Back

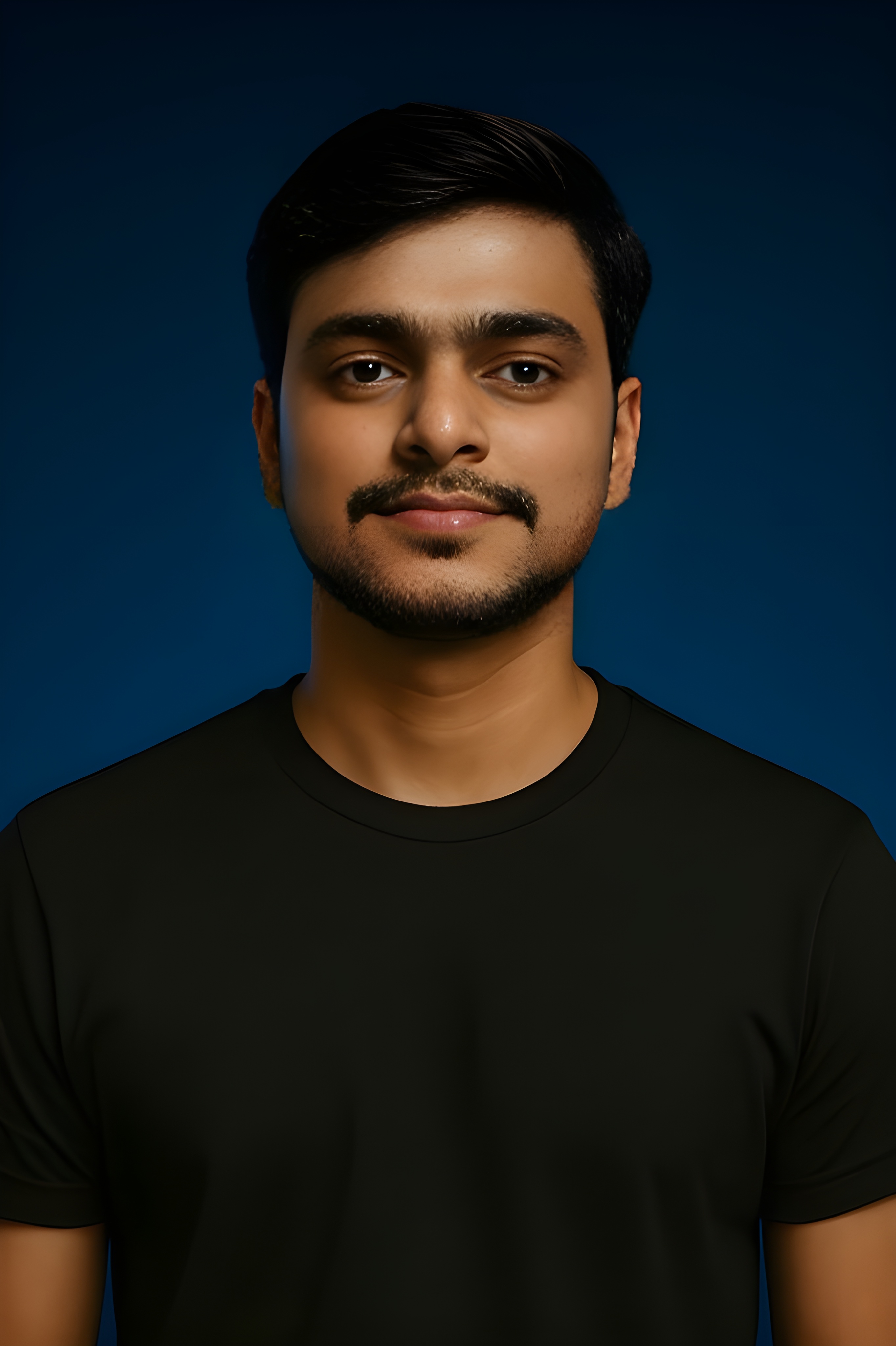

Nimesh Pinnamaneni

Making synthetic DNA... • 4m

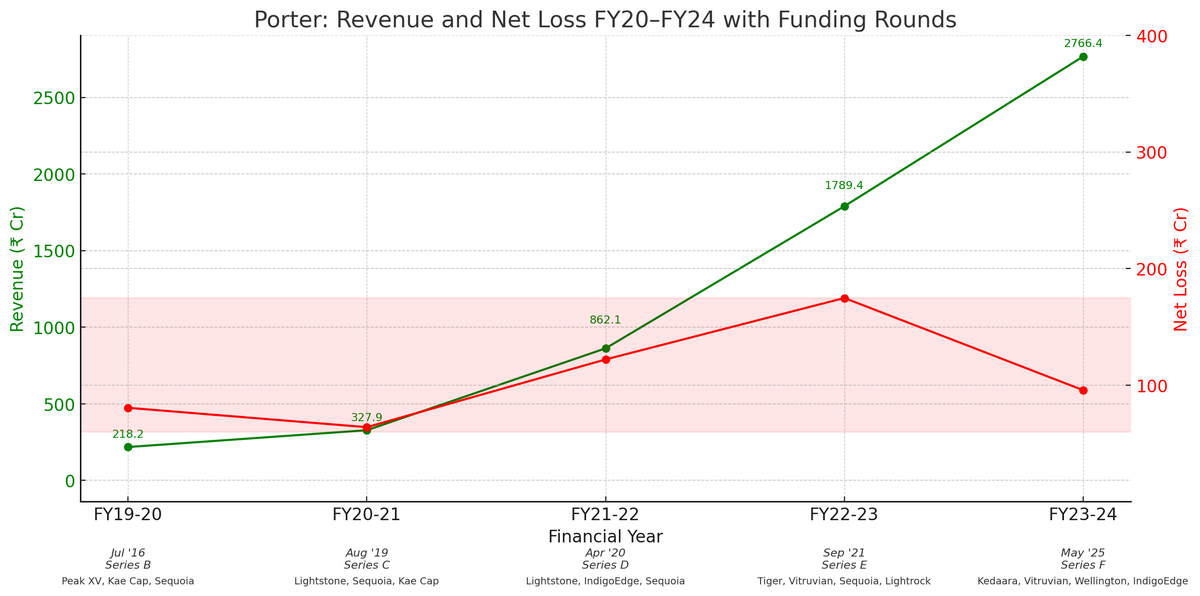

🚨 The magic number: ₹800 Cr ⸻ VCs invest in businesses that can be big enough to return their entire fund. To get VCs interested, your startup must at least have the potential to reach ₹800 Cr+ in annual revenue or ₹8,000 Cr+ in market cap (assuming a 10x multiple). Don’t worry if it will take time to get there. They account for that. ⸻ 💡 The Simple Formula: A × B × C ≥ ₹800 Cr Where: A = How many things you can sell (market size or customer base) B = How much you sell it for (price per unit) C = Your gross margin (profit after direct costs) ⸻ ✅ Example 1: B2B SaaS for Labs You’re building software for diagnostic labs: A = 10,000 labs B = ₹1,00,000 per year (₹8,300/month) C = 85% gross margin 👉 10,000 × ₹1,00,000 × 0.85 = ₹850 Cr ✅ VC-fundable: Big market, recurring revenue, high margin. ⸻ ❌ Example 2: Boutique Coffee Chain You’re opening premium cafes in Indian metros: A = 50 outlets B = ₹300 average bill - Customers/day = 1000 - Annual Revenue = ₹10.9 Cr per outlet → ₹547.5 Cr total C = 30% margin 👉 ₹547.5 Cr × 0.3 = ₹164.2 Cr ❌ Not VC-fundable: Great business, but not scalable enough for VC. ⸻ ✅ Example 3: Molecular Diagnostics You’re building a rapid sequencing diagnostics platform: A = 5,000 clinics B = ₹8,300 per test - Tests/year = 1,000 per clinic C = 60% margin 👉 5,000 × 1,000 × ₹8,300 × 0.6 = ₹2,490 Cr ✅ Highly VC-fundable: High TAM, strong margins, scalable diagnostics. ⸻ 🧠 TL;DR for Founders Before chasing VC money, ask: 🔍 Can this idea become a ₹1,000 Cr+ business? 📊 Do my unit economics work at scale? ⚔️ Am I swinging big enough? If you’re under that bar — just pick the right funding model: 💸 Angel, 💼 PE, 🧪 Grants, or 🛠️ Bootstrapping. ⸻ Run the math on your startup idea👇

More like this

Recommendations from Medial

Nimesh Pinnamaneni

•

Helixworks Technologies • 4m

From ₹51 Cr to ₹1,272 Cr in a year—this Indian biotech’s revenue chart is insane. 💰 Molbio is going public targeting ₹22,000–24,000 Cr valuation. IPO expected in November 2025, raising ₹2,200–2,400 Cr. 🔬 Their Truenat platform, is a battery-power

See More

Dhandho Marwadi

Welcome to the possi... • 3m

📊 HDFC Securities FY25 Performance Analysis A) Strong Growth Across Core Metrics Operating Revenue jumped 23% YoY to ₹3,264 Cr (vs ₹2,660 Cr in FY24), reflecting a robust uptick in broking, distribution, and retail activity. Operating Profit rose

See MoreSwapnil gupta

Founder startupsunio... • 1m

📌 Revenue Model of Groww 1. Subscription Charges: For premium services like advanced analytics. 2. Platform Fees: Charged for mutual fund investments. 3. Lending Services: Interest income from instant loans offered to select customers. A. Br

See More

Chamarti Sreekar

Passionate about Pos... • 2m

7 Essential Metrics Every Startup Should Track 1. Customer Acquisition Cost (CAC) https://www.investopedia.com/terms/c/customer-acquisition-cost.asp 2. Lifetime Value (LTV) https://www.investopedia.com/terms/c/customer-lifetime-value-clv.asp 3. Bu

See More

VCGuy

Believe me, it’s not... • 1y

Yesterday, Third Wave Coffee announced plans to open an 50 more stores. ⏩Lead Investors include: WestBridge Cap., Creaegis, Redbrook. ⏩Total Funding: $62 M, Last round- Series C: $35 M At present, Third Wave Coffee has 107 stores. Blue Tokai Coff

See MoreVCGuy

Believe me, it’s not... • 18d

Yesterday – reports suggested ChrysCapital finalised a ₹2,410 Cr deal to acquire Theobroma. One of India's most loved bakery chains is now set to be one of its largest cash exits in the F&B space. ICICI Ventures (which owned 42%) is expected to wa

See MoreDownload the medial app to read full posts, comements and news.