Back

PRATHAM

Experimenting On lea... • 8m

Forget VC Funding: Best Alternatives of VC funding For decades, raising round after round, burning cash and the founders are left with one digit equity. VCs own the equity. Founders are like puppets. They want 10x returns in 5-7 years whether your business can handle it or not. For every Google and Airbnb, there’s a WeWork, ( which was destroyed due to overexpansion even with funding) So what’s the alternative? How do you raise capital without selling yourself 1. Revenue-Based Financing (RBF) How it works: Investors provide capital in exchange for a fixed percentage of future revenue until they make 1.5x to 4x their investment. Basically Royalty without equity No dilution, no board interference, and no pressure to scale at breakneck speed. Who’s doing it: Clearco: has invested into 10,000+ startups like Haus, Untuckit, and Andie using RBF. E-commerce brand Doe Lashes took RBF from Clearco instead of raising VC. The result? 100% founder ownership and profitable growth. 2. Crowdfunding You raise money directly from the public, turning early adopters into evangelists. Similar to IPO You get capital + market validation without giving up board seats. Who’s doing it: Kickstarter & Indiegogo helped launch brands like Pebble (smartwatch), Oculus (VR headset), and Many more 3. Decentralized Finance (DeFi) Companies issue tokens or use DeFi lending platforms to raise funds. No banks, no middlemen, no gatekeepers—just direct access to global liquidity. Who’s doing it: Aave( It's quite popular on Web3 ) & Compound let startups take out loans backed by crypto collateral. DAOs (Decentralized Autonomous Organizations) like BitDAO have raised billions without traditional fundraising. Axie Infinity raised $152M through a token sale, skipping VCs entirely and then became a $3B gaming empire. 4. Micro-Venture Capital Smaller funds invest smaller amounts in early-stage startups, often with founder-friendly terms. Why it’s different from traditional VCs: Less pressure for hypergrowth, more focus on sustainable scaling. Who’s doing it: TinySeed invests in bootstrapped SaaS startups with revenue under $1M. If your goal is fast hypergrowth, then sure VC funding makes sense. But if you want to build a long-term, sustainable business? These alternatives might be a better fit. Best for Indiecorns imo. This is probably the best post by Me imo. I had alot of fun making this post.

Replies (9)

More like this

Recommendations from Medial

Mayank Kumar

Strategy & Product @... • 1y

The Impact of Venture Capital on Innovation! Venture capital (VC) plays a crucial role in driving innovation. By providing the necessary funds, VCs enable startups to scale and develop groundbreaking technologies. Think of companies like Uber, Air

See MoreMayank Kumar

Strategy & Product @... • 1y

Startup Funding 101: Bootstrapping vs. VC Funding Deciding between bootstrapping and venture capital (VC) funding is a critical choice for startups. Bootstrapping involves self-funding and can offer more control but may limit growth potential. V

See MoreVivek Joshi

Director & CEO @ Exc... • 3m

Venture Capital (VC) is a vital funding source for high-growth startups, typically those too risky for traditional bank loans. VCs pool capital from Limited Partners (LPs) to invest in promising early-stage companies with significant scaling potentia

See More

Vivek Joshi

Director & CEO @ Exc... • 2m

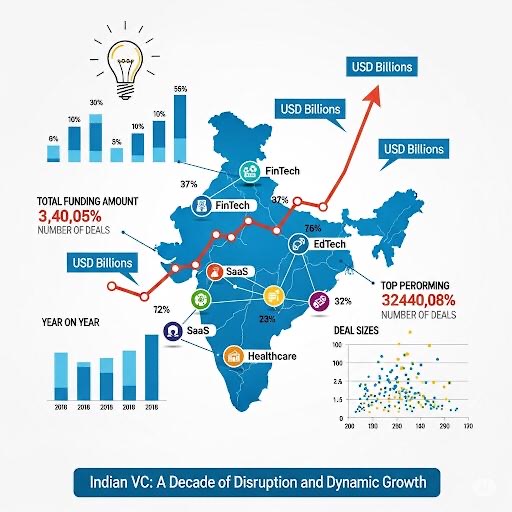

📈 Indian VC rebounds! PE-VC investments +9% to ~$43B in 2024, led by VC/growth at ~$14B (+40%) across 1270 deals (+45%). Consumer tech & SaaS lead. Public markets a key growth driver. VCs now prioritize AI with strong IP & early capital efficiency.

See More

Download the medial app to read full posts, comements and news.