go Hand in Hand Fear of losing can make you miss opportunities. Embrace volatility and make informed decisions, not emotional ones. 🔑 Final Takeaway: Mastering money is more about mastering your mindset than numbers! 🧠💵

Replies (4)

More like this

Recommendations from Medial

Tushar Aher Patil

Trying to do better • 8m

From Janitor to millionaire The Inspiring Story of Ronald James Ronald James, a janitor, left behind $8 million at his death. How did he do it? Simple habits: saving consistently, living below his means, and letting compound interest work its magic.

See More

Mohammad Ali Shah

Co Founder & CEO at ... • 1m

Consistency unlocked — founder mode: ON. “You won’t always feel motivated. But if you stay consistent, results will still show up. That’s the real compounding power.” Grateful for this streak journey on Medial. It’s not about the rewards — it’s abo

See More

Aakash kashyap

Building JalSeva and... • 10m

"The psychology of money" 🌟 (Book summary) Day 01 1. Wealth vs. Richness •Definition: Housel distinguishes wealth as the assets you have that generate income, while richness refers to a high income or spending power. •Living Below Your Means: True

See More

financialnews

Founder And CEO Of F... • 10m

Radhika Gupta's Investment Mantra: Stick to SIPs It's Cheaper Than Coffee Don't let market fluctuations scare you. Stay consistent with your SIPs and reap the rewards in the long run. Renowned investment expert and Edelweiss Mutual Fund CEO Radhika

See Moreprabhav sharma

NETWORK BUILDER|BUSI... • 6m

Picture an app that turns small investments into big gains through compounding—why not invest? This innovative platform simplifies wealth-building with a user-friendly design and proven algorithms, promising broad appeal and profitability. With the f

See MoreDownload the medial app to read full posts, comements and news.