Back

Rishu

•

Medial • 1y

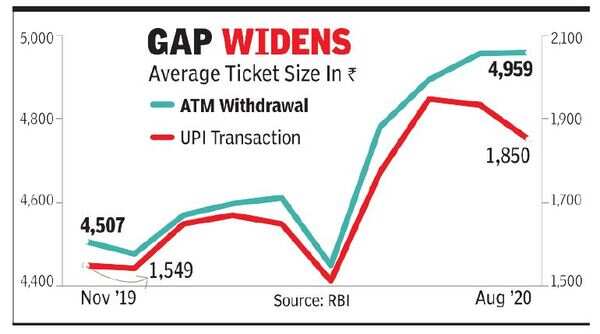

Banks are historically greedier is what I’m saying. Upi withdrawals toh nahi but for merchants to receive, they might. That might affect/or change the game completely, as there’s no scaling back, right? Remember, most kiranas didn’t feel the need to get the card machines for a reason, first the charges and secondly, the accessibility to debit cards wasn’t THAT widespread, compared to UPI.

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 7m

Google Pay now charges 0.5% to 1% (plus GST) for bill payments made via credit and debit cards, while UPI bank transfers remain free. Competitors like PhonePe and Paytm also charge similar fees. Fintech firms face high UPI processing costs, totaling

See More

gray man

I'm just a normal gu... • 5m

The Reserve Bank of India (RBI) has announced that it will soon revise the transaction limits for Unified Payments Interface (UPI) payments made to merchants, also known as person-to-merchant (P2M) transactions. This move is aimed at enhancing the ef

See More

Vedant SD

Finance Geek | Conte... • 12m

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large popu

See MoreNitish Jha Vats

•

Broadmate Global • 1y

Hey startup folks in Karnataka, what's your take on the idea of bringing reservation into private companies? How do you think it might affect your hiring process and company growth - could it boost diversity and help level the playing field, or might

See MoreVishnu kumaran

Design guide for you... • 9m

Why does capturing the market matter more than anything? Let's take UPI as an example. While other UPI apps took time to build an excellent, cutting-edge product, Google Pay and PhonePe started by releasing their MVP first and later improved their

See MoreDownload the medial app to read full posts, comements and news.