Back

Anonymous 1

Hey I am on Medial • 5m

There’s no single reason for PhonePe’s exit. It’s likely a mix of regulatory uncertainty, high costs, slow monetization, and better ROI in other verticals. While some could see this as a missed opportunity, others think it’s a smart strategic move to focus on lending, insurance, and UPI-based payments instead.

More like this

Recommendations from Medial

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Fintech in Bangalore: Trends and Opportunities * Trends: Mobile payments, digital lending, insurtech, blockchain, wealth management, regulatory sandbox. * Opportunities: Financial inclusion, increased access to credit, personalized fina

See MoreNitesh Vishwakarma

•

Ritco Logistics • 2m

Embedded Finance: The Future of Financial Services for Startups Ever heard of embedded finance? It’s revolutionizing how startups do business! 🚀 What is Embedded Finance? It’s the seamless integration of financial services—like payments, lending,

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

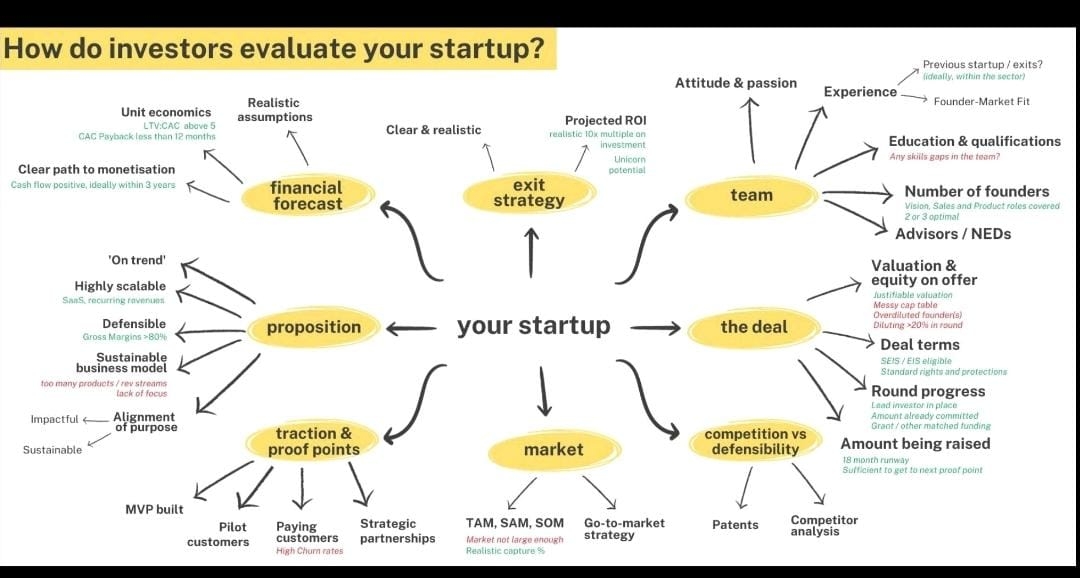

Investors evaluate a Startup based on the following keyfactors, hope this will be helpful 🚀🚀 1. Financial forecasts 📈 - Unit economics - Realistic assumptions - Clear path to monetization - 'On trend' - Highly scalable - Defens

See More

Poosarla Sai Karthik

Tech guy with a busi... • 13d

UPI on Credit? PhonePe’s Boldest Bet Yet In partnership with HDFC Bank and NPCI, the card is powered by Rupay and allows UPI payments through credit. NPCI had enabled this back in 2022, but PhonePe had to wait almost ten months to get RBI approval.

See MoreThe next billionaire

Unfiltered and real ... • 5m

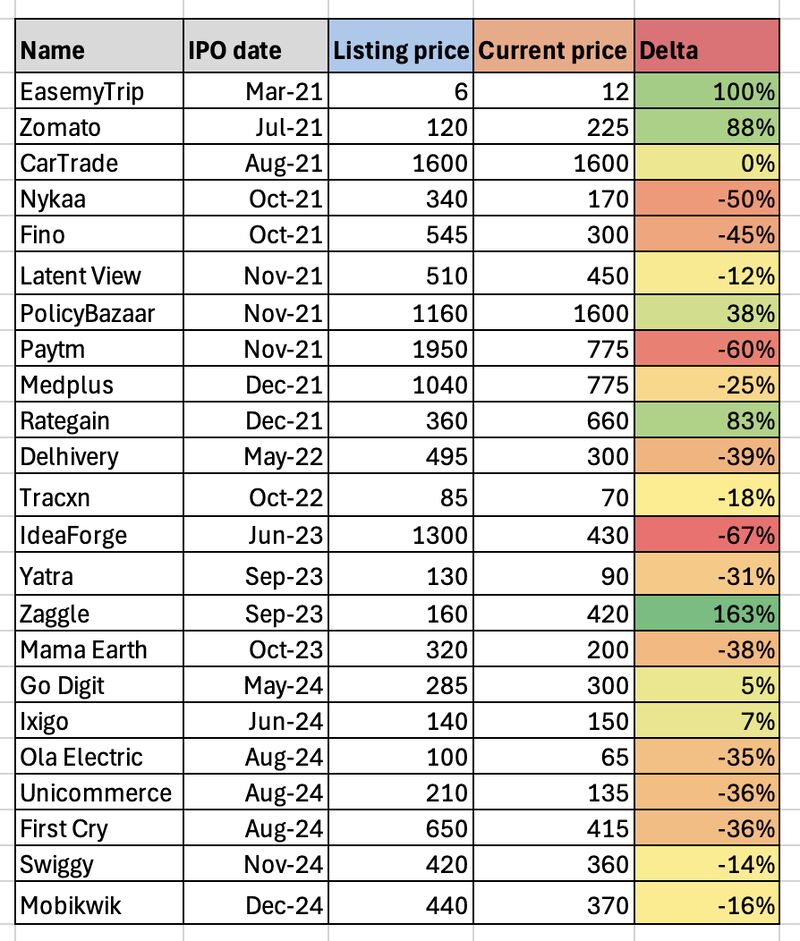

Are Startup IPOs Truly Creating Wealth—or Just Exit Liquidity for Founders and VCs? India has seen a wave of startup IPOs over the last three years - 23 companies went public, promising innovation, disruption, and wealth creation. But have they tru

See More

Poosarla Sai Karthik

Tech guy with a busi... • 4m

I've studied the Indus Valley Report published by Blume Ventures this year. Here are some key points I’ve noticed: 1. India’s Consumption Story is Uneven The top 10% contribute 66% of India’s economy, while the middle class struggles to grow. The lo

See MoreIncorpX

Your partner from St... • 2m

BluSmart’s Reboot: A Story of Promise, Pitfalls, and Possible Redemption In a dramatic turn for India’s all-electric ride-hailing pioneer BluSmart, major investors including BP Ventures are now in advanced talks to acquire co-founder Anmol Singh Jag

See MoreDownload the medial app to read full posts, comements and news.