Back

Shubham Jain

Partner @ Finshark A... • 1y

Hello Everyone, I hope this message finds you well. **Requirement for Registered Valuer’s Report** In accordance with Section 247 of the Companies Act, any valuation involving property, stocks, shares, debentures, securities, goodwill, or any other assets or net worth of a company, including its liabilities, must be conducted by a registered valuer accredited with the IBBI. Below are key scenarios where a Registered Valuer’s report is essential: 1. Additional issue of share capital 2. Amalgamation & Merger 3. Demerger & Slump Sales 4. Startup Valuation for fundraising 5. Buyback of shares 6. Conversion of Convertible debentures or preference shares into equity shares 7. Reduction of share capital 8. Insolvency and Liquidation Best regards, Shubham Jain

Replies (2)

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 1y

"ITC Invests ₹111 Crore in EIH and Leela Mumbai Ahead of Hotel Demerger" "ITC Acquires Stakes in EIH and Leela Mumbai Worth ₹111 Crore Before Hotel Demerger" ITC Ltd Consolidates Stakes in Oberoi and Leela Ahead of Hotel Business Demerger ITC Ltd,

See Morefinancialnews

Founder And CEO Of F... • 1y

"RBI Lifts 7-Month Ban on JM Financial Services, Allowing Financing Against Shares and Debentures" Following the RBI's decision to lift restrictions after seven months, JM Financial Services can now resume offering financing against shares and deben

See MoreVCGuy

Believe me, it’s not... • 1y

On April 24th, Swiggy filed its DRHP with SEBI via the confidential route (this route restricts public access to the DRHP until an updated version is filed) 💡Would be super interesting to see how much of Swiggy: Accel and Elevation Capital still ow

See More

Kolkata Index

•

West Bengal Tourism • 1y

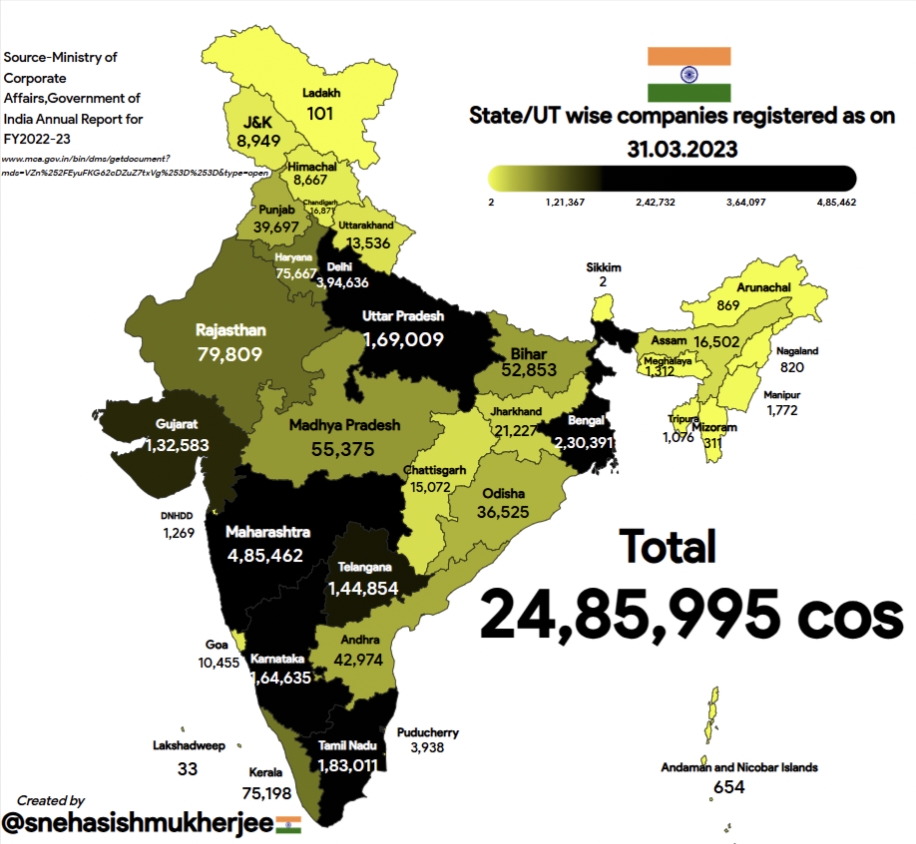

West Bengal ranked 3rd in total no. of regd companies and total no. of active companies in India as on 31.03.23. AlsoBengal ranked 8th in new companies registered during FY 22-23. (MCA does not release city wise data of cos registered ) src - MCA A

See More

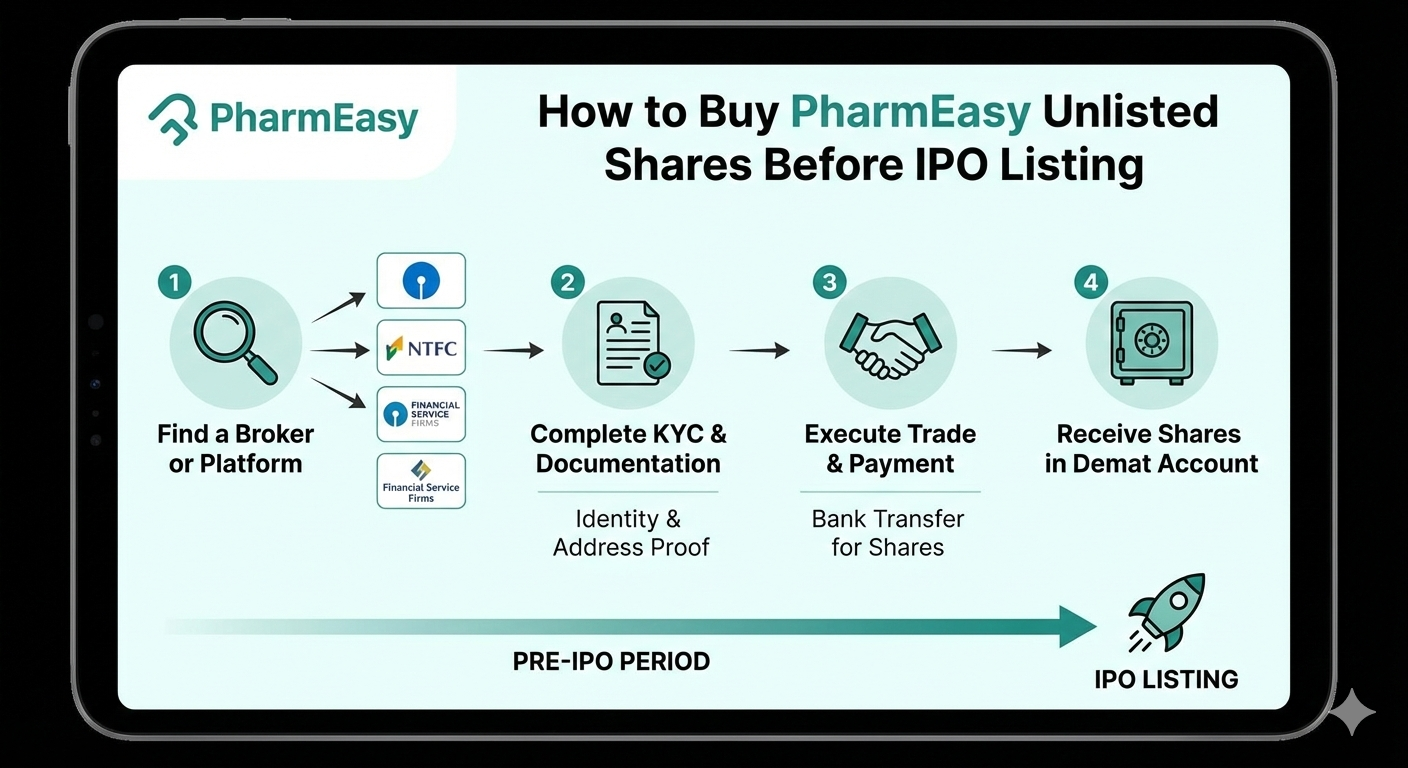

planify

pre-IPO shares, ESOP... • 28d

Unlisted shares of SBI Mutual Fund represent ownership in the AMC before it becomes publicly traded. These shares are exchanged privately, often among long-term investors and institutions. visit here:- https://www.planify.in/research-report/sbi-mutua

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)