Back

LetsConnect Mind care technology pvt ltd

•

Signitycs • 8m

In india Upto 18% GST Is Applicable - Education sector. Medical Industries - GST is Applicable. Luxury cars - Low ROI Tractors, - High ROI This Rules are Correct What is your opinion. its just an Question.. Because we stopped questionings..?? Join #AbFirPuchegaindia Campaign

Replies (5)

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 1 Evolution of GST across the years - 2000 - PM introduced the concept of GST and set up a committee 2006 - Announced by FM that GST to be introduced from 1st April 2010 2014 - Bill introduced in Lok Sabha 2015 - Bill passed in Lok Sa

See MoreAditya Arora

•

Faad Network • 19d

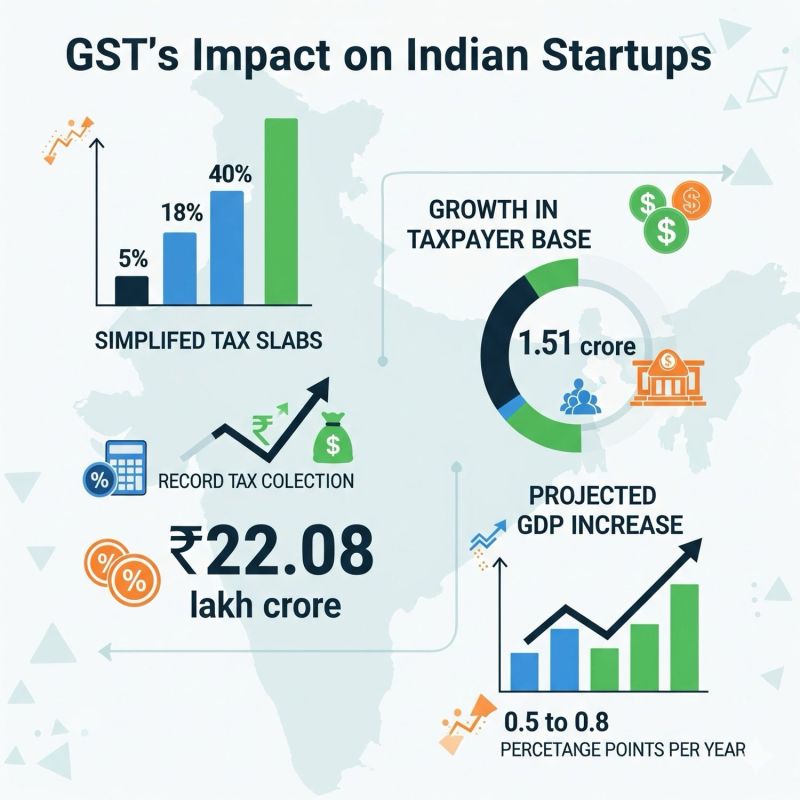

Why are the latest GST reforms being rightly called the Next Gen GST reforms for Startups and MSMEs? Here's why. ⬇️ In 2017, the government rolled multiple taxes (excise, VAT, service tax, entry tax, etc.) on differentiated products into "One Natio

See More

Rohan Saha

Founder - Burn Inves... • 1m

India’s GST Rate Cut - What It Means for You From this September 22 the government is making some big changes in GST instead of too many tax slabs now there will mostly be two rates 5%, 18% and for luxury stuff a new 40% rate for common people this

See More

AASHIRWAD DEVELOPER GROUP

The business should ... • 10m

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Dr Sarun George Sunny

The Way I See It • 1m

📌Starting 22nd September 2025, India’s GST structure has been simplified into three key slabs: 💸 GST Slabs Simplified👉 🟢 0% GST (Exempted) • Food & Beverages: Ultra-High Temperature (UHT) milk, chena/paneer (pre-packaged and labelled), pizza

See MoreDownload the medial app to read full posts, comements and news.