Back

Pranjal Majumdar

Hey I am on Medial • 5m

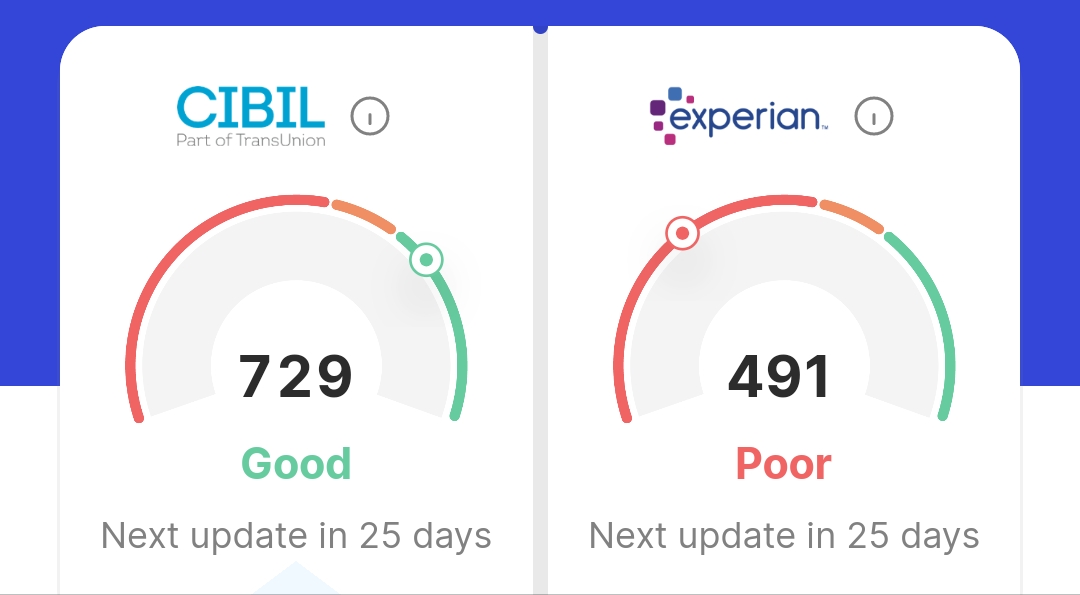

"Big Changes in Credit Score Rules by RBI – Here’s How It Affects You!" Starting January 1, 2025, the RBI has introduced new rules that will make credit score updates faster and more accurate. Here’s what you need to know: ✅ Credit Score Updates Every 15 Days Earlier, banks updated credit scores every 30-45 days. Now, they must update it every 15 days. 💡 Why It’s Important: This means your credit report will reflect your latest financial activities faster. Whether you repay a loan or take a new one, it will show up sooner. 💼 Better Loan Approvals: Banks will be stricter in approving personal loans. This will reduce the chances of people taking too many loans and falling into debt. 🛠 Quick Error Corrections: If there’s a mistake in your credit report, banks must fix it faster. If they deny a correction request, they need to provide a valid reason. 🔄 Impact on Borrowers: With these changes, customers can get better loan offers, faster credit updates, and more accurate records

More like this

Recommendations from Medial

Download the medial app to read full posts, comements and news.