Back

SHIV DIXIT

CHAIRMAN - BITEX IND... • 9m

📖 DAILY BOOK SUMMARIES 📖 🔗 DIRECT FREE E-BOOK DOWNLOAD LINK AVAILABLE — https://drive.google.com/file/d/1i50x1Zx4uVjKiArsV39GRDvhyrPzbGM3/view?usp=drivesdk 🔥 Corporate Finance 🔥 🚀 27 Lessons by 👉 ✨ Jonathan Berk and Peter DeMarzo ✨ 1. Fundamentals of Corporate Finance: • Emphasizes foundational concepts, such as time value of money, cost-benefit analysis, and the role of finance in decision-making. 2. Valuation Principles: • Explains valuation techniques, particularly Discounted Cash Flow (DCF), to assess the worth of assets, investments, and firms. 3. Risk and Return: • Introduces the relationship between risk and return, including CAPM (Capital Asset Pricing Model), beta, and the risk-free rate. 4. Investment Decision Rules: • Covers methods for evaluating projects and investments, including Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period. 5. Capital Budgeting: • Provides strategies for selecting profitable investments, assessing cash flows, and conducting scenario and sensitivity analysis. 6. Capital Structure Decisions: • Analyzes the optimal mix of debt and equity, the benefits of leverage, and the trade-off theory vs. pecking order theory. 7. Cost of Capital: • Discusses calculating the Weighted Average Cost of Capital (WACC) and understanding its impact on financing decisions and valuation. 8. Financial Statement Analysis: • Reviews interpreting financial statements for cash flow analysis, identifying trends, and forecasting financial performance. 9. Payout Policy: • Examines factors influencing dividend and share buyback decisions, considering tax implications and shareholder preferences. 10. Efficient Markets Hypothesis (EMH): • Explains market efficiency, exploring its implications for corporate finance and the impact on investment and financing choices. 11. Working Capital Management: • Focuses on managing short-term assets and liabilities, including inventory, accounts receivable, and accounts payable. 12. Mergers and Acquisitions (M&A): • Covers M&A valuation, strategic motives, financing deals, and the complexities of integration. 13. International Corporate Finance: • Discusses challenges in global finance, such as exchange rates, political risk, and managing international operations. 14. Derivatives and Risk Management: • Explores the use of derivatives, hedging strategies, and risk management techniques to mitigate financial risks. 15. Behavioral Finance: • Introduces how psychological factors and biases can impact financial decisions, providing a contrast to traditional finance theories. 16. Real Options in Investment Decisions: • Examines the concept of real options—the flexibility in decision-making for investments, such as delaying, expanding, or abandoning projects.

Replies (2)

More like this

Recommendations from Medial

Madhavsingh Rajput

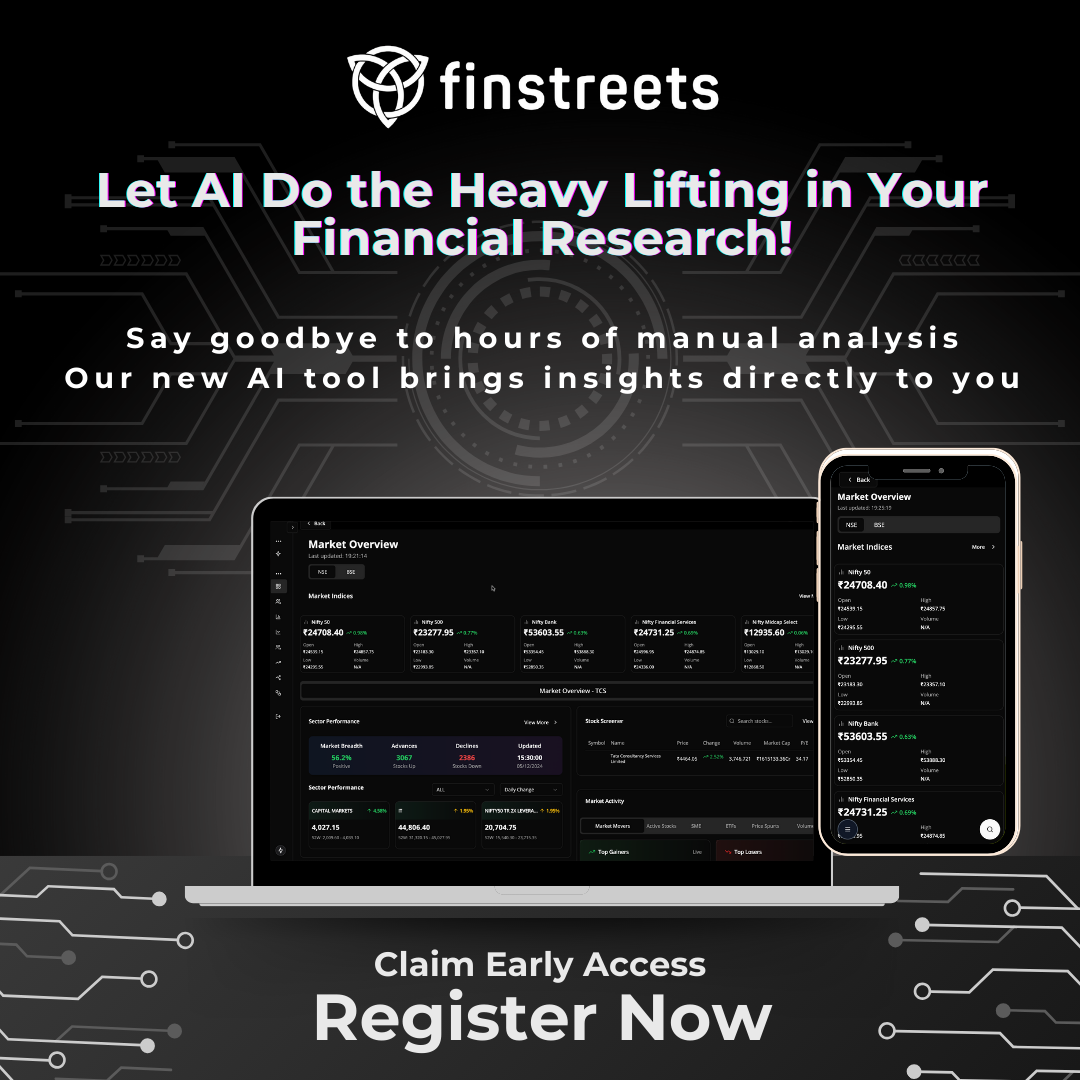

Founder & CEO at Fin... • 8m

I am thrilled to announce the launch of our beta version of India’s first Open Finance AI, Finstreets. Designed to transform how individuals and professionals approach financial solutions, it’s your one-tap solution for all finance needs, from invest

See More

Akash Koli

Experienced Financia... • 11m

Financial Analysis: The Espresso Shot for Your Business! ☕📊 Just like a strong cup of coffee, financial analysis gives your business the boost it needs! It helps you spot where profits are brewing ☕, where costs are too bitter, and keeps your cash

See MoreShivam Singh

"Igniting My Startup... • 10m

Fundamental Challenges of Finance #Valuation . How are financial assets valued? How should financial assets be valued? How do financial markets determine asset values? How well do financial markets work? #Management . How much should I save

See Moresujeeth challa

Hey I am on Medial • 1m

How many of you struggle to understand personal finances and investments? Imagine having an Ai powered personal finance copilot. It tracks and analyses expenses (via bank statement) gives you actionable insights - directs you to right kind of inves

See MoreAanya Vashishtha

Drafting Airtight Ag... • 4m

Should You Raise Fund or Bootstrap? Here’s a Reality Check Every founder faces this question: Should you raise external funding or bootstrap your startup? Both paths have pros and cons, and the right choice depends on your business goals, risk tol

See MoreHarsh Verma

Built Different. Bui... • 8m

Discover the shocking story of *The Trader Who Crashed the Global Stock Market*! 📉 A tale of ambition, risk, and consequences that changed the financial world forever. Watch now and uncover the secrets behind the crash #StockMarketCrash #Trading

See MoreDownload the medial app to read full posts, comements and news.