Back

Rohan Saha

Founder - Burn Inves... • 9m

Important events for next week: - Fed Interest Rate Decision on 19th March - Bank of England, Bank of Japan interest rate decisions on 19th & 20th March - India’s WPI inflation and balance of trade data on 20th March

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 9m

WPI DATA Feb WPI inflation rate at 2.38% vs 2.31% in Jan Feb WPI food inflation at 5.94% vs 7.47% in Jan Feb WPI primary articles inflation at 2.81% vs 4.69% in Jan Feb WPI fuel and power inflation at -0.71% vs -2.78% in Jan Feb WPI manufactured

See MoreRootDotAi

From the ROOT to the... • 1y

Here's a Summary of the FED decision on March 20, 2024: 1. The Federal Reserve keeps interest rates steady at 5.50% for the fifth consecutive meeting. 2. The Fed maintains its anticipation of three interest rate reductions in 2024. 3. The proje

See Morefinancialnews

Founder And CEO Of F... • 1y

"RBI Expected to Cut Repo Rate by 25 Basis Points to 6.25% in December Amid Concerns Over Volatile Food Prices" "RBI Likely to Cut Key Policy Rate by 25 Basis Points to 6.25% in December as Inflation Expected to Ease, Aiming to Boost Economic Growth

See MoreAccount Deleted

Hey I am on Medial • 1y

Hello Everyone 🖐️, FED is now trying to cut their interest rates from 5.5% to maybe 3-4% . Now , Inflation is in control so that they will cut fed rates till June . Due to this , companies don't have high interest on loans so that I think recession

See More

Tushar Aher Patil

Trying to do better • 3m

SUMMARY OF FED CHAIR POWELL'S SPEECH (9/17/25): 1. Unemployment rate has risen along with downside risks to employment 2. Inflation has risen and remains "somewhat elevated" 3. Growth in economic activity has "moderated" 4. Job creation rate is "bel

See MoreTushar Aher Patil

Trying to do better • 8m

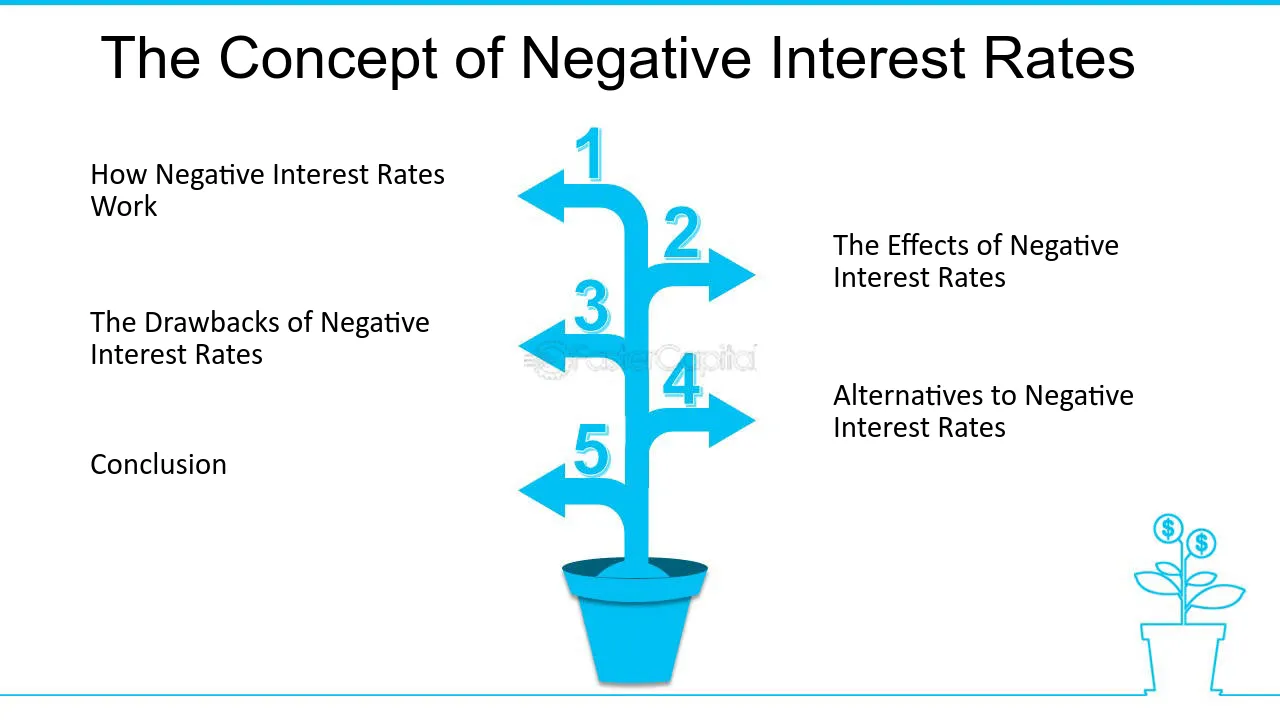

Exploring Negative Interest Rate Policy (NIRP) Have you ever wondered about central banks setting interest rates below zero? This is known as Negative Interest Rate Policy (NIRP). Here's a quick look at this unconventional monetary tool: ✍️ What is i

See More

Himesh Jain

Chasing for infinity • 1y

Hi what are your thoughts on Compound interest Let's say if I invest 10000 Rs every month for 40 years at an annual interest of 8% then after 40 years My invested amount = 48 lacs Money I will get = 3.51 cr But will it really be worthy with an a

See MoreSairaj Kadam

Student & Financial ... • 1y

This Thing Will Actually Blow Your Mind. Click on This. "Inflation is taxation without legislation." - Milton Friedman Inflation: A Major Concern in India Inflation remains a pressing issue in India, with the state of Odisha facing the highest r

See More

Atharva Deshmukh

Daily Learnings... • 1y

Have studied about Monetary Policy in short and it's effect. The monetary policy is a tool through which the Reserve Bank of India (RBI) controls the money supply by controlling the interest rates. RBI is India’s central bank. While setting the int

See MoreDownload the medial app to read full posts, comements and news.