Back

Adithya Pappala

G.P Seed-VC|Investin... • 10m

#9TDAYVC-DAY-15 What are Additional Returns? What is the Catch-Up Clause? In Developed Markets, The structure is in 2-20% where 2 is Management Fees & 20 is Additional Returns.Additional Returns & 2-20 structure is not ideal in Indian AIF Market.Additional Returns could entirely depends on the Manager & his track record of experience. Investment Managers that deliver consistent returns above the preferred returns can expect the Additional Returns. As AIF’S are highly Illiquid in nature, Management Fees can be payable based on the NAV of the fund from time to time.NAV is the valuation of a fund like Assets-liabilties.Example,If a VC had 100 Crores of Assets & Liabilities are valued at 10 Crores then the NAV is 90 Crores.Additional Returns can only be assessed while they exit.The Investment Agreement also specify whether it will have“Catch-Up” Provision or not?The catch up clause is meant to make investment managers extra additional returns of total returns. Shoot the Comments

Replies (1)

More like this

Recommendations from Medial

Adithya Pappala

G.P Seed-VC|Investin... • 10m

#9TDAYVC-DAY-16 🎯What is High Watermark in VC? 🎯What are Distributions/Waterfall? Apart from hurdle rate, Some consider also “high watermark” This is more common practice in hedge funds. This market denotes the highest value recorded by the f

See MoreAdithya Pappala

G.P Seed-VC|Investin... • 10m

#9TDAYVC- DAY-8 🎯Who are Custodians in VC? 🎯What is Net Asset Value? 🎯Custodians:Custodians are for security but also safekeeping the Investments.Custodians needs to give & accept delivery securities of dematerialised Investment Funds whic

See MoreAdithya Pappala

G.P Seed-VC|Investin... • 10m

#9TDAYVC- DAY-14 🎯What is Hurdle Rate? 🎯What is Carry Fees? 🎯The preferred returns are also called as “Hurdle Rate” in VC & P.E Funds. It is the threshold return that LP’S should receive prior GP’S receive. In developed markets, The hurdle

See MoreAdithya Pappala

G.P Seed-VC|Investin... • 10m

#9TDAYVC-DAY-17 🎯Types of Waterfalls in VC? 🎯What is Clawback? Two types that are “European & American Waterfall”-Under European Waterflow, 100% of all Investment Cash is paid out to Investors on a pro-rata basis & therefore preferred returns

See MoreREDWOODTRADEWORKS

Connecting Buyers & ... • 1m

Exclusive Green Energy Investment Opportunity We at Mursan Kamalpur Green Energy Pvt. Ltd. are setting up a ₹19 Cr Bio-CNG & Organic Fertilizer Plant in India under the Govt.-backed SATAT Scheme with additional revenue from Carbon Credits. Seeking

See MoreRohan Saha

Founder - Burn Inves... • 7m

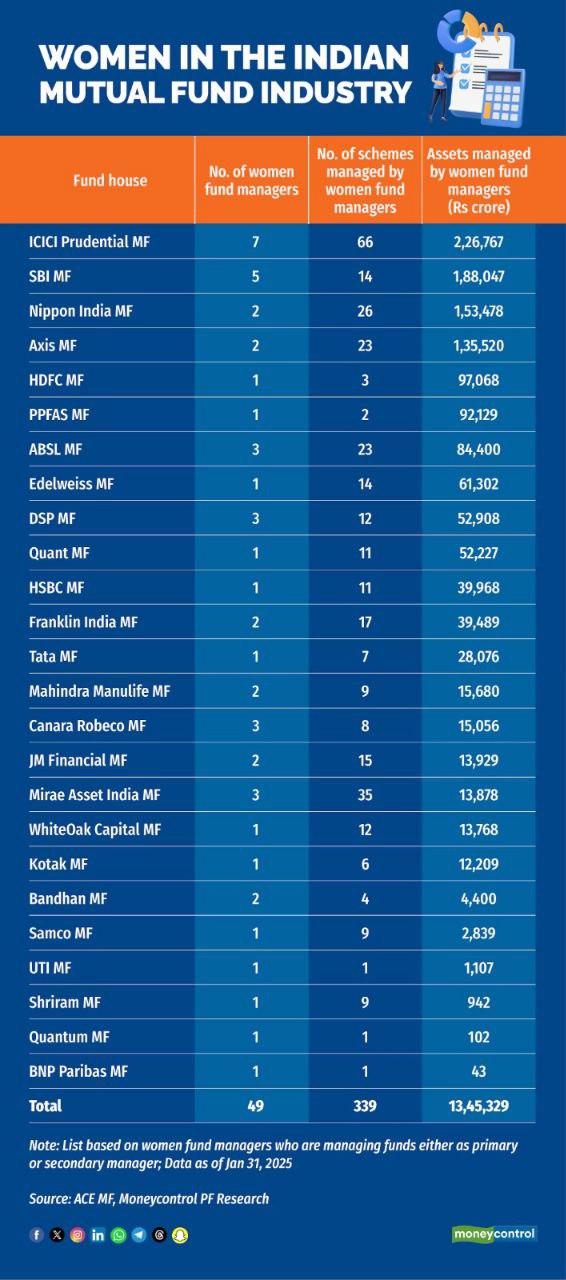

The assets under the management of Indian women fund managers have surged, doubling to Rs 13.45 lakh crore within a year. Despite this impressive growth, the proportion of assets managed or co-managed by women still constitutes a small fraction of th

See More

Download the medial app to read full posts, comements and news.