Back

Adithya Pappala

G.P Seed-VC|Investin... • 10m

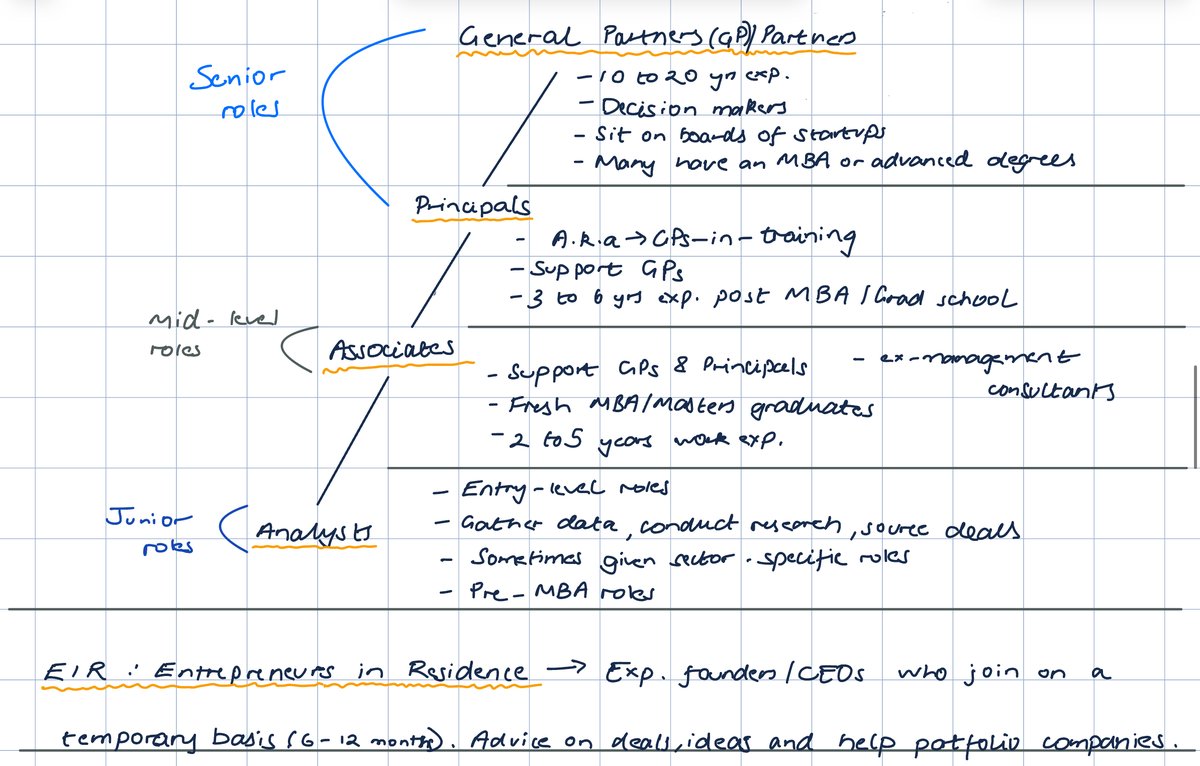

#9TDAYVC-Day 1 For those who don't know about this, Checkout my last post📌 So, I will explain 2 things today: 🎯What is Venture Capital? 🎯How was it started in India? 1) Venture Capital is an Alternative Investment Funds(AIF'S) which Invests in Early Stage Startups, Businesses, Real Estate, Social Ventures & Infrastructure Funds. These are highly risky & long gestation period investments come with high Illiquidity(Means the conversion to money is very hard) 2) VC started back then in the 1960s in western parts of the world through the Banks, Gradually it was picked up in the late 1970's with the start of Sequoia Capital. It emerged from the 1980s with the tremendous growth in Investments. That's where India officially started in 1988 with the inclusion of INFOSYS Boom.In 2001,The VC Industry in India made its first Investment in Bharti Televentures by warburg Pincus with 292 Million Dollars & had a successful exit with IPO in 2007 Continue reading tomorrow🔥,Pump the feedback.

Replies (5)

More like this

Recommendations from Medial

Adithya Pappala

G.P Seed-VC|Investin... • 10m

#9TDAYVC- DAY10 🎯What is meant by Blind Pool? 🎯What is Draw Down? 🎯Capital Commitments: Capital Commitments under less than 1 Crore is not acceptable under AIF.Employees or Directors of the AIF should Invest a minimum of 25 lakhs. 20 Crores

See MoreVivek Joshi

Director & CEO @ Exc... • 2m

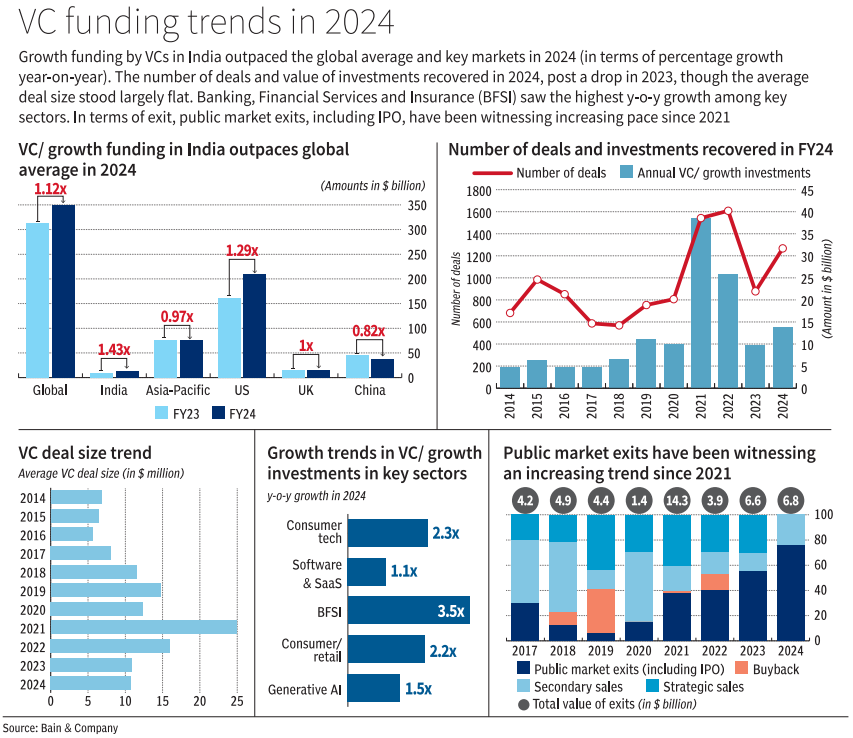

📈 Indian VC rebounds! PE-VC investments +9% to ~$43B in 2024, led by VC/growth at ~$14B (+40%) across 1270 deals (+45%). Consumer tech & SaaS lead. Public markets a key growth driver. VCs now prioritize AI with strong IP & early capital efficiency.

See More

Adithya Pappala

G.P Seed-VC|Investin... • 10m

#9TDAYVC-DAY-2 😳Only 21 Indian VC Firms are there in 2013 So, Today’s VC topics are: 🎯Who Invests in Venture Capital? 🎯Definition & Difference between Private Equity & Venture Capital? 🎯Investors-VC also raises, We also raise but the di

See MoreVamshi Yadav

•

SucSEED Ventures • 6m

India led global VC growth in 2024, outpacing major markets with 1.43x growth. Investments gained momentum with BFSI (3.5x growth), Consumer Tech (2.3x), and Generative AI (1.5x) attracting the most capital. Public market exits have been rising since

See More

SamCtrlPlusAltMan

•

OpenAI • 8m

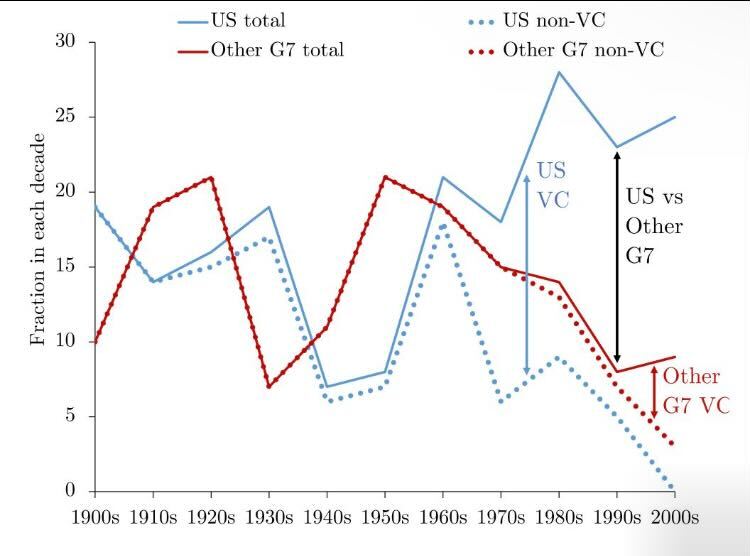

Have you ever heard of a British Apple, a French Tesla, or a Japanese Google? ❌ NO ❌ The simple reason is – Venture Capital. Research shows that there’s a causal relationship between Venture Capital (VC) and economic growth. In 2015, Stanford profes

See More

Download the medial app to read full posts, comements and news.