Back

CA Jasmeet Singh

In God We Trust, The... • 6m

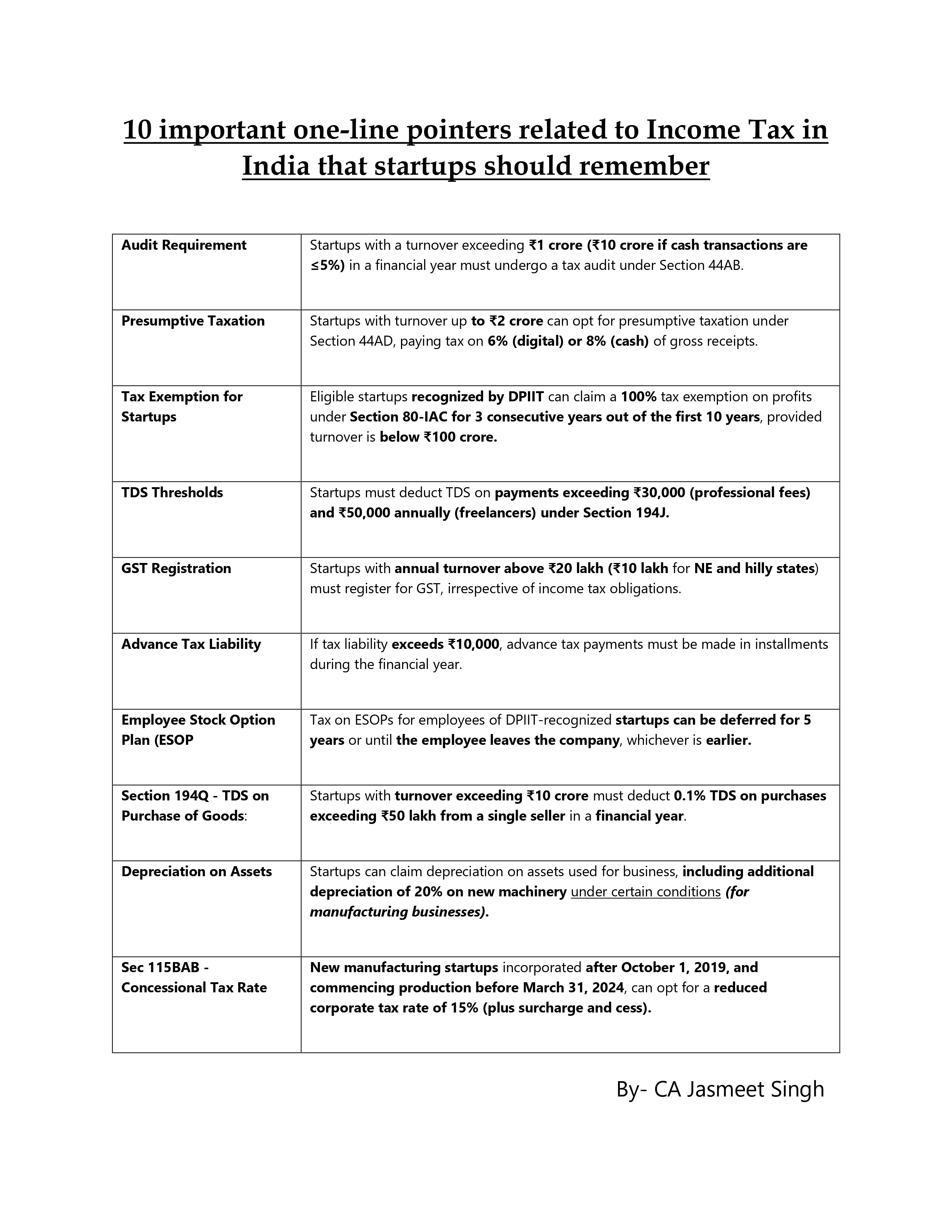

10 Important Tax & Exemption related Pointers that a Startup Founder should Know.

Replies (11)

More like this

Recommendations from Medial

Shiva Prasad

Passionate Software ... • 1y

Hi Guys, I want to know few things about below mentioned points 1. Will we invest in startup(Starting from 2,000 rupees) and become a share holder if you like it? 2. What are the benefits we get, if we invest in Startups? 3. Any tax exemption

See MoreSandip Kaur

Hey I am on Medial • 11m

Essential Tax Tips Every Indian Startup Shld Know- Navigating taxes can be tricky for startups, but mastering them is crucial for growth. Here’s what every Indian entrepreneur shld keep in mind: •Startup India Exemptions: If your startup is recognize

See MoreCA Jasmeet Singh

In God We Trust, The... • 4m

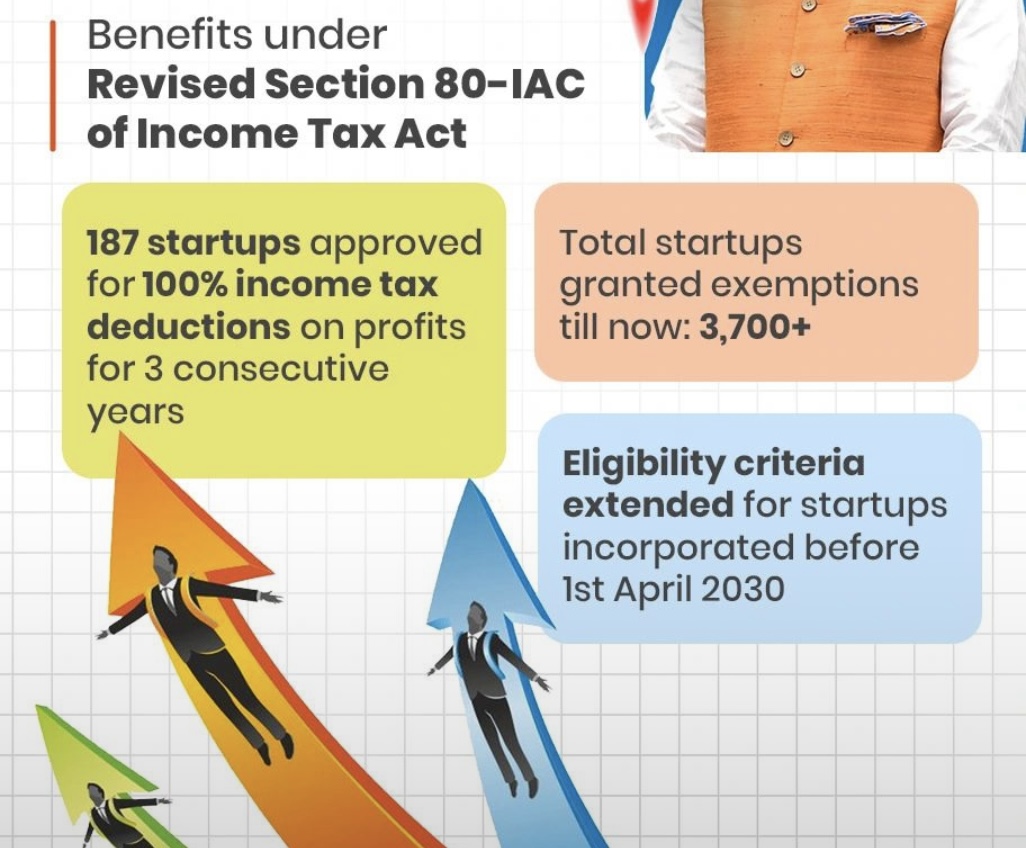

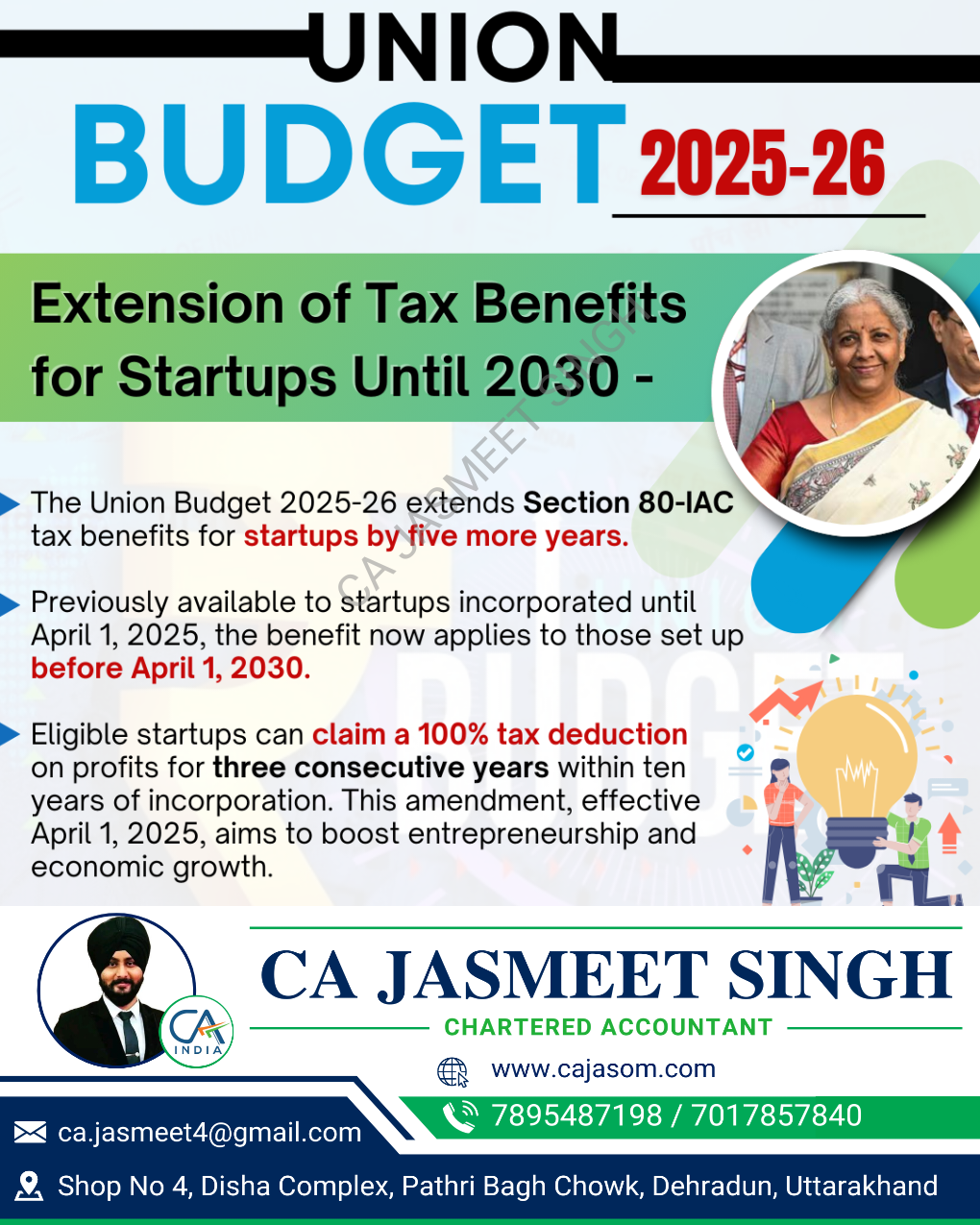

🚀 Section 80-IAC: Tax Exemption for Startups! 💡 If you're a startup recognized by DPIIT, you can claim a 100% tax deduction on profits for 3 consecutive years out of the first 10 years! 🎉 📌 Eligibility: ✅ Incorporated as a Private Ltd. Co. or L

See More

Account Deleted

Hey I am on Medial • 1d

Startup Recognition in India ' (under DPIIT – Department for Promotion of Industry and Internal Trade) 🎁 . Benefits After DPIIT Recognition: Tax exemption for 3 years under section 80IAC. Exemption from Angel Tax under section 56(2)(viib). Easie

See MoreDownload the medial app to read full posts, comements and news.