Back

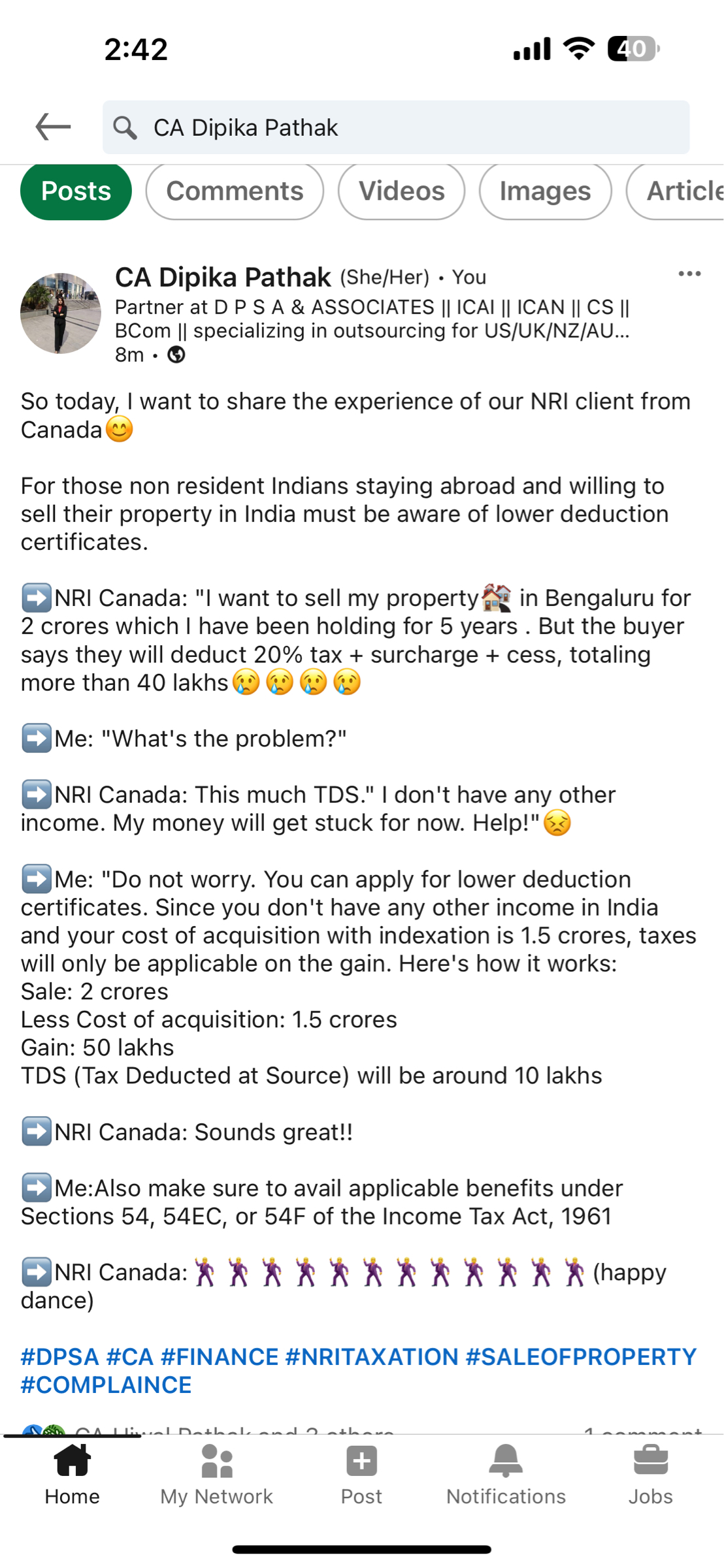

CA Dipika Pathak

Partner at D P S A &... • 1y

NRI tax on sale of property in India

More like this

Recommendations from Medial

Sameer Patel

Work and keep learni... • 1y

Cost Inflation Index The Cost Inflation Index (CII) helps adjust the purchase price of an asset to account for inflation, making it easier to calculate capital gains tax fairly in India. The government updates the CII every year. Example: If you b

See MoreNandha Reddy

Cyber Security | Blo... • 1y

Did you guys ever wondered? In India we pay most of the taxes and get nothing on return?. Eg: Let's assume a family earns 1.5 lac per month. And they buy groceries 20k enjoyment 10k Children's study 20k (both) Rent 15-20k (depends) Tax - 30% exc

See MoreAnonymous

Hey I am on Medial • 1y

I think next civil war in India happens because of tax . We are facing this huge problem since 1947 and every government force only middle class people's for tax . According to reports only 3.5% people in India paying tax and other are just enjoying

See MoreDownload the medial app to read full posts, comements and news.