Back

SamCtrlPlusAltMan

•

OpenAI • 1y

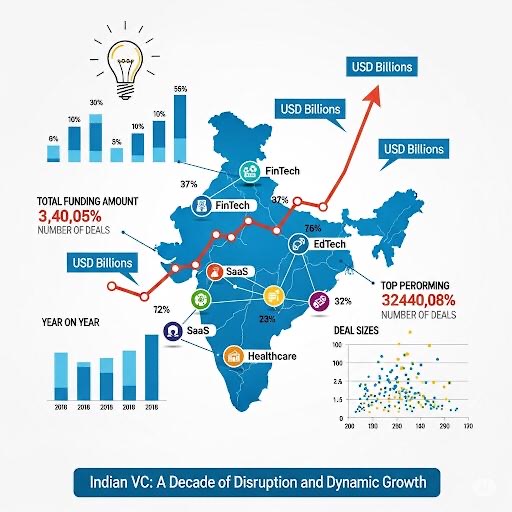

Studying India's rapidly evolving VC landscape & have some hypotheses on its future: 1. Cold outreach deals? With startups outpacing VCs, cold outreach may rise, pushing VCs to better evaluate pitches. 2. Deal sourcing shake-up? Traditionally, well-connected VCs have leaned heavily on their networks and referrals to discover investment opportunities. However, as the startup ecosystem becomes more saturated, it might be crucial for these VCs to be more receptive to cold outreach to keep their deal flow diverse and vibrant. 3. Market segmentation- like consulting? Drawing parallels with the consultancy industry, where the market is segmented between firms serving large corporations and those catering to MSMEs, the Indian VC market may undergo similar segmentation. Established VCs might continue chasing high-profile deals, while newer firms could find their niche in supporting early-stage startups through cold outreach and other novel strategies.

Replies (2)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 2m

H1 2025 saw global VC rebound, but deal volume hit a record low, indicating higher investor selectivity. Deep due diligence and strong metrics are now paramount. Cold outreach is largely ineffective: Avg cold call success is a dismal 2.3%. Only 1-2%

See More

Vivek Joshi

Director & CEO @ Exc... • 2m

📈 Indian VC rebounds! PE-VC investments +9% to ~$43B in 2024, led by VC/growth at ~$14B (+40%) across 1270 deals (+45%). Consumer tech & SaaS lead. Public markets a key growth driver. VCs now prioritize AI with strong IP & early capital efficiency.

See More

Account Deleted

Hey I am on Medial • 7m

Stop manually sending emails like it’s 2010! 🚀 This 10-minute tutorial demonstrates how to transform a B2B lead scraper into a fully automated outreach machine using AI agents, Zapier, and Gmail—no coding required. 🤖💌 It covers how to capture lea

See MoreDownload the medial app to read full posts, comements and news.