Back

Anonymous 2

Hey I am on Medial • 7m

Its all a game of valuation maxing and taking secondary exits while having very high salaries so you can invest as an angel in some startups too to hedge your bets and get big returns

Replies (1)

More like this

Recommendations from Medial

Charan Reddy

IDEATE PROTOTYPE TES... • 1m

Saw a great question on Instagram and felt like Asking it here so the question is Suppose there are 2 Companies A & B having Same Revenue and same valuation calculated using EV/EBITDA multiple, Where one company A is having 25% margin and growing 10

See MoreAnonymous

Hey I am on Medial • 1y

99.99% of founders don’t end in heaven. While the cannon fodders of Byju Raveendran are vacating the 400,000 Sqft Bengaluru office space, this sarojini market replica of the Neuman couple have already taken out over 300 MILLION DOLLARS in secondary

See MoreVivek Joshi

Director & CEO @ Exc... • 2m

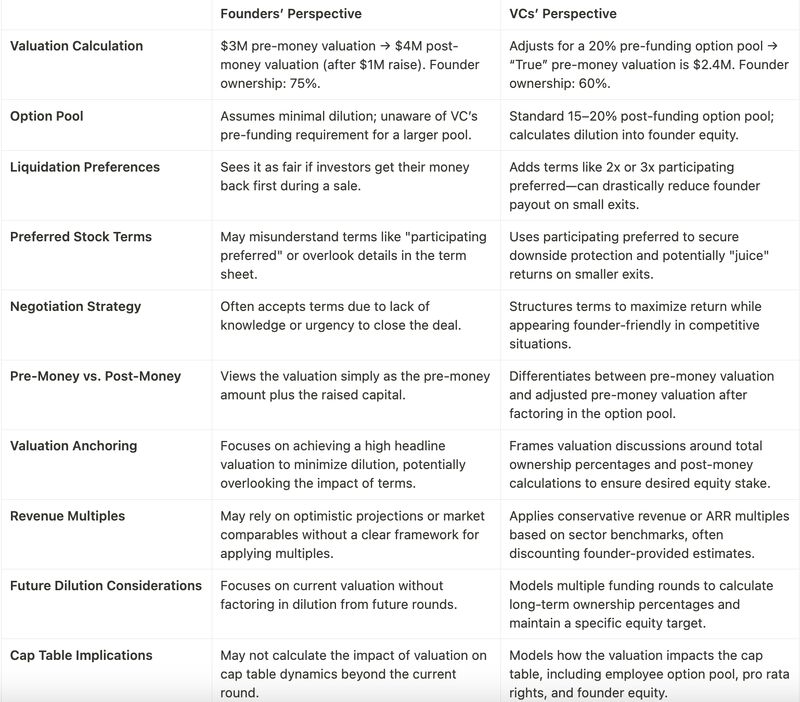

Ever wondered what happens before a startup secures funding? Let's deconstruct it Valuation is key in funding rounds – is it art or science? For early-stage startups, it's a mix. Common Valuation Methods: DCF: Future cash flows discounted to present

See More

Vishwa Lingam

Founder of Simulatio... • 16d

🚫 Why VCs Reject Your Pitch — Even If It’s a Solid One 💡 You're not alone if your startup pitch got rejected by a VC. But here's the hidden truth most won’t tell you: VCs have limited capital from their LPs (Limited Partners) & they’re under pre

See MoreAshish Sharma

Turning ideas into I... • 4m

HapiKeys(Preserve Property Value, Protect Deposits, Prevent Disputes) Core Offering What: A subscription-based service offering bi-annual / Quarterly professional inspections + preventive maintenance for rental properties. For Landlords: Protects a

See MoreDownload the medial app to read full posts, comements and news.