Back

Nikhil Chaudhari

Venture Partner • 5m

Hi, We are an investment bank with an early-stage fund, actively looking for businesses raising capital through equity and debt. Debt Funding: We facilitate deals above ₹40 Cr Equity Funding: We work on deals above ₹35 Cr (for companies with strong traction) Direct Investments: We invest ₹2 Cr – ₹8 Cr in high-growth companies with proven traction With ₹9,200 Cr+ raised across 85 deals in the last 2 years and two decades of industry expertise, we have a strong track record in facilitating successful fundraises. If you're raising capital, DM me with your deck and funding requirements. Happy to explore opportunities! Thanks!

Replies (4)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 3m

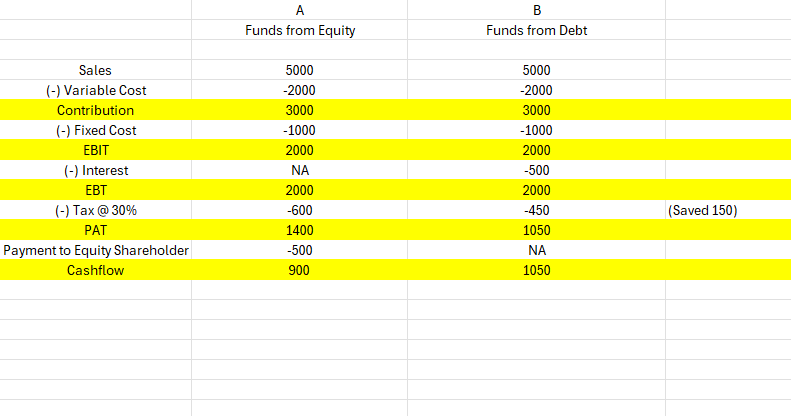

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Nawal

Entrepreneur | Build... • 5m

Electric cab-hailing startup BluSmart Mobility is reportedly grappling with a cash crunch, which caused the Delhi NCR-based company to default on INR 30 Cr of debt in early February. 🔰 BluSmart, which is in the middle of raising about INR 434 Cr in

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 7m

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

VENTURE NAVIGATOR

INVESTOR | Start up ... • 6m

Scaling a Traditional Business with Debt Funding 💰🍦 Recently, I had the opportunity to consult the founder of an ice cream brand looking to raise funds—not for an exit, but for scaling up! 🚀 With an annual turnover of ₹2 Cr, he needed ₹30 Lakhs

See More

Download the medial app to read full posts, comements and news.