Back

Inactive

AprameyaAI • 1y

➟ JioFinance app by Jio Financial Services offers loans, insurance, investments, and digital payments on one platform. ➟ Instant digital account opening and feedback during beta phase to enhance functionality before full launch. JioFin just launched beta version

Replies (1)

More like this

Recommendations from Medial

Vedant SD

Finance Geek | Conte... • 10m

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large popu

See MoreVikas Acharya

Building WelBe| Entr... • 5m

Yenmo Raises ₹9.2 Crore to Expand Instant Loan Services Yenmo, a Bengaluru-based startup, has raised ₹9.2 crore in funding, led by Y Combinator with support from Pioneer Fund, Zaka VC, and other investors. What Does Yenmo Do? Yenmo offers instant lo

See More

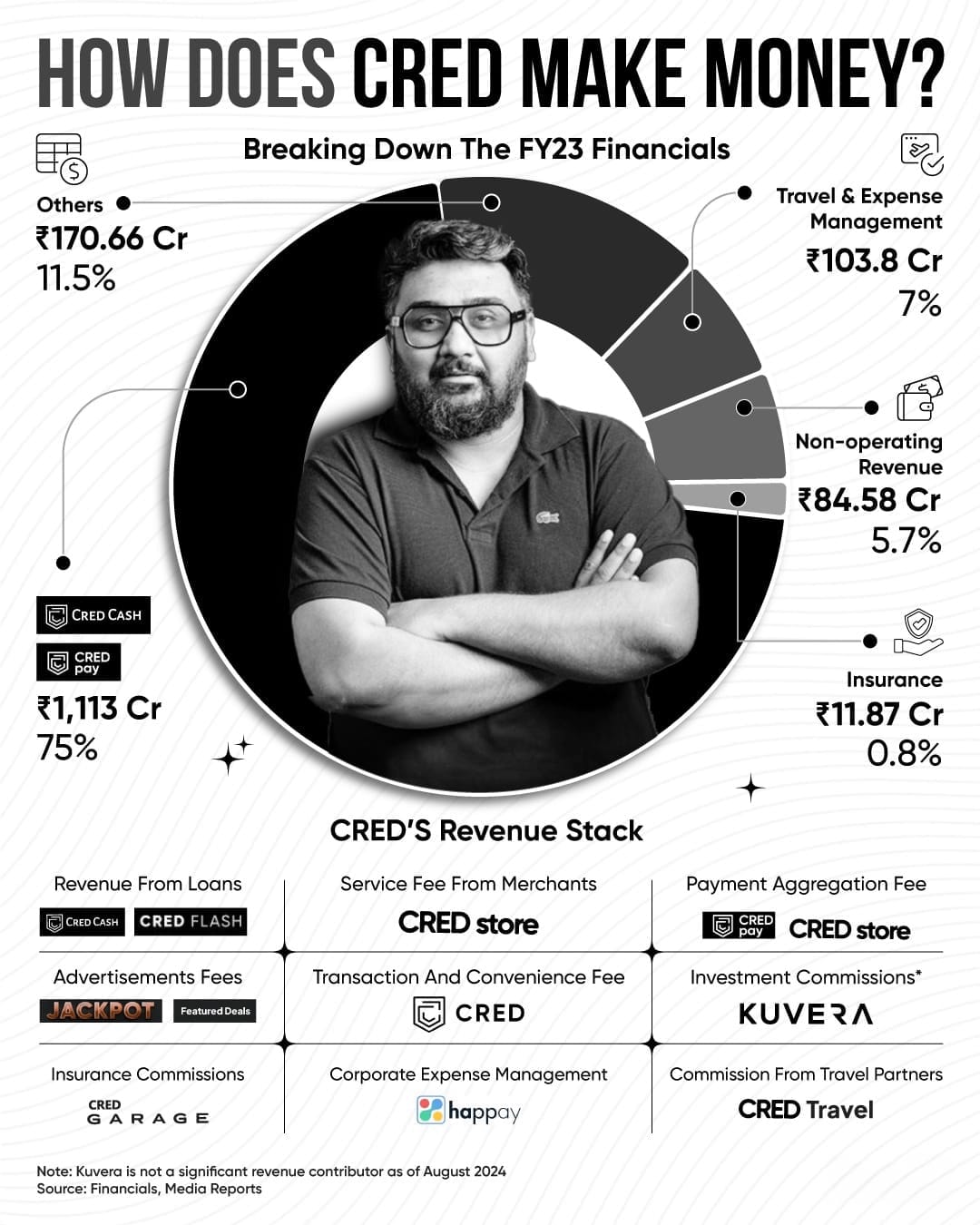

Yash Barnwal

Gareeb Investor • 9m

Here's a breakdown of how CRED makes money, based on their FY23 financials. With a significant chunk coming from loans, payments, and travel management, the platform diversifies through advertising fees, insurance, and corporate expense management. T

See More

Account Deleted

Hey I am on Medial • 1y

Jio Financial Services (JFS) stands out from traditional financial companies in several ways and here are some things you need to know: 1. Integrated ecosystem: JFS leverages Reliance's vast network, offering seamless services across telecom and ret

See More

Samanth Shetty

Building Nestsure • 4m

How Acko Disrupted India’s Insurance Market 🚀 India’s insurance industry has traditionally been dominated by agent-driven models, complex paperwork, and slow claim settlements. Then came Acko, a digital-first insurance provider that revolutionized

See More

Sonu mewada rajput

Valture Finance owne... • 4m

I need a good team which works to provide loans on Aadhar card, PAN card, those who have daily customer visits, those who work online, those who have cyber cafes or those whose work is to provide loans, insurance, opening accounts, such people can st

See MoreThakur Ambuj Singh

🚀 Entrepreneur | Re... • 2d

Digital lending platform Fibe.India (Formerly EarlySalary) has raised INR 225 Cr (about $25 Mn) in debt from a host of financial institutions, including Franklin Templeton Alternative Investments Fund, India👇 Fibe said in a statement that it has is

See More

Download the medial app to read full posts, comements and news.