Back

Vikas Acharya

Building WelBe| Entr... • 6m

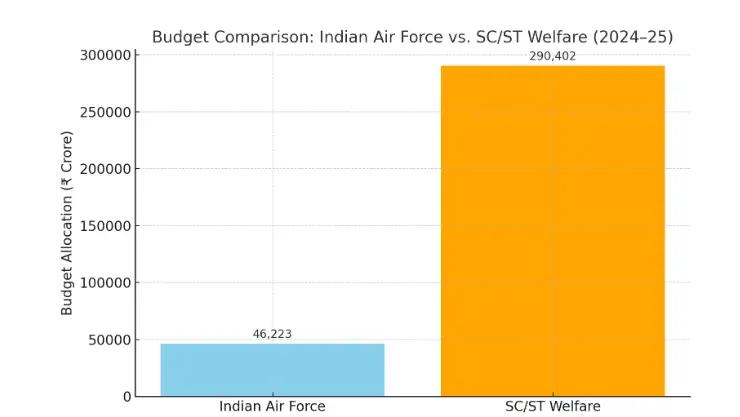

hey I hope this would be helpful 1. PMEGP: For setting up new ventures with credit-linked subsidies. 2. CGTMSE:Offers collateral-free loans for MSMEs. 3. Stand-Up India: Loans for women, SC, and ST entrepreneurs. 4. Udyam Registration: Gives tax benefits and easier access to schemes. 5. NSIC Subsidy:Provides raw material assistance and financial aid. Check the MSME portal or your local District Industries Centre for details.

More like this

Recommendations from Medial

Krishna Chaitanya

We are planning to s... • 5m

Despite the government's push for renewable energy and biogas under schemes like SATAT, banks are still demanding collateral for CGTMSE loans, making it difficult for startups to enter the sector. How can first-time entrepreneurs in the biogas indust

See MoreShubham Jain

Partner @ Finshark A... • 1y

**Opportunity Alert: CGTMSE Scheme for MSEs** Dear all, Exciting news! The CGTMSE Scheme offers collateral-free loans up to *Rs. 2 crore* for micro and small enterprises (MSEs). Key features include: - No need for collateral or third-party guarante

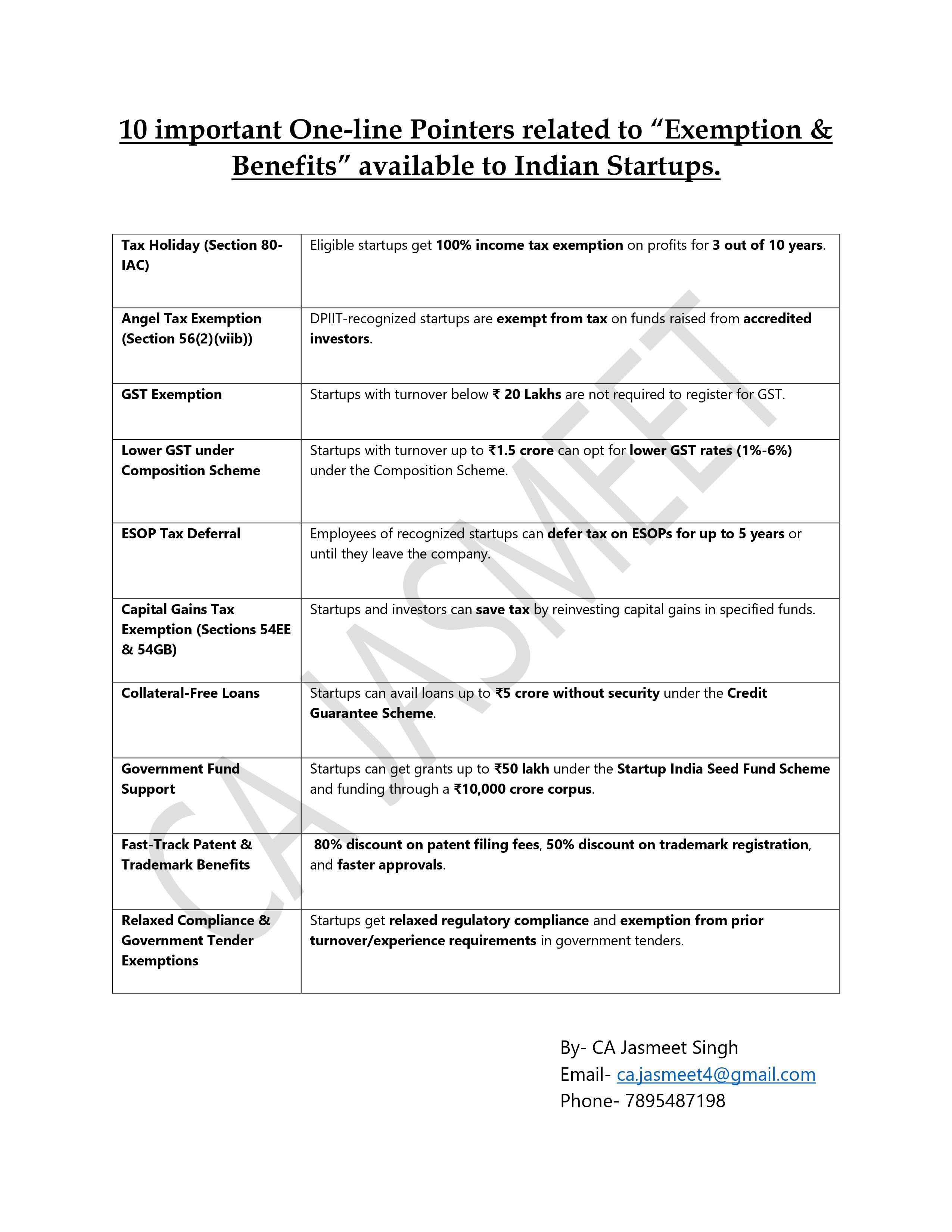

See MoreCA Jasmeet Singh

In God We Trust, The... • 6m

🌟 Big News for Startups! 🚀💼 Did you know Indian startups get amazing tax breaks, funding support, and compliance relaxations? 🏦📊 From 100% tax exemptions to collateral-free loans, here are 10 key benefits every entrepreneur must know! 💡✅ 🔥 C

See More

Download the medial app to read full posts, comements and news.